“狗树皮, 但大篷车上移动。”

阿拉伯谚语

汇款初创公司的基础’ 公关音调集中于一个相对直观的概念,该概念涉及银行的作用: 它们是具有官僚文化的大型机构, 低于标准的客户服务, 和过时的数字能力. 所以, 银行退出跨境汇款行业只是时间问题. 讽刺地, 这个前提成立. 与领先的金融科技初创公司相比. 此外, 大多数银行不认为汇款业务战略.

为什么银行不拿钱转账严重

假设银行不关心竞争是天真的想法. 仅在美国, 有 4,000 银行和无数信用合作社的高管将其策略与地方和国家竞争者进行比较. 然而, 银行自然会务实地观察他们的竞争: “收入放缓的五大原因是什么?” 或 “哪些新的商业趋势可能会危及 10% 利润?”

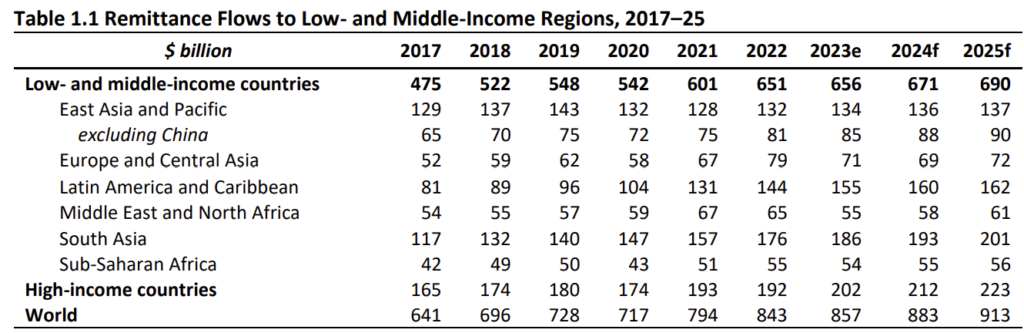

您可能已经听说过,消费者跨境汇款服务的市场规模很大. 根据世界银行, 仅汇款几乎是 $0.9 兆, 整体跨境C2C交易量约为其两倍.

然而, 平均利润小于 4%, 甚至 $2 万亿数量将转化为大约 $70 消费者跨境汇款行业的全球收入达 10 亿美元. 由于银行的收入主要来自国内, 与银行相关的汇款收入部分要小得多. 美国, 全球最大的消费者汇款境外市场, 贡献 20% 占全球收入的, 相当于大约 $15 billion.

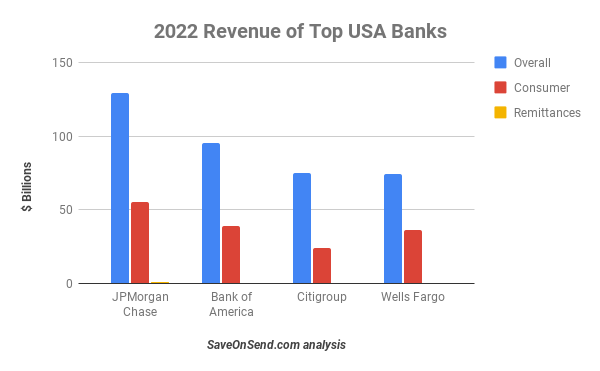

那怎么办 $15 与美国四大银行目前的收入相比? 我们来看看整体情况, 消费者, 以及这些银行的跨境业务收入, 均名列前茅 25 全球银行:

如果将上图放大, 银行’ 目前的汇款收入变得几乎看不见. 它大约代表 0.5% 银行的’ 总收入或约为 1-1.5% 的消费银行收入.

由《卫报》提供, 您可以观察桑坦德银行的类似数据, 所有跨境相关业务都代表各地 1.5% 银行的 总 收入 (忽略关于耸人听闻和错误的观点 “10% 该集团的利润):

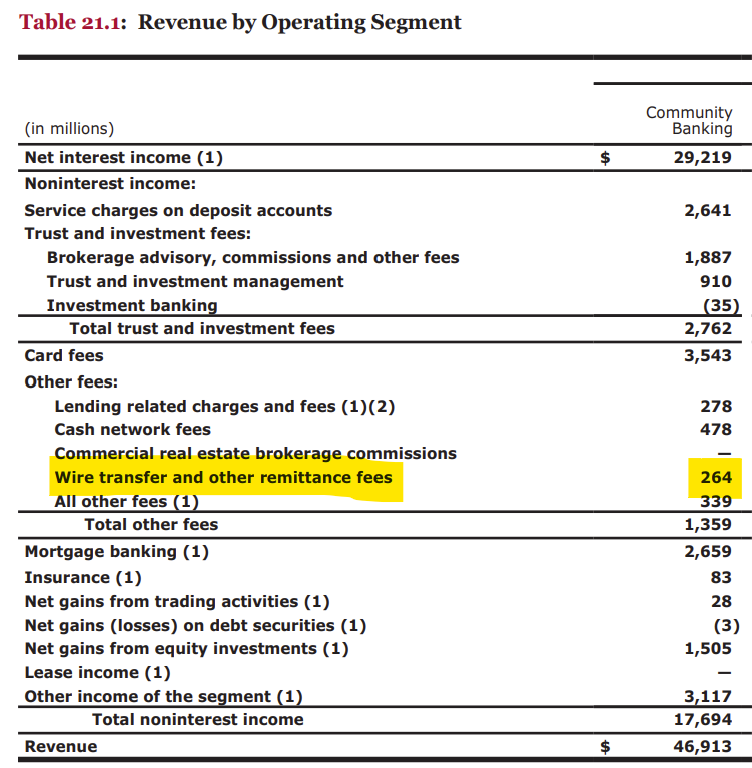

对于富国银行, 跨境汇款费用极低,以至于银行最后一次将其分开 2018:

即使其中一家银行奇迹般地成为该国唯一的汇款提供商, 在此过程中取代数百名竞争对手, 它只会获得额外的 10% 在其消费者业务之上.

银行竞争地位

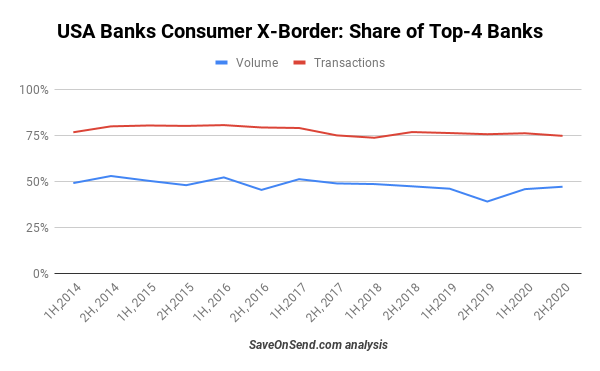

美国所有银行’ 年度跨境消费者汇款量大约总计 $150 billion, 约占美国出口量的一半. 这个数字涵盖了所有类型的消费者, 包括银行的富裕客户’ 私人银行集团. 银行如此重要的市场份额并非美国独有. 例如, 从阿联酋转账至印度, 单一银行, 轴, 命令一个 20% 市场份额. 韩国的顶部 5 国外汇款提供商是该国四大银行和西联汇款.

现在, 让我们来比较一下银行和跨境专业机构之间的跨境全球汇款量规模, 也称为汇款运营商 (跨国运营商), 包括金融科技公司:

每个国家最大的银行通常处理大部分交易和约一半的境外转账量:

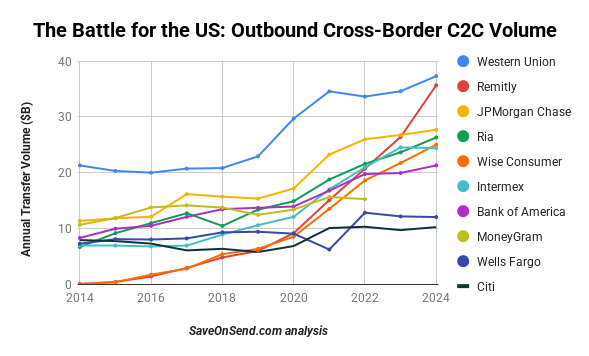

顶级银行在转账量方面落后于领先的专家, 部分原因是它们在许多国家缺乏消费者存在. 然而, 在美国这样的单一国家内, 前两家银行并没有落后于领先的传统MTO和金融科技:

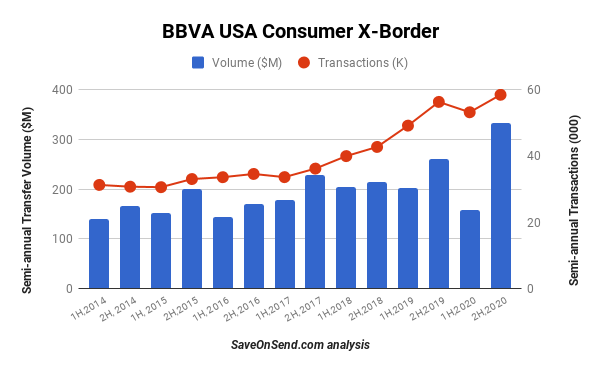

请注意这张图表,十年后, 美国四大银行集体转账量翻倍, 超过西联汇款的增长. 然而, 较小的mtos, 特别是金融科技, 在同一时期生长得更快. 自推出以来不到十五年, 与任何银行相比, 怀斯也不甘落后.

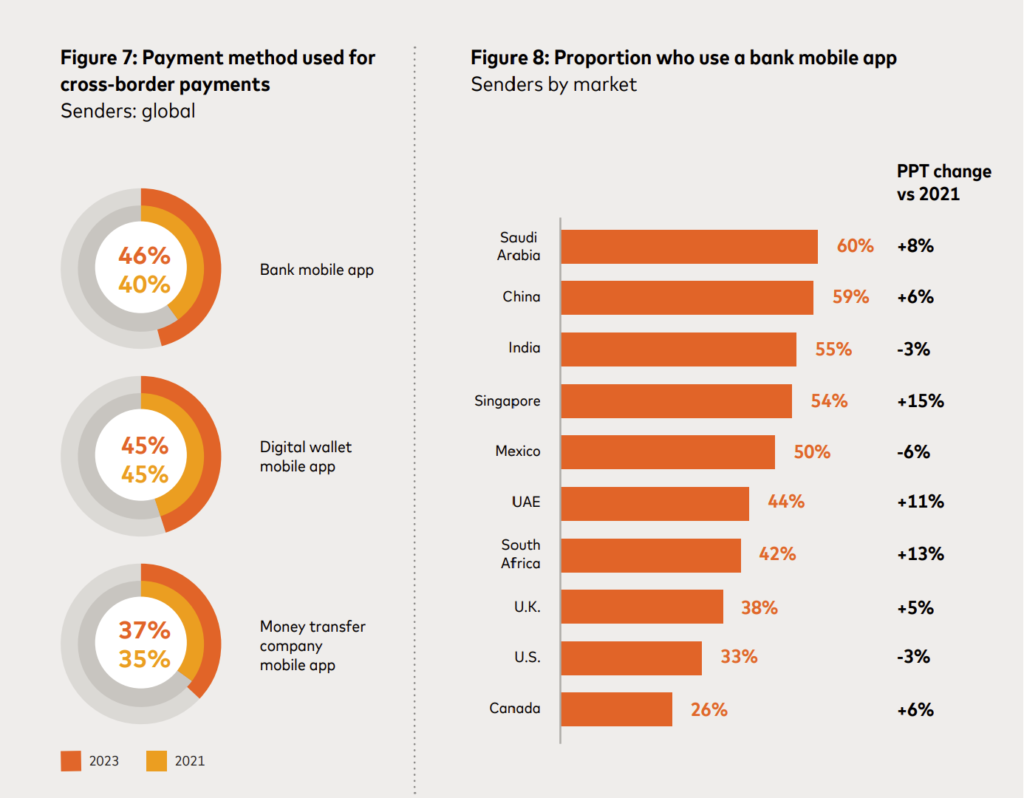

顶级银行不仅保持领先地位 10 尽管金融科技的增长,但每个国家 /地区的出站球员, 但也变得越来越成熟. 之间 2021 和 2023, 与钱包和汇款应用程序相比,银行移动应用程序的汇款使用量增长最快, 使其成为这三组中最常用的应用程序:

银行不喜欢消费者跨境货币转移

除了是次要银行收入来源, 跨境汇款已变得越来越具有挑战性. 正如另一篇文章中概述的 SaveOnSend 文章, 旨在打击恐怖主义融资的法规, money laundering, 和逃税, 当有必要时, 还对服务提供商进行了大量的资源和系统投资.

大型银行的这一负担是双重的: 向客户提供跨境汇款和向汇款运营商的银行服务 (跨国运营商). 从合规角度来看,后一项业务已变得极其复杂, 主要银行集体关闭汇款提供商的账户, 被称为全球趋势 “去冒险“. 在本质上, 银行从为 MTO 提供服务中获得的利润并不能抵消法规带来的额外投资要求和法律风险. 以下是一位资深银行家私下描述与大型汇款公司持有代理账户相关的风险的方式 (“XYZ,” 保持匿名):

“我们有对我们银行监管行动严重关切,如果XYZ的X-边境客户端提交的非法活动. 为了管理风险, 我们的银行进行的XYZ每年两全天专用遵守尽职调查与反洗钱, Compliance, 支付委员会成员,并从利益相关者的风险, 银行和现金管理团队. 其中的首要任务是确保我们只实现业务占转移为XYZ和那些传输是为特定目的而进行的 (不赌, 毒品, 等等) – 作为供应商, 有时, 在知情或不知情, 歪曲类型的帐户及其用途. 讨论信贷承诺的为XYZ续期即使, 话题看似远离跨境转移的性质, 大约有三分之一的银行同业的下滑加入到我们的银行由于潜在的监管问题。”

到这一点, 去风险化主要影响了最小的 MTO, 加密货币交易所, 以及少数高风险目的地,例如索马里或开曼群岛. 然而, 即使是最杰出的汇款专家, 这仍然是一个重大关注的问题. 他们中的大多数都有主要银行合作伙伴,但也与另一家主要银行保持一定的业务关系,作为预防措施.

银行定期使用其服务审核汇款提供商来减轻监管暴露. 所以, 许多银行员工了解汇款专家如何运作, 无论是西联盟还是明智的. 如果银行’ 高级领导层倾向于这样做, 对于他们的汇款经理来说,复制相对简单 “最佳实践” 并专注于消费者汇款. 然而, 这不是他们选择追求的方向.

银行’ 汇款策略

有三个去对市场的机型在银行汇款:

- 忽视: 大多数银行只提供电汇.

- 优先: 建立一个独立的资金转账业务.

- 伙伴: 依靠专家来为客户服务.

银行’ 与现有 MTO 或金融科技公司的合作关系已存在多年. 在 2016, 声称这是一个较小的自下而上的实验, TransferWise 与两家当时无关紧要的银行签约, N26和低热值. 它又签了一份 2017 (欧椋鸟). 在 2018, Transferwise 筹集了股份并创建了一个独立的全球合作伙伴团队,同时推出了 API 门户. 那年, 它失去了 欧椋鸟 并获得 Monzo:

在七月 2018, Transferwise与大型银行签订了第一个合作协议, BPCE, 但它从未投入生产. 在 2019, Transferwise 在美国和澳大利亚又签约了几家小型银行. 之后, 速度开始加快. 早期 2024, 明智的平台有结束的协议 85 合伙人代表 10 万客户和企业 (自从这些协议签署以来,N26和Monzo已大大增长). 一些合作伙伴甚至声称 15% 渗透, 但假设平均 5% 渗透, 这种业务可能已经有助于 5-10% Wise 的活跃客户. 明智的人期望其大部分卷都会通过其平台业务。.

毫不奇怪, 世界上最大的银行忽略了此类伙伴关系,因为它们对中断不关心, 虽然较小的银行通常没有客户有这样需要的客户. 例如, 在美国, 只有约 10% 的银行为其客户提供国际汇款服务. 讽刺地, 而不是摩根大通使用 Wise 作为汇款白标解决方案, Wise是第一个使用Chase提供利息帐户的人.

谁在使用银行进行汇款?

所有消费者群体都使用银行进行国际汇款, 包括最近的移民.

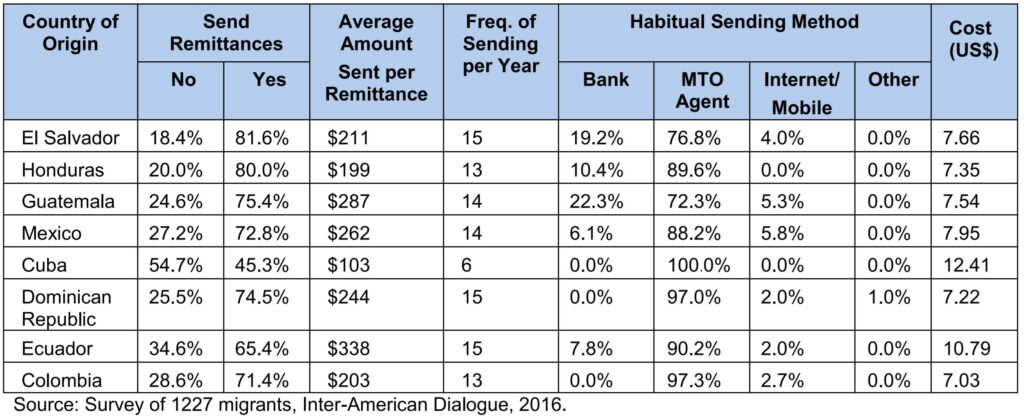

直到大约十年前, 移民更加依赖银行进行跨境转账. 然而, 供应商喜欢 西联汇款 和 XOOM 开始提供数字服务. 尽管如此, 随着越来越多的移民来到美国并开设银行账户,通过银行的汇款量持续增加:

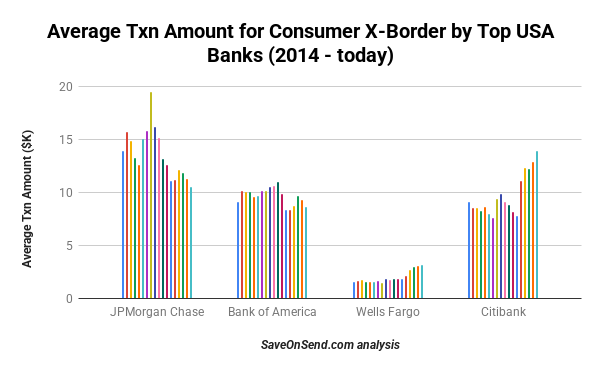

然而, 银行汇款服务的典型用户不同于 MTO 和金融科技公司的客户. 让我们查看平均转账金额 (千美元) 顶级银行之间:

将此与线下汇款的平均本金额进行比较 (通过现金剂): $200-400, 与数字: $1,000-2,000.

银行’ 初级消费者子段是不同: 汇款频率较低但汇款金额较大并使用电汇方式汇款的人. 但为什么富国银行的平均交易规模差异如此之大? 这是唯一一个积极针对客户中传统汇款消费者的银行, 发行了专用产品 1994 和一个单独的 登陆页面 在推出 2007:

在整体表现良好的同时, 富国银行在美国至菲律宾走廊尤其成功, 名列前茅 5 数字汇款提供商, 尽管收取高于平均水平的利润.

银行’ 汇款定价

传统的银行货币转移服务往往很昂贵. 转移甚至声称银行是 10 贵几倍.

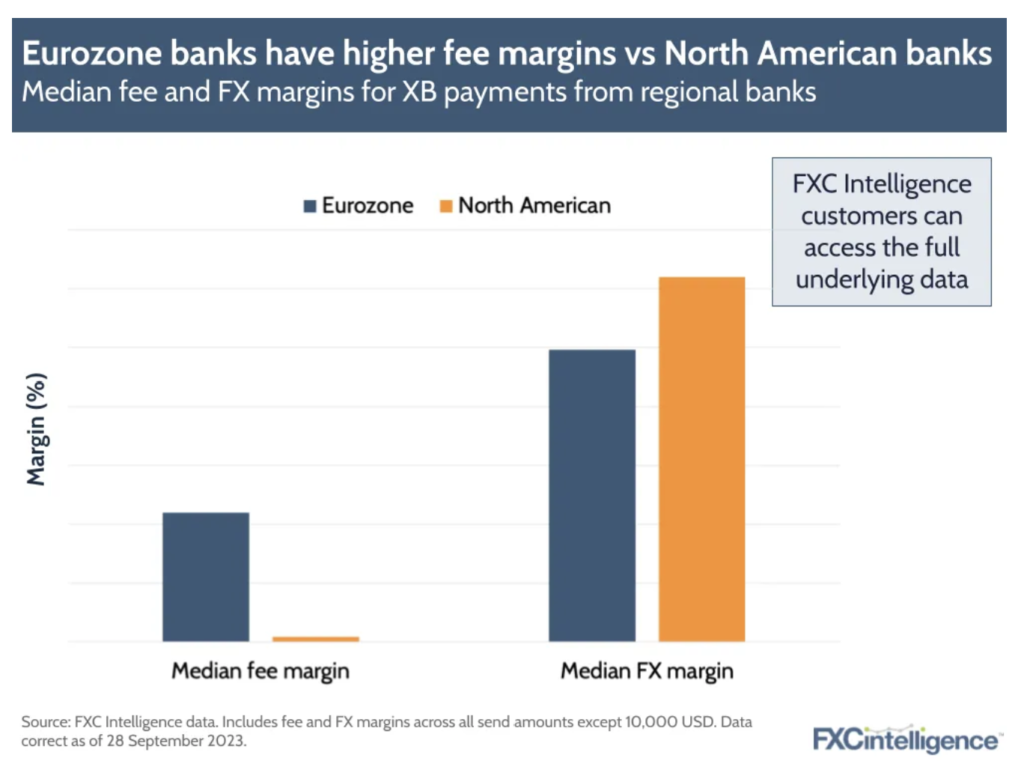

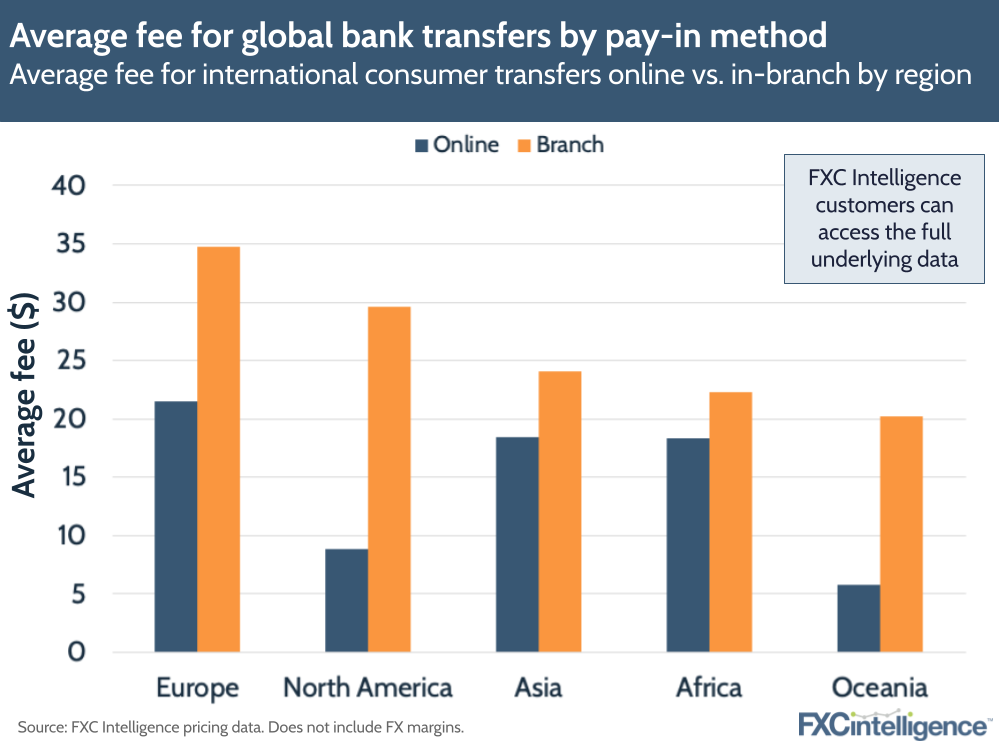

这些说法具有误导性 (看到这 SaveOnSend 文章了解更多), 但传统银行和汇款专家之间的定价差距仍然很大. 这主要是由于银行’ 外汇率较差, 对客户的透明度不如费用透明. 然而, 与北美相比,欧洲银行通过跨境转账赚钱的方式有所不同. 在欧洲, 银行收取更高的费用, 在北美时, 他们收取更高的外汇加价.

历史, 银行收取的费用不等 $25 to $50 用于电汇. 然而, 金融科技公司的竞争以及数字渠道的成本优势与在线转移相比,在线转移的价格要低得多.

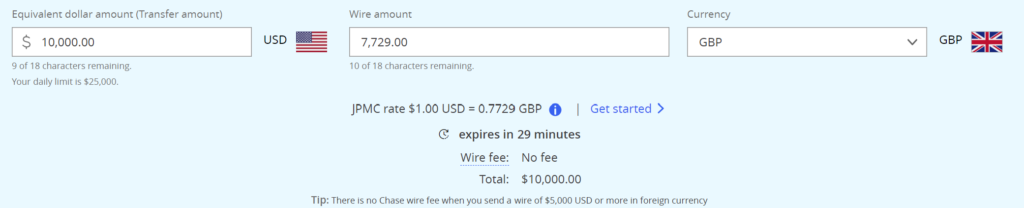

银行可能不收取高批量转移的费用. 例如, JP Morgan Chase, 美国最大的零售银行, 例如, 不收取超过电汇的费用 $5,000:

当银行按汇率进行国际汇款时 2-3% 低于市场利率, 消除可见费用很容易. 平均转移 $10,000 转换为 $200-300 通过低成本数字渠道每笔交易的收入. 生意不错.

客户喜欢他们的银行吗?

这些银行中跨境客户的服务质量呢? 人们普遍认为消费者对银行持负面看法, 陈词滥调暗示千禧一代宁愿扎根管而不是与银行家打交道. In reality, 在千禧一代中, 对银行分行体验的满意度超过 80%. 另一方面, 寄钱时,光滑的在线界面可能会被认为不那么值得信赖.

甚至可以说,消费者像他们的银行一样强烈. 这缘分到底有多强? 以富国银行为例, for example, 卷入多起公共丑闻, 包括开设虚假账户和扣留保险退款. 该银行的客户是否将业务转移到了其他数千家银行中的任何一家,或者选择了一家时尚的金融科技初创公司? 没了, 他们坚持选择富国银行:

而且, 移民往往对在东道国提供服务的本国银行表现出强烈的忠诚度. PNB 是 5日 菲律宾最大的银行并发挥着重要作用. 同样, ICICI银行和IndusInd, ranked #2 和 #6 在印度, 继续成为从美国到印度转移的活跃参与者.

银行’ 服务质量

类似于美国银行, 许多非美国银行的汇款门户 (国民生产总值, ICICI, IndusInd) 似乎已经过时了十到二十年. 鉴于MTO和Fintech玩家提供的优越的数字功能和定价, 这些银行继续吸引汇款业务可能令人困惑. 然而, 这种落后可能会引起某些客户的传统和稳定感.

富国银行因其针对典型汇款的全面方法而在美国最大的银行中脱颖而出, 其他银行也可能有选择地参与. 例如, 印度不仅是世界上最大的汇款获得者, 但是它在美国的公民往往比其他大型移民群体更精明. 所以, 花旗银行创建了专门的全球 登陆页面 针对这个利基市场量身定制.

银行’ 尝试建立汇款金融科技

只有少数银行建立了专门用于跨境汇款的单独的金融科技子公司. 这种方法使他们能够探索数字技术,而不会危及他们的主要品牌. 美国的 BBVA Compass 就是一个典型的例子, 前 BBVA 子公司. 它强烈强调了拉丁美洲市场,并在消费者跨境数量中排名美国三十个银行之一. 然而, 跨境交易量显着下降 2016 促使该银行高管将跨境消费业务纳入其总体战略的优先顺序.

以其创新文化而闻名, BBVA 十月份采取重大举措 2017 通过启动专用的移动汇款应用程序. 该银行从美国到墨西哥走廊开始,并命名了该应用 Tuyyo, 翻译过来就是‘你和我’。’ 该应用程序提供了基本的用户界面,并且功能有限.

该银行继续收取高于平均水平的保证金, approximately 3% in total, 其中一半来自费用,另一半来自外汇加价. 尽管开展了广泛的公关活动, 推出六个月后, 该应用程序的下载量最少:

发布后不到两年, 显然,该应用无法与该领域的领先的金融科技播放器竞争, BBVA 宣布关闭其服务.

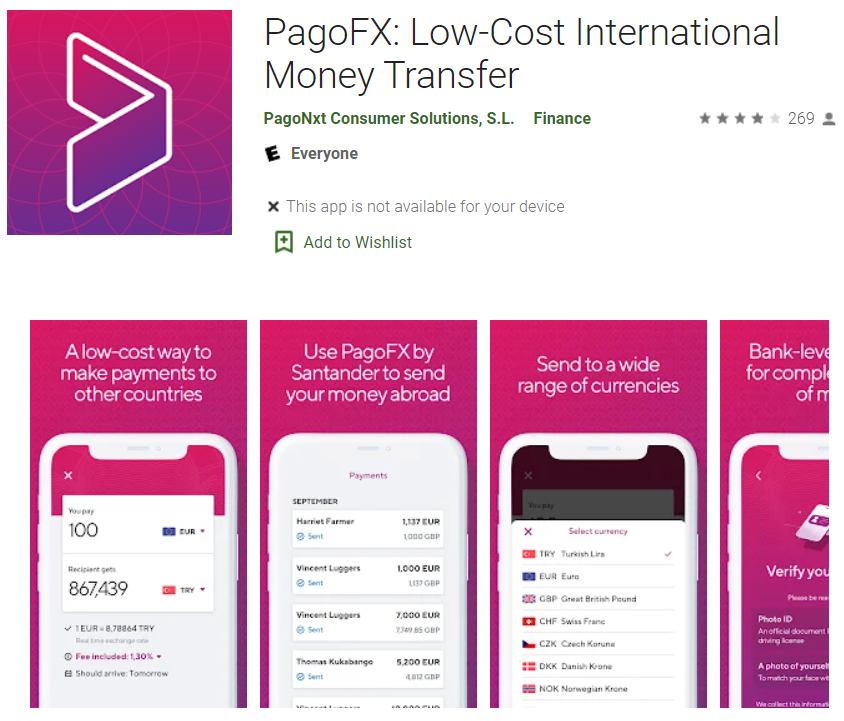

同样的命运等待着另一家总部位于西班牙、业务遍及全球的银行, 桑坦德. 在 四月 2020, 该银行推出了 PagoFx, 一个聪明的崇拜者:

桑坦德银行只拿了 15 months 关闭 PagoFx 的汇款业务并转向商业支付 帕格尼克斯. 银行一再未能认识到,从专家手中夺取市场份额比通过增强的数字用户体验满足现有客户更具挑战性.

在 2020, 看起来汇丰银行在推出Revolut的多币种跨境钱包时从其他人的失败中学到了, 这仅适用于现有客户,并且没有单独的品牌.

但不是, 汇丰也无法抗拒在 2024 通过推出不同的品牌, 津, 瞄准外部消费者:

为什么对Wise和Wester Union或其银行的货币转移羊群满意的消费者会感到满意? 那些年轻的专业人士据说梦想 “创始人成员” Zing并获得限量版借记卡.

一年后, Zing被关闭. 一方面的结果还可以. 根据财务新闻, 汇丰银行的Zing获得了 9,000 每月用户 131 千客户. 令人震惊的部分是在招聘时花费两年零1亿美元的准备工作 400 employees. 什么更糟, 汇丰银行决定在多种产品中闪电扩大规模, 100 走廊 - 是, 根据财务新闻, 失败 优先考虑其祖国的欺诈控制:

Green项目旨在增强Zing的欺诈控制, 与监管要求和汇丰银行的反洗钱政策保持一致, 并建立一个监视交易的框架, 根据内部文件.

大修于去年夏天开始, 当工作人员被告知,Zing将其资源集中在英国市场上,并解决了审计的问题。, 熟悉此事的人说.

一些从事国际扩张的工作人员随后被重新分配为Green项目,但没有被转移回去, 该人添加了.

然而, 即使汇丰银行的Zing在战略上有能力, 市场营销, 和法规遵从, 它的设置注定了它. 银行在不同的品牌下未能扩展金融科技子公司的历史悠久,尤其是在无情的跨境消费者转移空间. 而不是在其核心业务中利用其C2C X-Brote Transfer量的$ 11B, 汇丰银行以前重复了与BBVA和Santander相同的错误.

Zing将被记住是银行将角色扮演作为金融科技的又一次奢侈的尝试 - 通过数百名员工的资源燃烧, 豪华的推荐奖金, 和传统广告, 在以惊人的速度发射的同时,竞争性的金融科技公司花了5 - 10年才扩展. 与明智和叛徒对比, 通过始终达到开创性的里程碑,多年来筹集了$ 1.7B. 例如, Wise在五年的六轮比赛中仅获得了1亿美元的收入,这一点, 它已经超过了Western Union Digital和Intermex的数量.

结论

作为班级, 银行将继续在跨境货币转移中发挥重要作用. 尽管他们可能不认为汇款是一种需要争夺更大市场份额的战略产品, 银行将始终保持关注并在汇款服务上进行足够的投资以满足客户的需求. 在极少数情况下,, 他们可以主动针对利基市场,并具有巨大的增长机会. 银行不必担心来自汇款专家的竞争, 包括金融科技公司, 如果银行中断为他们提供记者银行服务,这些参与者会引起重大关注.

感谢您花时间阅读我们的分析. 我们不断更新博客上的文章, 所以我们鼓励您定期回来. 如果您对我们的事实和结论的准确性或客观性有任何疑问, 我们欢迎您在下面的评论部分提供反馈.