汇款创业公司的成本结构与. incumbents? What are the primary customer acquisition channels for money transmitters? 什么可以解释汇款初创公司’ 相对估值较高与. established providers? If you are interested in such questions, 这篇文章是 YOU.

We will cover the following topics:

- 市场规模

- 定价

- 供应商

- 数字趋势

- 用户

- 商业模式

- Acquisition Channels

- Valuations

市场规模

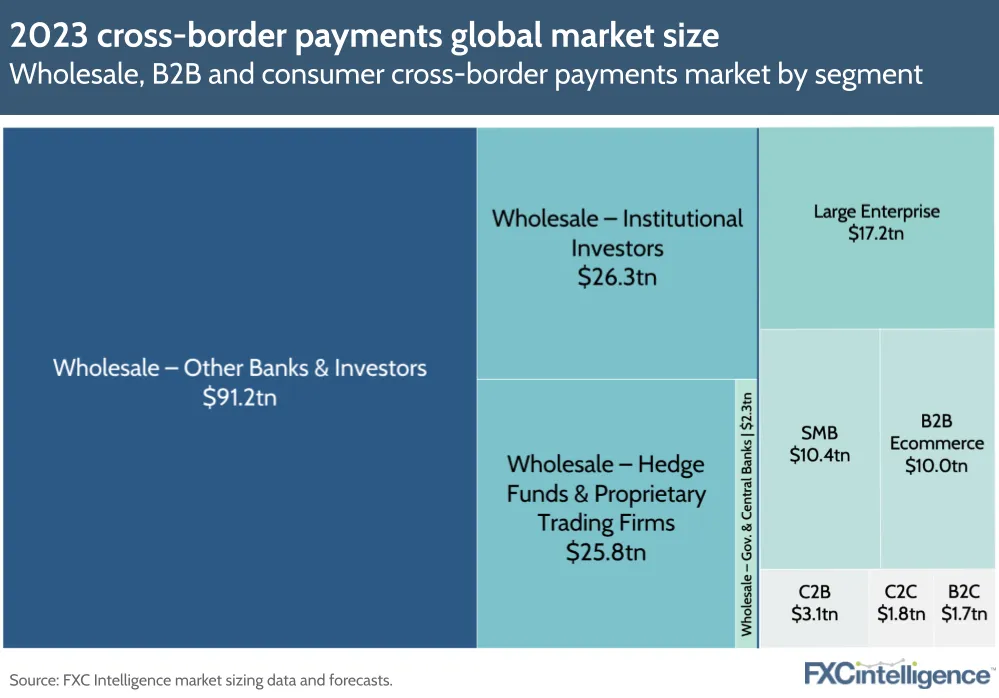

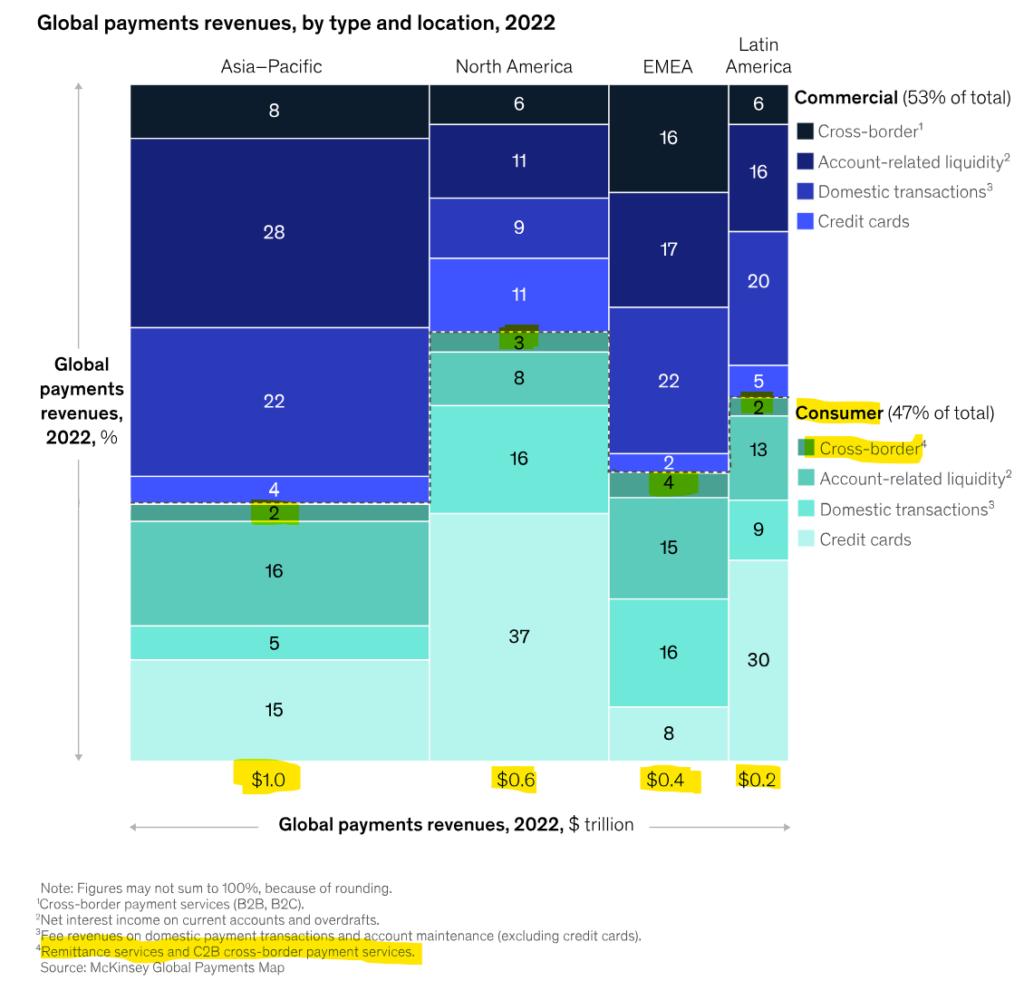

汇款是消费者对消费者最常见的类型 (C2C) 消费者之间的跨境汇款. 其中包括农民工寄钱回家养家糊口. 这代表了一小部分 跨境支付 年产量约为 $1 兆. 在其他用例中,人之间发送了类似数量的C2C交易 (例如, 不是移民, 对他们自己, 不向家庭成员).

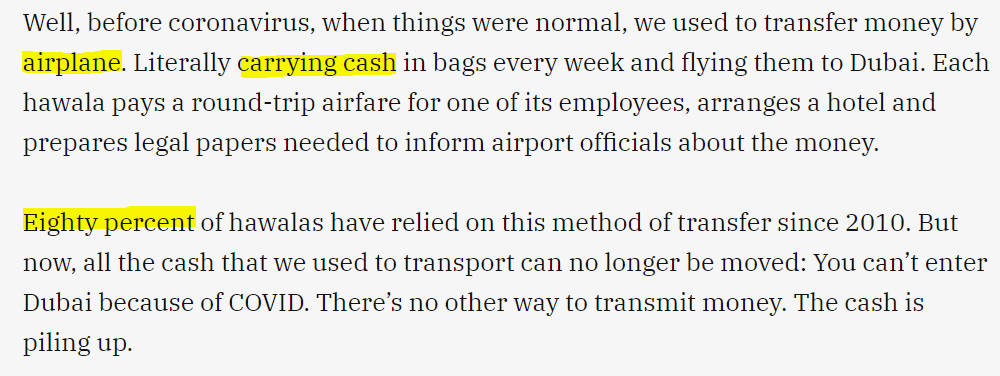

虽然正规的汇款渠道越来越受欢迎, 非正式的, 作为。。而被知道 “hawala,” 继续在特定的走廊上占有很大的市场份额. 这是由希望隐瞒转账的消费者以及 “去冒险” 银行拒绝向高风险国家(如 索马里:

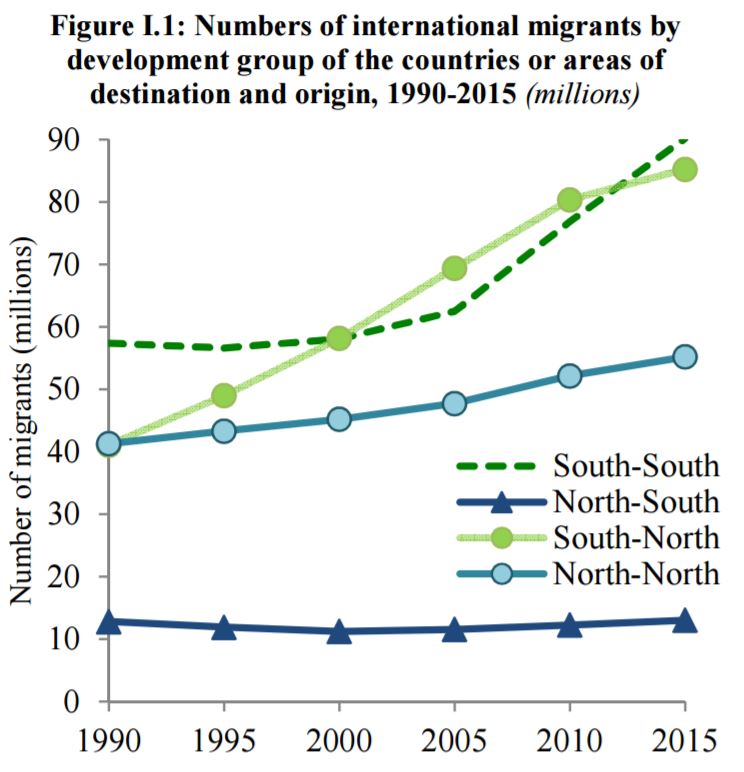

汇款与全球移民规模相关, 20世纪90年代从南到北国家以及从20世纪90年代开始从南到南国家经历了显着增加 2005:

来源: 和

不断增长的移民意味着每年都会有数百万新的跨境汇款消费者. 即使新进入市场的企业也无法从现有企业那里抢走客户, 他们仍然可以通过更容易捕获的移民和外籍人士来显着增长.

迁移模式与汇款量的变化直接相关. 例如, 随着中国共产党在 20 世纪 90 年代开始允许移民, 华人成为美国第一大移民群体. 这使得中国成为 #2 最大的汇款目的地 2000, 虽然它甚至不在雷达上 1995.

由于毛利相对较低 (采取率) 公司对国际汇款收取费用, 消费者集体支付 $60 billion 每年向汇款提供商提供. 这包括 C2C 和 C2B 用例, 比如教育. C2C 公司的收入大约占总收入的一半. 值得注意的是,C2C 跨境交易量的很大一部分仍然是非正式发送的, 有时被称为哈瓦拉, 并且不为合法公司创造收入.

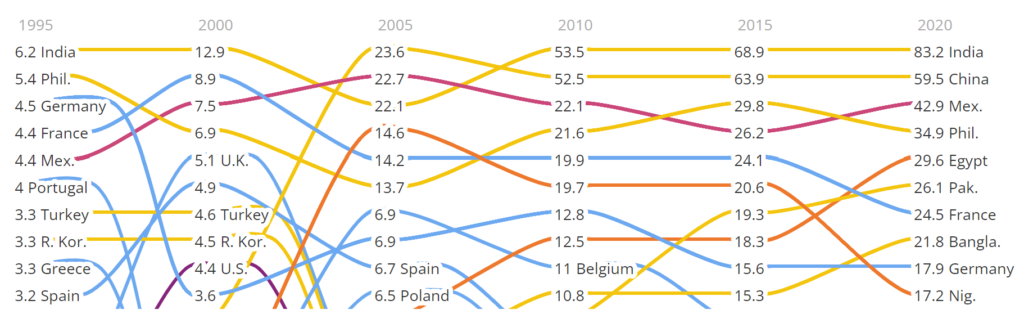

如果是汇款的话, 产生最多移民和移民的国家明显集中, 最后, 接收他们的汇款. 仅印度的入境转账就超过 10% 全球汇款. 从美国到墨西哥的转运构成了世界上最大的单一走廊, 占比超过 5% 全球汇款额. 最后, 汇款在某些国家发挥着巨大的经济作用, 约占GDP的一半.

Not surprisingly, 如果蓬勃发展和停滞经济体分开,人均汇款量有根本的差异. 缺乏国内机会自然会推动更高的移民和入站汇款转移. 因此, 中国和印度仅收到 $50 国家. 与此同时, 墨西哥, 菲律宾人, 埃及得到 $300.

美国是, 到目前为止, 最大的移民接收者, 导致汇出汇款量占主导地位, reaching $200 在十亿 2021 或 25% 占全球出境游总量的. 毫不奇怪, 在顶部 10 汇款的发件人是世界上一些最大的经济体 (见下图, 以百万美元衡量). 然而, 值得注意的是哪些顶级经济体被遗漏了: Japan, 由于其非常严格的移民政策, 以及印度和中国, 因为他们不存在促进移民的劳动力短缺.

作为一个国家越来越发达, 它往往会产生较少的移民, 转移出站和入站汇款的平衡. 例如, 火鸡, 曾经是汇款净接收者, 看到转变为 60/40 汇出汇款与汇入汇款的比率 2017, and by 2021, 这进一步偏向于 90/10 比率.

跨境汇款价格

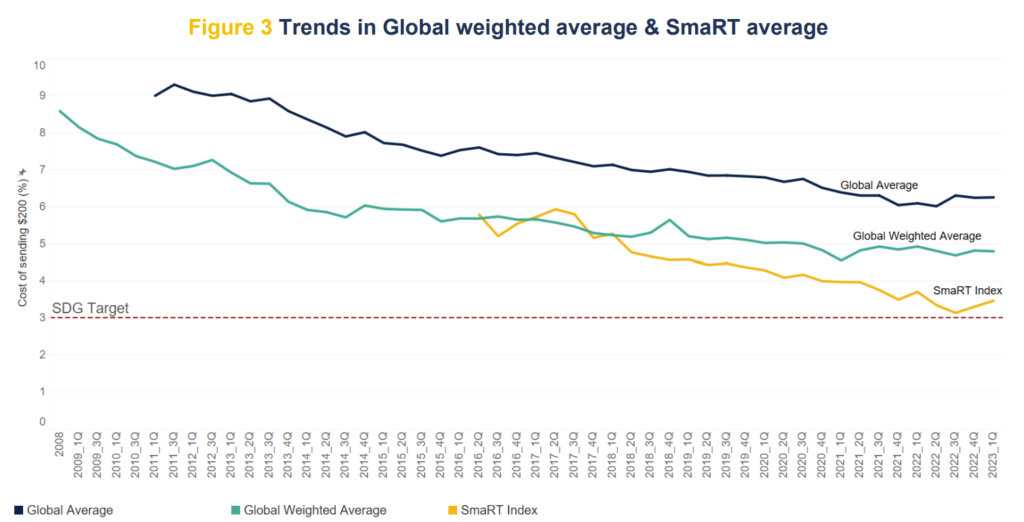

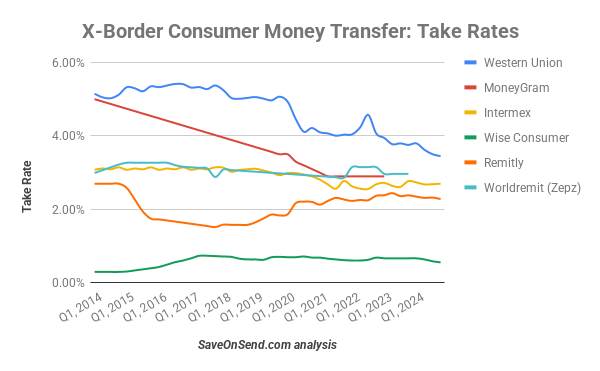

过去三十年国际汇款价格大幅下降. 20世纪90年代, 平均采纳率 (费 + FX标记) 掉落自 20% to 15%. By 2010, 它已跌至低于 10%, 以及最佳可用选项 (智能指数) 现在小于 4%.

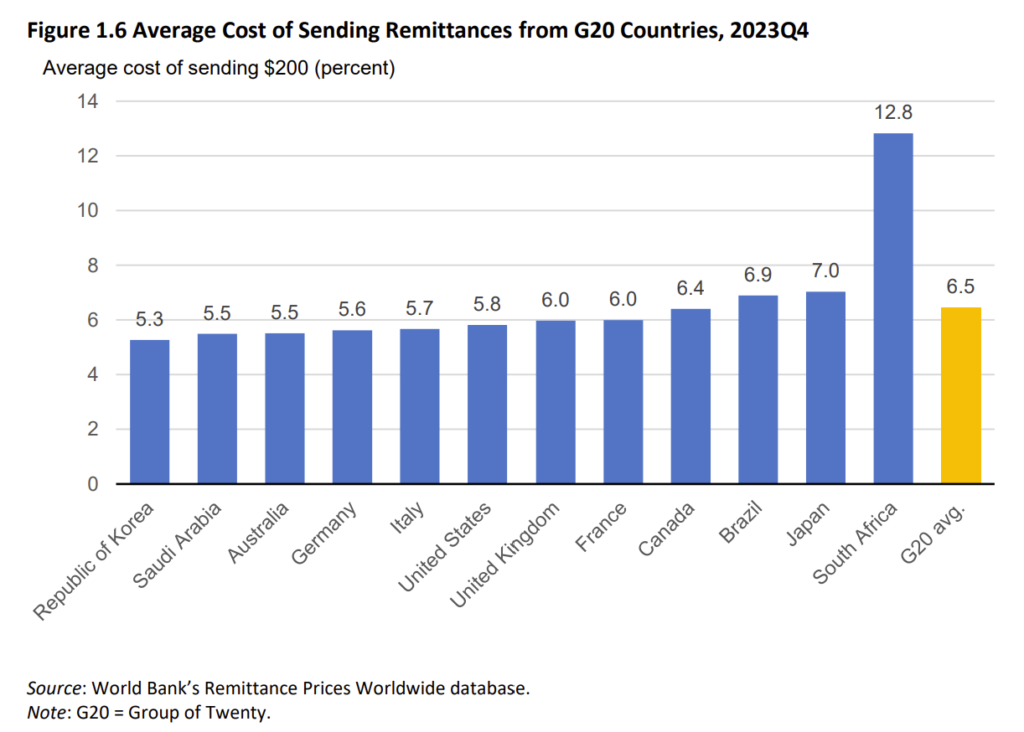

全球最大汇款走廊的平均定价大致相似, 除了南非.

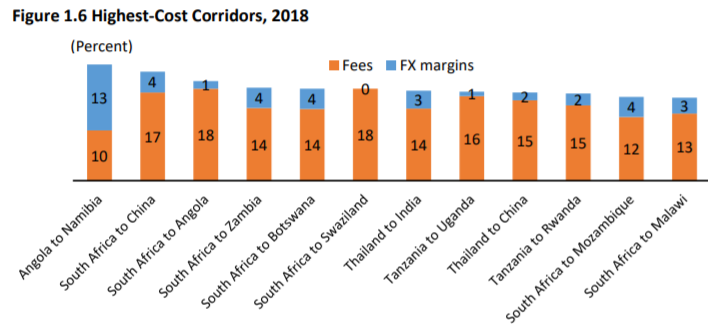

世界上最昂贵的走廊中有一半是从南非来单独:

来源: 世界银行

是什么导致南非的物价比其他国家贵得多? 大多数专家将其归因于两个因素: 去冒险 银行和 独家 通过西联汇款和速汇金合作的零售商:

“一个主要障碍降低汇款成本是由国际银行去冒险, 当他们收的钱转移运营商的银行账户, 为了应对高监管负担旨在减少洗钱和金融犯罪. 这构成了对提供和汇款服务成本,某些地区的一大挑战。”

“… 核心问题与吴是已经使用了几十年来成功地锁定市场的一个供应商的排他性条款, 那么谁能够提高他们的加价费,因为没有替代品。”

南非的情况也不是这样. 很容易被指责 “banks” 或 “西联汇款,” 但真正的根本原因通常在于:

- 不透明或腐败的政府,其法规有利于银行而不是汇款运营商 (跨国运营商).

- 现有企业满足于现有市场份额,不愿进行价格竞争.

- 不喜欢货比三家寻找最优惠价格的消费者.

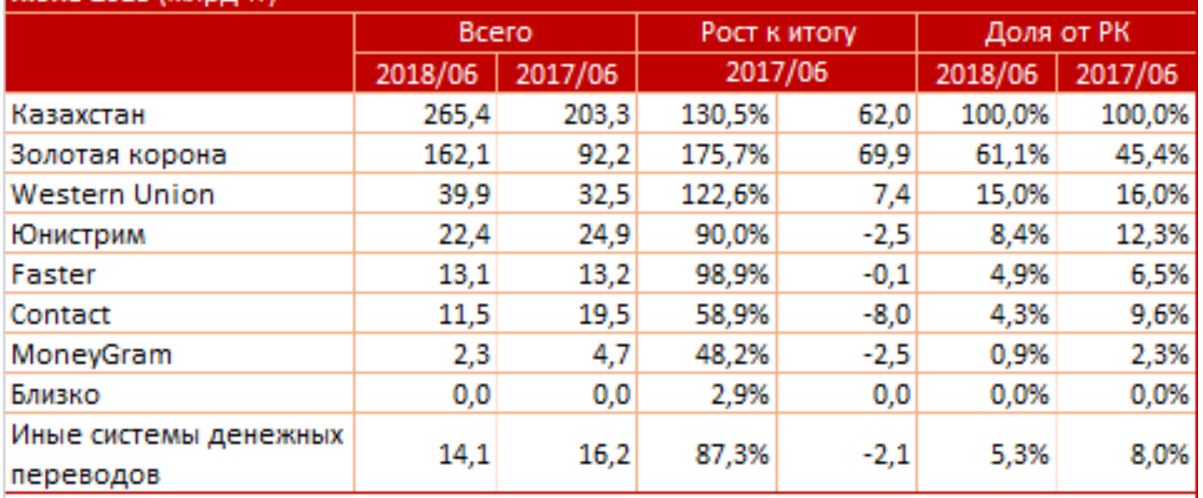

这就是为什么, 在一些相反的国家, 有利条件, 像哈萨克斯坦的金冠这样的低价老牌企业可以控制 60% 市场的.

来源: 首都

顶级跨境汇款提供商

虽然它可能会觉得西联汇款和速汇金已经撒手人寰, 银行和邮局之外的跨境汇款服务于不到四十年前推出. 那些日子, 消费者的选择仅限于银行缓慢且昂贵的电汇服务或实体邮寄汇票. 西联汇款, 正如本文详细介绍的那样 SaveOnSend文章, 开始国际汇款在80年代末, 最初利用Visa和MasterCard网络. 它开始了全球迅速的扩展。 1989. 同样, 美国运通推出国内汇款服务 “速汇金” in 1988 并开始在国际扩张 1989.

目前国际汇款领域的其他全球领导者是在接下来的几年中起步的: 阿联酋交流 (被 Wizz Financial 收购 2022), 利雅ENVIA (现在 Ria 汇款, 被 Euronet 收购 2007), 和金皇冠 (总部设在俄罗斯). 即使富国银行开始单独的汇款业务中 1994. 到了90年代末, 多家供应商提供 近乎即时 (几分钟内) 在全球范围内转移. 请记住这个事实,当你读到今天的汇款一直服用几天或几周另一个误导性文章.

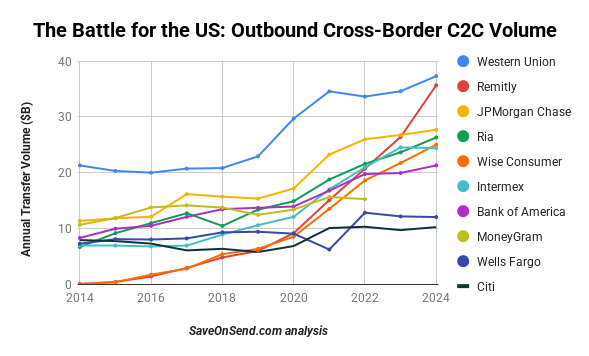

Today, 而银行, 作为一类, 仍然处理大多数C2C X-brote量 (看到这 SaveOnSend文章 详情), 他们无法与地理覆盖范围匹配跨境专家. As a result, 银行不在全球前五名之列:

然而, 在特定的市场, 顶级银行通常是最大的汇款提供商之一:

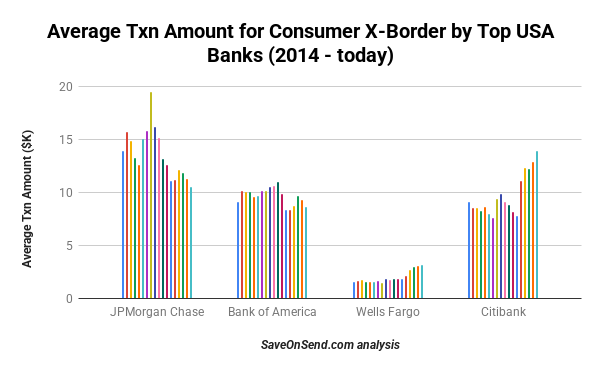

除了极少数例外, 银行客户往往是转账金额较大的不频繁汇款人 (富国银行是一个独特的故事; 阅读更多在此 SaveOnSend文章):

汇款专家继续以较低的数量占主导地位, 典型的汇款方式. 这在数字渠道使用率较低的目的地尤其明显, 例如美国至墨西哥走廊, 世界上最大的走廊:

来源: Intermex

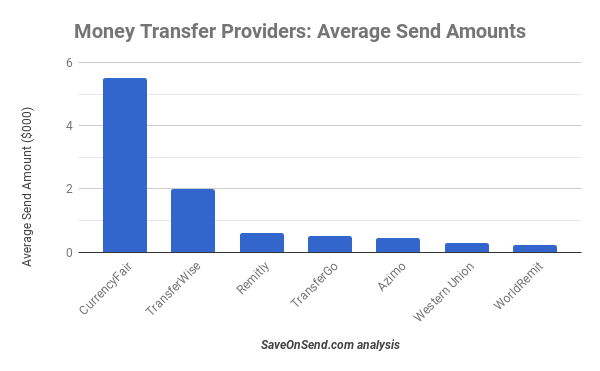

然而, 即使在汇款专家中也是如此, 根据用例的不同,平均传输量可能会有很大差异. 货币公平和 TransferWise (明智的) 主要是来自发达国家的外籍人士,并且往往具有数千美元的平均转移尺寸. 相比之下, 针对发展中国家移民的汇款公司的平均汇款金额通常为数百美元.

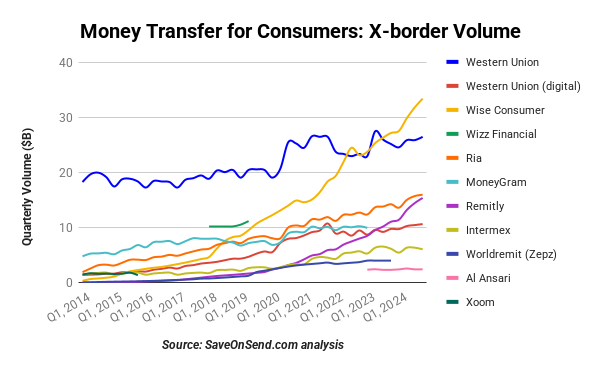

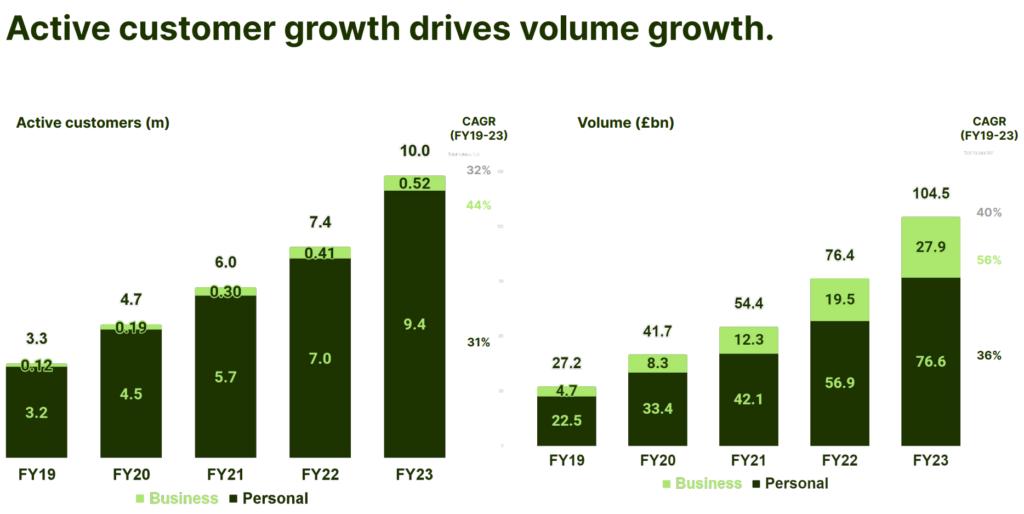

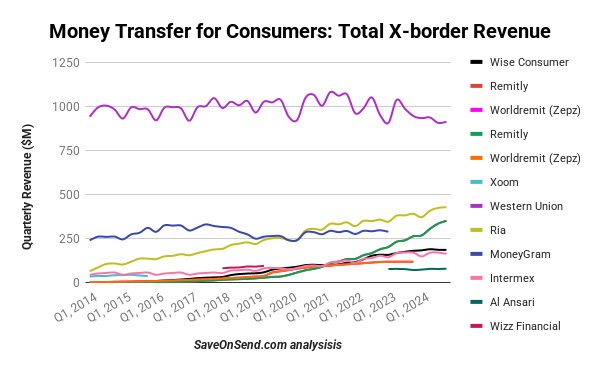

明智的, 又名 TransferWise, 是一家在汇款专家中特别有趣的公司. 成立于 2011, 其消费者跨境交易量在2006年超过了MoneyGram 2018, Ria汇款 2019, 和西联盟 2022. 您可以在此找到有关所有顶级汇款初创公司的更多详细信息 SaveOnSend文章.

除了这些主要供应商, 成千上万的其他货币发射机专门从事特定的走廊和发送接收方法, 主要利用现金代理. 而且, 存在许多基于比特币的汇款初创公司, 但是没有人会产生大量的传输量. 进一步了解比特币, 块链, 和加密货币汇款趋势, 你可以参考这个 SaveOnSend文章.

跨境汇款的数字化趋势

定义发送和接收汇款的方法时会有一些混乱. 各种术语如 “数字,” “在线,” “移动,” 或 “移动支付” 经常互换使用. “Digital” 是一个涵盖一切的总称, 含 “在线” 和 “移动。” Additionally, 移民’ 对特定频道的偏好很大程度上受其种族影响, 甚至邻国之间.

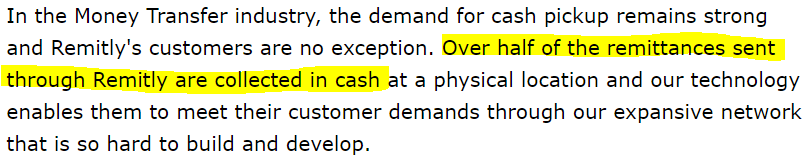

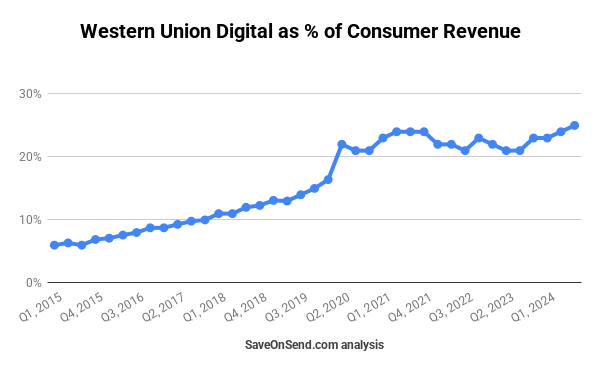

总体, 数字渠道仍被现金交易所掩盖. 尽管结束了 70% 拥有银行账户的西联汇款客户, 消费者收入中的数字份额仅增长了 1-2% annually, 除了一次性增加 2020 由于19号:

接收端的现金汇款比例甚至更高. 因此, 而金融科技初创公司热衷于讨论数字化即将战胜现金, 他们继续与现任者签署协议来分配现金. 例如, 与RIA货币转移的合作伙伴, 和 50% 其汇款的现金收到.

汇款数字化渗透率达到如此高水平有几个关键原因. 对于一个, 消费者对基于现金的产品非常满意.

在某些走廊中,很大一部分消费者也避免了严格的银行依从性,以逃避驱逐或税款.

Since 2016, 现任者试图在现金和数字选择之间找到中间立场. 他们介绍了移动应用程序,使现金客户可以在线输入所有转移详细信息,并将现金带给代理商,而无需填写任何其他文书工作. So far, 有 没有证据 这些努力在客户中产生了显着的采用.

期限 “移动支付” 通常意味着资金是从客户在电信提供商处的帐户支付的. 尽管西联试行 2007, 移动支付仍然只占全球汇款的一小部分, 主要用于向肯尼亚、坦桑尼亚等少数非洲国家转账. 它在这些国家蓬勃发展,因为它们不像较发达国家那样拥有高质量的银行卡支付基础设施. 最著名的例子是 M-Pesa, 在推出 2007 沃达丰.

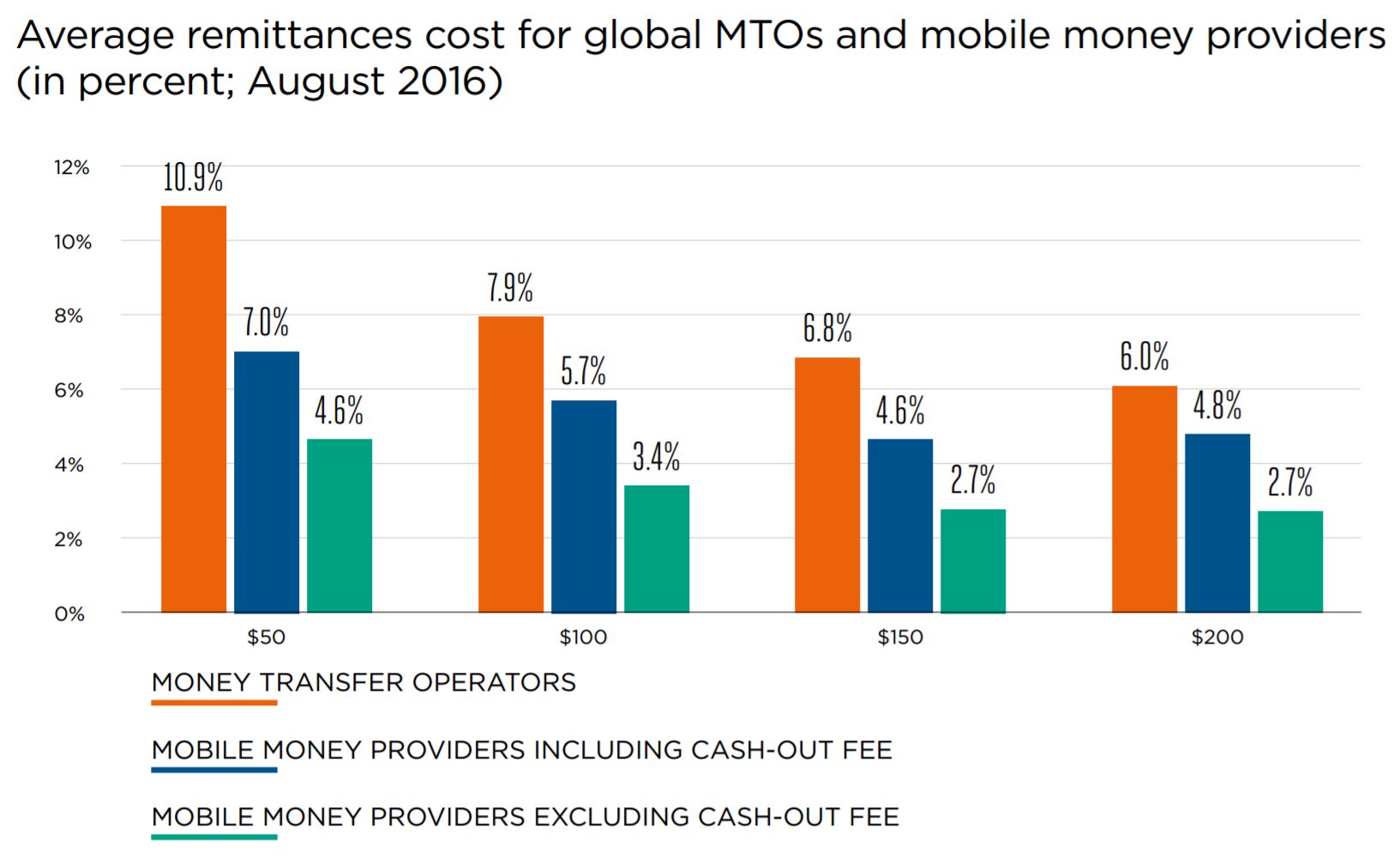

这些非洲国家之间的汇款额往往相对较小,而且, 从而, 不属于现有企业或金融科技初创公司的数字扩张重点. As a result, 与现金销售相比,移动货币方法可能是这些走廊最具成本效益的选择.

之间没有真正的区别 “在线” 和 “移动。” 随着智能手机的到来 2007, 汇款的使用量稳步增长, 现在大多数数字交易都是通过移动设备发送的. 例如, for 速汇金, 在线渠道中移动交易的比例从 60% in 2016 to 80% in 2019 并 85% in 2020. 对于 西联汇款, 它同样从 65% in 2016 to 75+% in 2019. 这是一个图表 XOOM 在整个过程中领先 2011-2015:

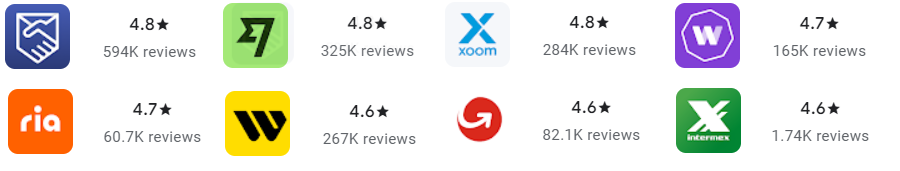

几乎所有大型企业都有移动应用程序, 客户的反馈大多是积极的:

有一个广泛持有的信念, 由金融科技影响者宣传, 银行正在将业务输给像 Wise 这样的新参与者, 部分原因是它们的数字成熟度滞后, 导致低于PAR的移动体验. In reality, 之间 2021 和 2023, 与钱包和汇款应用程序相比,银行移动应用程序的汇款使用量增长最快, 使其成为这三组中最常用的应用程序:

国际汇款的用户

移民汇款的原因因走廊及其内的细分市场而异. 例如, 早 2017, Remitly 被调查的 其客户发现分布原因如下:

- 70% 汇款以帮助他们的家人满足基本需求, 包括住房, 餐饮, 和公用事业

- 16% 把钱捂个人开支和投资

- 11% 寄钱帮助支付教育费用,如学习用品, 图书, 和学费

- 3% 发钱,以帮助支付医疗和紧急费用

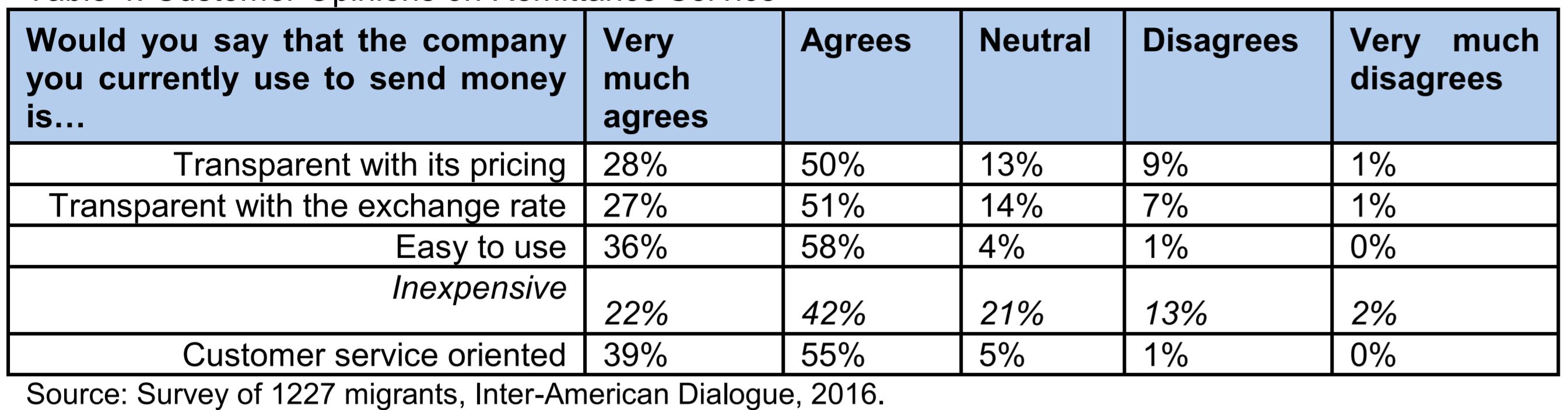

正如我们在上一篇文章回顾 西联汇款, 针对不同的移民群体,当同一供应商可以有很大的不同的方法. 背后的原因是每个移民群体都是唯一的. 例如, 考虑这张图表,它比较了美国不同种族的收入和教育程度, 并尝试猜测哪个群体更有可能在线汇款:

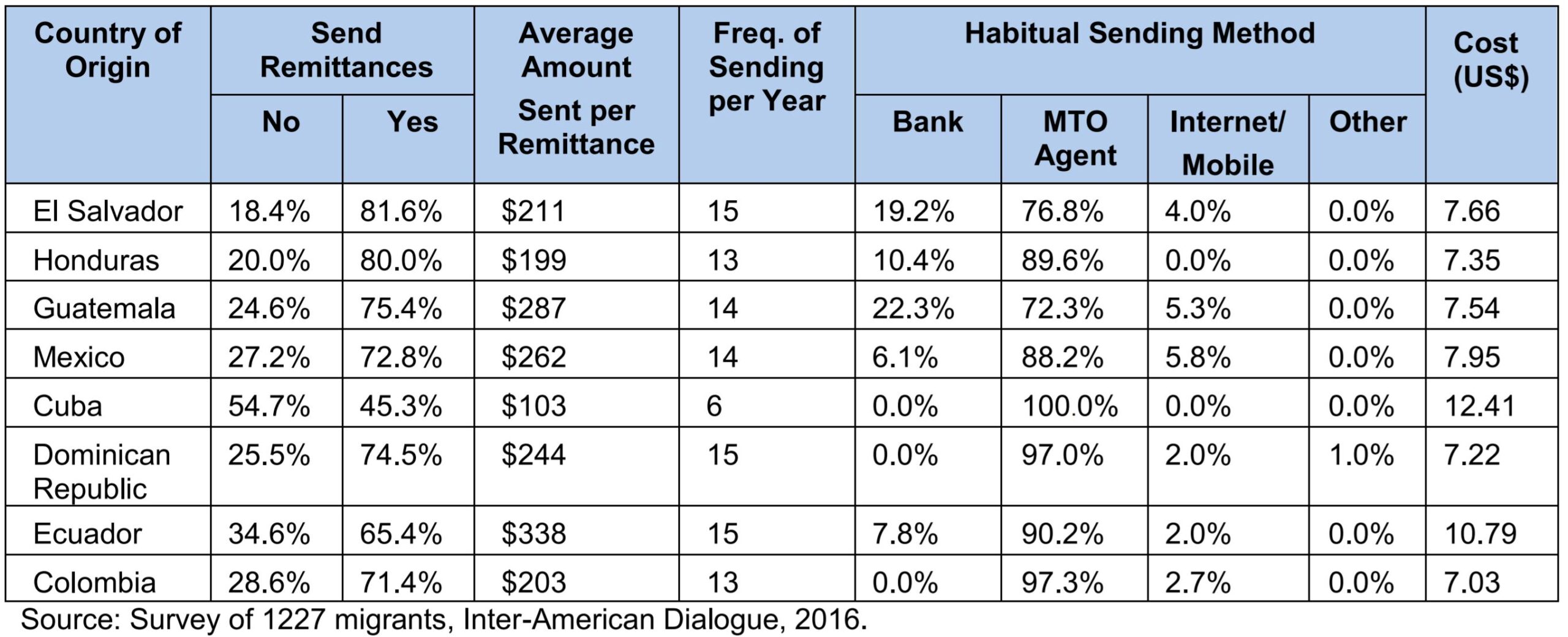

受教育程度越高的消费者更有可能在网上汇款,原因有几个: 他们往往更精明的数字, 更愿意尝试新的提供商, 并在其银行帐户中获得应税收入. 因此, 超过 80% 从美国到印度的汇款是通过网上发送的, 而小于 40% 适用于美国-墨西哥走廊.

反过来的关系也是如此: 在线发件人往往收入较高. 即使在同一种族内, 在线发送的平均金额可能是 50-200% 不是通过现金剂更高. 高收入消费者群体寄钱回家也有不同的原因. 低收入的移民转移通常数额较小 ($200-300) 每月支付其家庭的基本需求回家或紧急情况. 反过来, 高收入的人寄来更多的钱 ($1,000-2,000) 不太频繁, 要么存入他们家乡的储蓄账户, 作为礼物, 或紧急情况.

移民群体之间也存在文化差异. 例如, 作为消费者,美国的印度人通常表现出高度的价格敏感性. 他们比其他人更倾向于通过比较应用程序寻求最佳交易,并且更倾向于更换提供商以最大限度地降低费用或确保更优惠的汇率. 反过来, 墨西哥人或菲律宾人往往对价格不太敏感,并对当前的服务提供商表现出更高的忠诚度.

最后, 即使在同一移民群体和收入水平内, 有行为偏好. 有些人可能要立即支付额外的钱, 而其他人会等待几天以确保最佳汇率. 这些因素, 和许多其他人一起, 对提供商如何营销和定价其服务有直接影响, 最终影响他们的收入来源.

商业模式

大多数著名的跨境汇款提供商都迎合三类客户/客户:

- 消费者: SaveOnSend 文章的主要焦点.

- 企业: 通常是习惯数字自助服务的小型企业.

- 竞争对手 (平台): 提供汇款,但更喜欢使用更高级提供商的核心平台.

SaveOnSend 主要关注消费者细分市场,并没有深入研究业务和平台细分市场. 值得注意的是,在汇款专家中,商业部门产生的收入通常小于消费者部门, 平台部分甚至更小. 举个例子, 明智的 细分其消费者和商业部门, 随着平台业务的通过 5% 的总体积 2025.

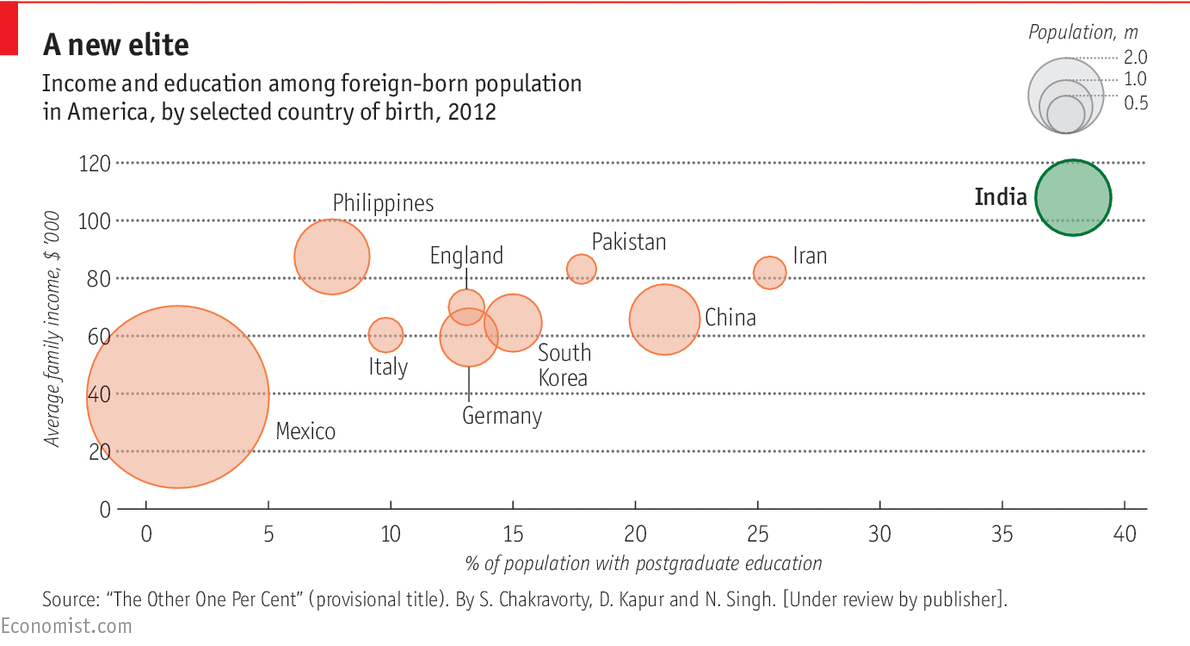

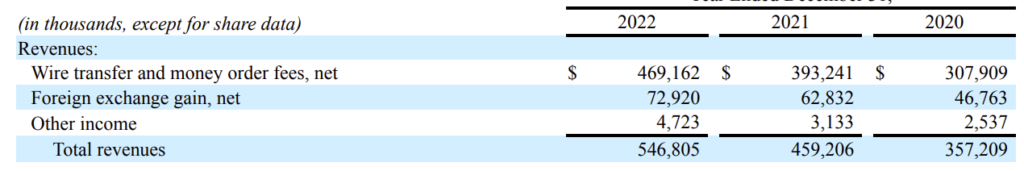

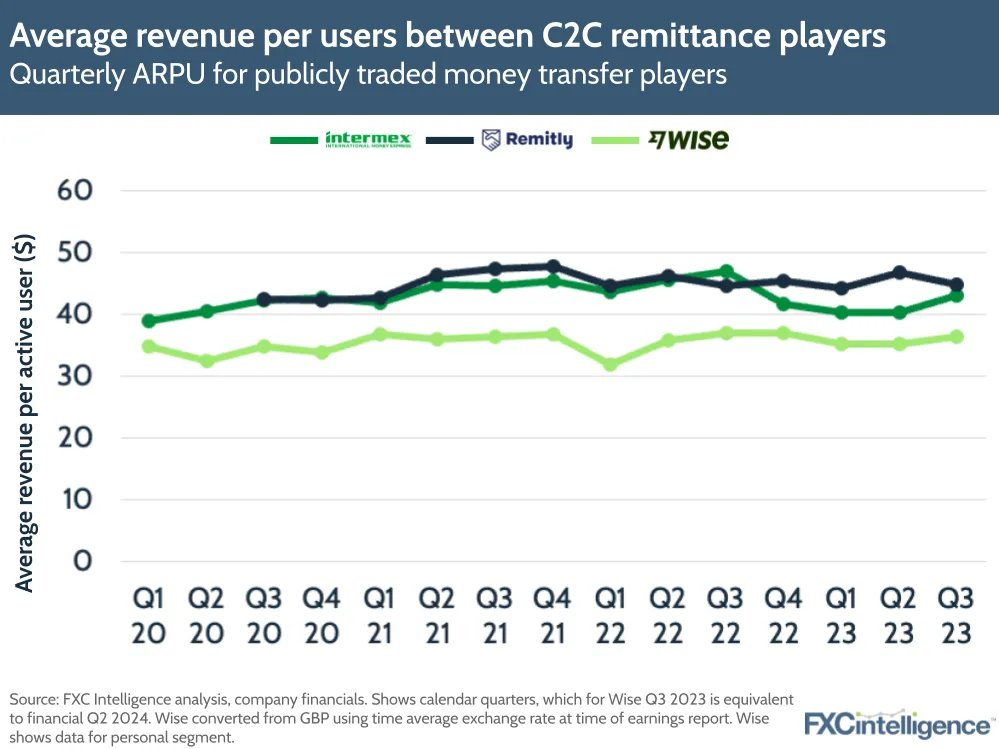

提供商通常通过费用和外汇产生收入 (外汇) 在消费者细分市场中加价. 外汇加价涉及客户的资金以低于提供商可用的汇率进行兑换. 取决于发送和接收方法,甚至取决于特定的转移走廊, 同一提供商可能不收取任何费用并仅依靠外汇加价. 例如, Intermex 产生小于 20% 的收入来自外汇加价:

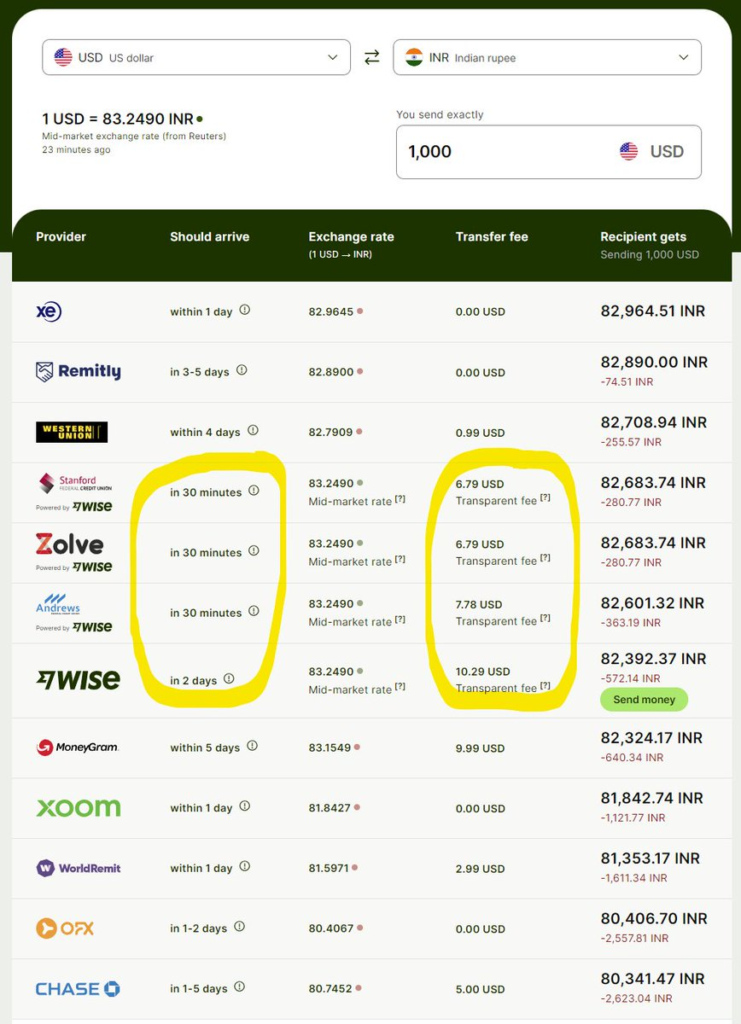

Some providers, 例如明智, 以不收取费用而闻名,仅从FX标记中获利.

明智的, 的确, 利润最低的运营.

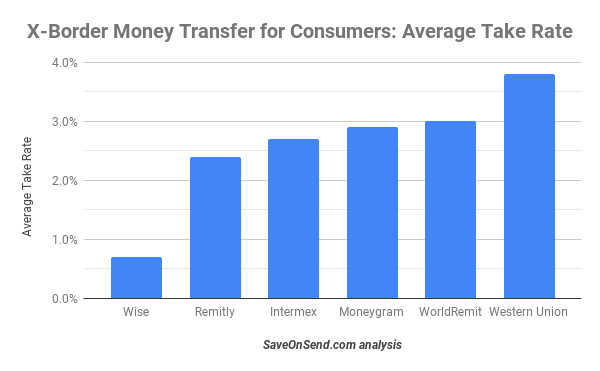

Wise可以盈利地做到这一点,因为由于我们之前提到的客户类型和用例,其平均转移量要高得多. 这就是 Wise 为何能够以较小的转账金额为每个用户带来与汇款专家相同的收入:

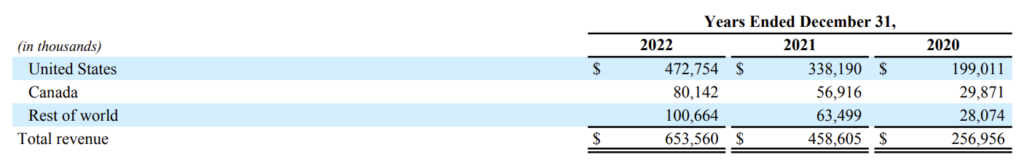

知名提供商均覆盖多个出境国家甚至更多入境目的地. 供应商从其原籍国获得的销量通常多于后来扩张的其他市场. 这是一个例子 Remitly, 成立于美国.

虽然费用往往很少变化, 一些提供商动态调整外汇加价,波动幅度较大:

一些提供商还进行临时定价促销, 大大降低FX标记几周,甚至不收取任何标记, 迅速在特定走廊中增加市场份额.

像西联汇款这样的成熟公司和Moneygram过去可以收取更高的平均标记, 部分是由于更强大的品牌以及支持更多小规模走廊的推动. 然而, 在过去的十年里, 品牌加价已经变得可以忽略不计. 正如已经讨论过的, 一项定价例外是明智的, 其商业模式明确涉及将价格降低到中断银行和专家.

最后, 汇款提供商通常会根据走廊的成本结构收取不同的评价, 转移类型, 和客户行为. 例如, 正如西联汇款所承认的 2020, 一些种族往往对价格更加敏感并且更有可能更换提供商, 所以他们通常会得到较小的加价.

这驱使一些提供商甚至提供负面的FX, 即, 在大型走廊中因对价格高度敏感的客户而蒙受损失,例如从美国或英国向印度汇款, 正如 MoneyGram 在 2019:

那么为什么有这么多不真实的文章, 部分由金融科技推动, 关于现有专业提供商和银行的费用有多昂贵? 这种误导性的评论 (看多本 SaveOnSend文章) 方便比较 “apples and oranges”: startups’ 在线发送大额金额与. what incumbents charge for sending small amounts via cash agents.

如果记者对现有企业有偏见, 它会很容易感到自以为是由樱桃采摘西联汇款和速汇金的费用一定的转移. 看看他们寄多少钱 $20 通过现金代理从美国到墨西哥: almost 30%!

虽然很容易谈论帮助 “poor,” 建立一个将保持不变的现金代理网络实际上是相当昂贵的, 可能几十年, 发送农民工的钱的主要方法. 而且, 我们知道,很少有消费者发送如此少量, 许多人知道他们可以通过) 发送更多和b) 从现金代理转向数字发送方式.

那么怎么办 “老” 和 “新” 提供者比较以数字方式发送典型的转移金额? Here is a global poster child, ground zero of online consumer remittances, 美国至印度走廊, 其独特之处在于其受过高等教育的发件人倾向于更换提供商以获取更优惠的价格:

虽然 Wise 往往是最便宜的提供商, 其商业模式主要基于推荐,营销支出很少. 不幸, 许多消费者似乎并不关心他们是否付款 0.5% 或 2.5%, 那些确实从Wise的竞争对手那里看到的价格较低, 从向印度的转移中可以看出. As a result, 明智的消费者量增长率已停滞在附近 20%, 这可能会迫使明智投资常规营销和激励措施.

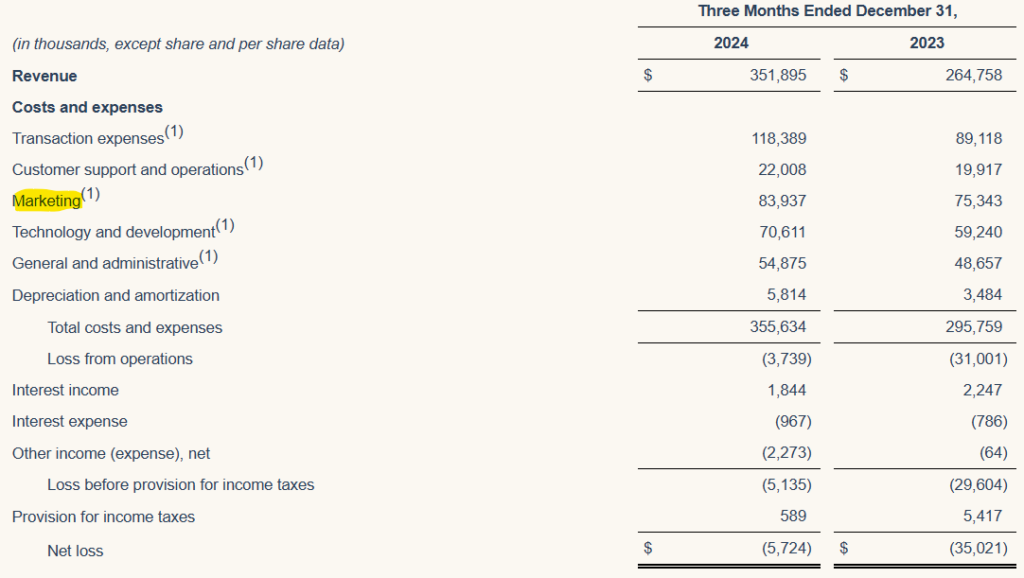

另一个极端, 烈性人仍在成长 40%, 但它正在花费 20-25% 收入 (5X 怀斯的) 关于营销, 发射后十多年使它无利可图.

可变成本和固定成本

在成本方面, as you remember from financial statements, 可变成本与每笔交易和总体固定成本有关.

Variable costs 包括每个交易特定的许多标准组件, 代表 30-50% 所有费用, 取决于提供者. 它们大致分为提供商为接收资金和发放资金而支付的成本.

Receiving funds: 货币发射机付费代理网络以收集现金转移和付款银行,以从客户的银行帐户或链接的借记卡/信用卡汇款. 银行对客户的转账收取的费用相对较低’ 账户, 大约~30美分, 因为它是通过 FedACH 服务提供的,象征性收费 (见 “origination per item” in the table below):

For a bank-funded transfer, 费用通常是固定的,金额范围很广 (例如, 发送相同的费用 $0-1,000 or even $0-2,999).

卡资金付款通常是可变的, 通常 1-2% 在传输量. 这就是为什么想要使用借记卡或信用卡为其转让资金提供资金的消费者通常会收取更高的费用.

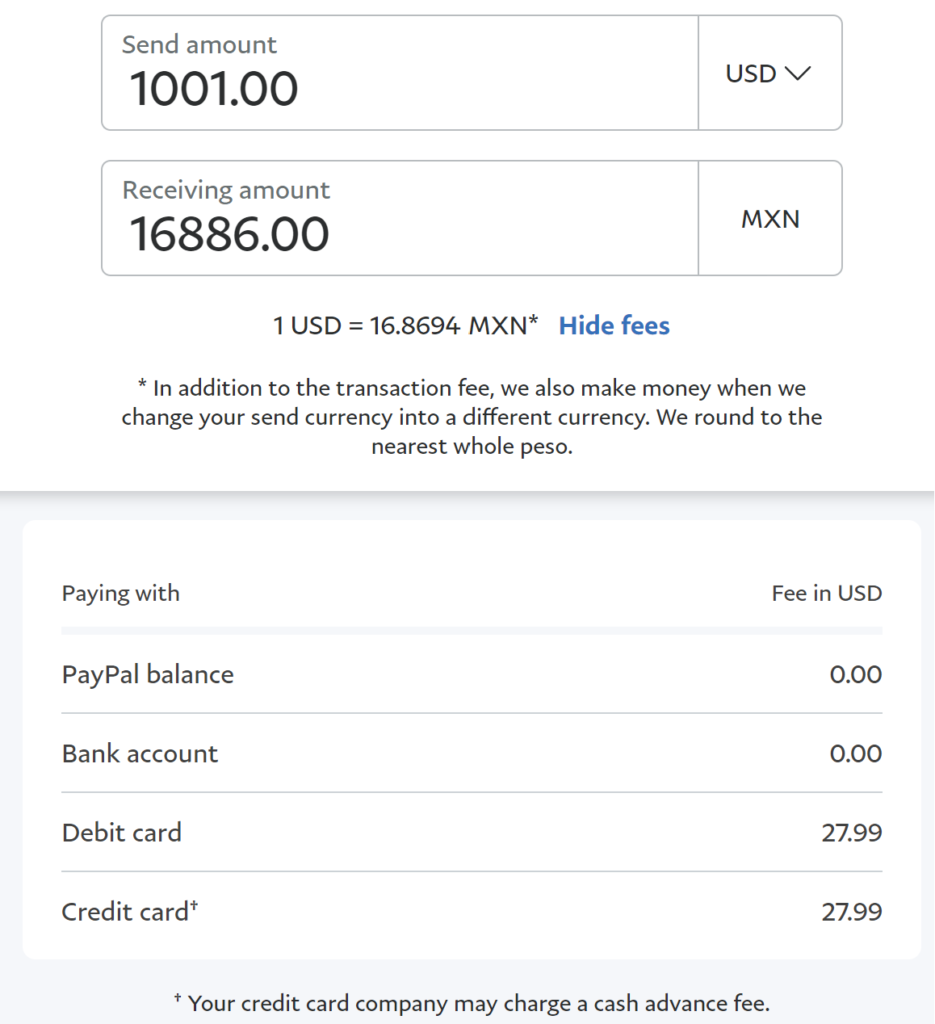

例如, Xoom 收取约 100 美元的固定费用 $4 发送少于 $1,000 从美国到墨西哥. 还有, 它的卡片转移价格可用于大量 (对于消费者来说,信用卡融资方式是最昂贵的,因为, 除了汇款提供商收取的高额费用之外, 信用卡公司会收取预借现金费用):

一些货币发射机使用所谓的 “on-us” 最小化基于卡的资金成本的技术. 他们通过在代理位置申请处理借记信用卡传输来实现这一目标. In a sense, 他们是从一个链接借记信用卡汇款和处理这种转让的开闭循环内部没有充分利用的Visa / MasterCard /等. networks.

付款方式为现金剂更加细致入微,并涵盖了费用和FX标记. 协商的条款可能涉及这些提供商必须收到的分配或最低门槛,同时允许代理商自行决定对费用和汇率进行标记费用和汇率. 取决于提供商, 零售连锁店, 和市场, 收入以截然不同的方式分配.

例如, 市场领先者像西部联盟可能会更有选择性, 只支付 10-30% 收取的费用以现金剂. 一个较小的供应商可能会分成费 50/50, 在某些情况下, 当货币发射机想要快速获得市场份额时, 它可以通过承诺向他们支付最多加现金代理网络额外奖励 100% of collected fees. 还有一个类似的逻辑,当涉及到分裂的FX标记. 反过来, 更大的零售连锁企业可以协商更好的条件比较小.

放电资金: 提供商向银行和现金代理网络支付汇款或向客户提供现金. These payments are usually fixed; for example, 提供商可能会付费 $2 per transaction to a bank in a destination country.

大型玩家与大型银行和现金网络建立了直接关系/联系. 这些提供商将每天为每个目的地发送资金到通讯银行. 例如, 如果西部联盟每天传送一千万美元到墨西哥代表其客户, 这将每日量发送给其在美国的代理行 (以美元) 以便银行可以在墨西哥分配资金.

由于汇率在白天可以大大移动, 一些提供商还会有一个内部对冲交易台,配备一些负责买卖货币的人员,以尽量减少汇率风险. 每个目的地的每日电汇加上交易人员似乎是一笔巨大的支出, 但不是在百万美元交易量的背景下 ($30 电汇每日交易量达 100 万美元 3% 平均毛利率代表 0.1% 收入).

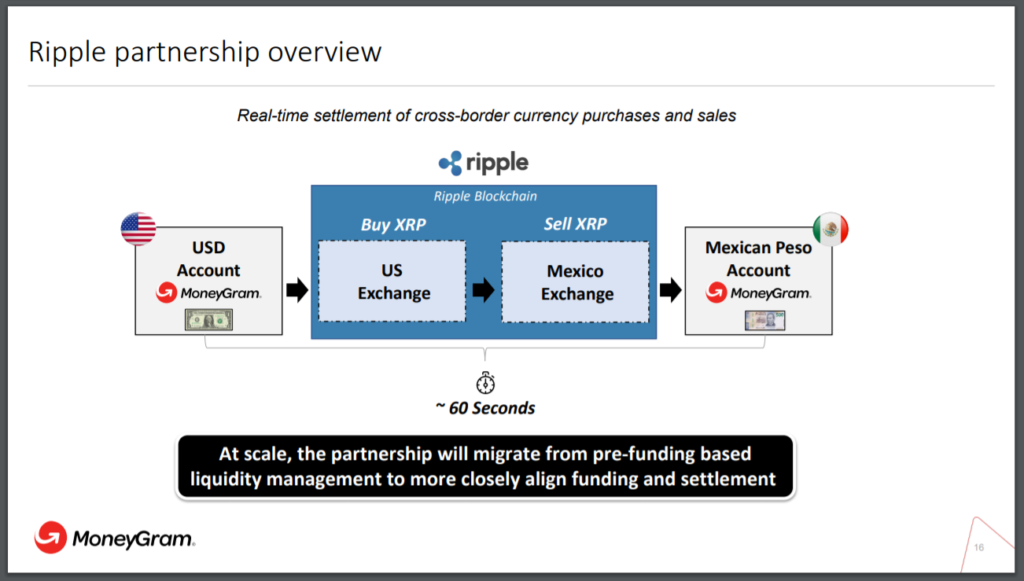

这就是为什么区块链-比特币-加密货币转账方法, 同时理论上消除了电汇的需要, 由于额外的货币兑换和更高的波动性,节省的资金相对较少,并且实际上增加了更高的额外成本 (有关区块链的更多详细信息, Bitcoin, 和加密汇款, 读这个 SaveOnSend文章):

Blockchain一边, 货币转移机构一直在通过中介机构为部分或所有市场部署转移服务. 在某些情况下,, 使用Xoom Earthport, 明智的 – Earthport, WorldRemit – 地球港和 BTS, Azimo – CurrencyCloud, 和维亚美洲 (又名, Vianex) – Earthport. 也有区域中介, 就像Wise与FlutterWave一起前往尼日利亚的案例. 这种方法更容易,更快,但从长远来看可能会更昂贵. 例如, 货币云正在充电 0.1% 其服务的传送量 (看到完整的报告 这里):

使用这样的中介还增加了依赖单个提供商的风险: transferring funds across entities.

除了中介, 金融科技初创公司还可以与银行甚至现有企业中的直接竞争对手合作,以更快地获得分销机会. 例如, in December 2016, WorldRemit与Xpress Money签署了一项协议 (阅读更多 这里):

“我们希望我们的客户提供的支付方案的最广泛和最方便的选择. 随心金钱是一个值得信赖和可靠的汇款品牌与代理世界各地的梦幻般的网络. 我们的合作将我们的足迹延伸到新的领域,将使更多的人,使安全, 即时转账。”

Fixed costs 并不特定于每笔交易,并且涵盖技术组件的支出, 包括软件和硬件.

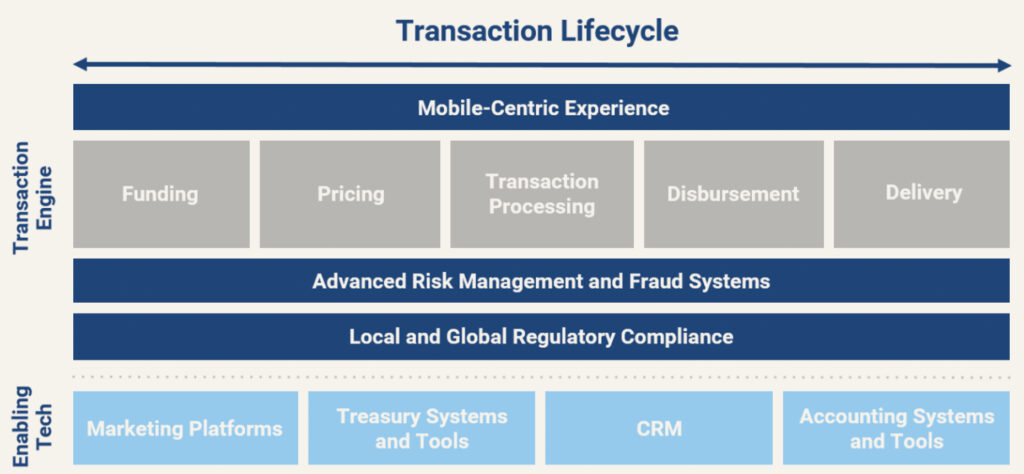

金融科技公司’ 架构往往比现有企业更简单,因为它们收购的拥有遗留系统的公司较少. 他们首先 5-10 开发它需要多年的时间, 随着IT费用有时达到 30% 收入. 然而, 之后, 架构良好的平台的固定成本可以扩展到更高的交易量, 导致 15-25% 花费的收入.

- Licenses 需要在美国货币转移机构开展业务的州开展业务. 获得许可既耗时又昂贵, 随后进行彻底的年度审计,检查运营的各个方面, 包括网络安全. 这就是为什么你会看到像 WorldRemit 这样的金融科技公司开始于 2015 只需几个, 通常更小, 美国州更容易获得许可,然后在许多月内努力到达最大的州的州, if not years. Others, like TransferWise, 进入美国 2015 通过与获得许可的提供商合作,例如 PreCash (后来改用 CFSB):

- Fraud:

- “NSF” (Not Sufficient Funds) 当客户从关联的银行账户或银行卡汇款但没有这些资金时,就会发生这种情况.

- “Misrepresentation” is when a customer lies about NOT sending money after the transfer is completed (根据美国法律, a customer has up to 12 months to dispute a transfer).

- “Account takeover” 当客户的帐户被盗用时.

以下是欺诈经济学如何运作的 $1,000 从提供商的角度来看汇款:

- 每笔此类交易的平均收入为 $30, 利润是 $5.

- So, 汇款提供商需要 200 成功转移以弥补一项欺诈性交易 (来弥补损失 $1,000 欺诈) - 破裂 - 是 0.5% 因欺诈而发生的交易.

- 各个移民群体的欺诈尝试的总数范围从 1-5%, 不仅仅是 0.5% 盈亏平衡点.

- 汇款机构采用各种技术来降低实际欺诈的发生率, close to 0.1%. 在里面 2017 联邦贸易委员会 诉讼 反对西方联盟, 公司的投诉数据库包括 50 每年有数千起与欺诈相关的投诉, around 0.02% 大约 250 每年百万交易. 该公司估计实际数字可能高出五倍 (0.1%) 由于报告不足.

随着欺诈者变得越来越老练,打击欺诈的斗争也在不断发展. 一些提供商拥有出色的欺诈性团队,具有深厚的统计背景,但仍然被剥夺了.

- 网络安全: 类似诈骗, 由于潜在成本高昂,防止黑客攻击变得越来越具有挑战性,但势在必行 (阅读 Xoom’s debacle in December 2014).

- Compliance: 除了实施上述与控制相关的过程, remittance providers must prove 这些过程有效 有效地.

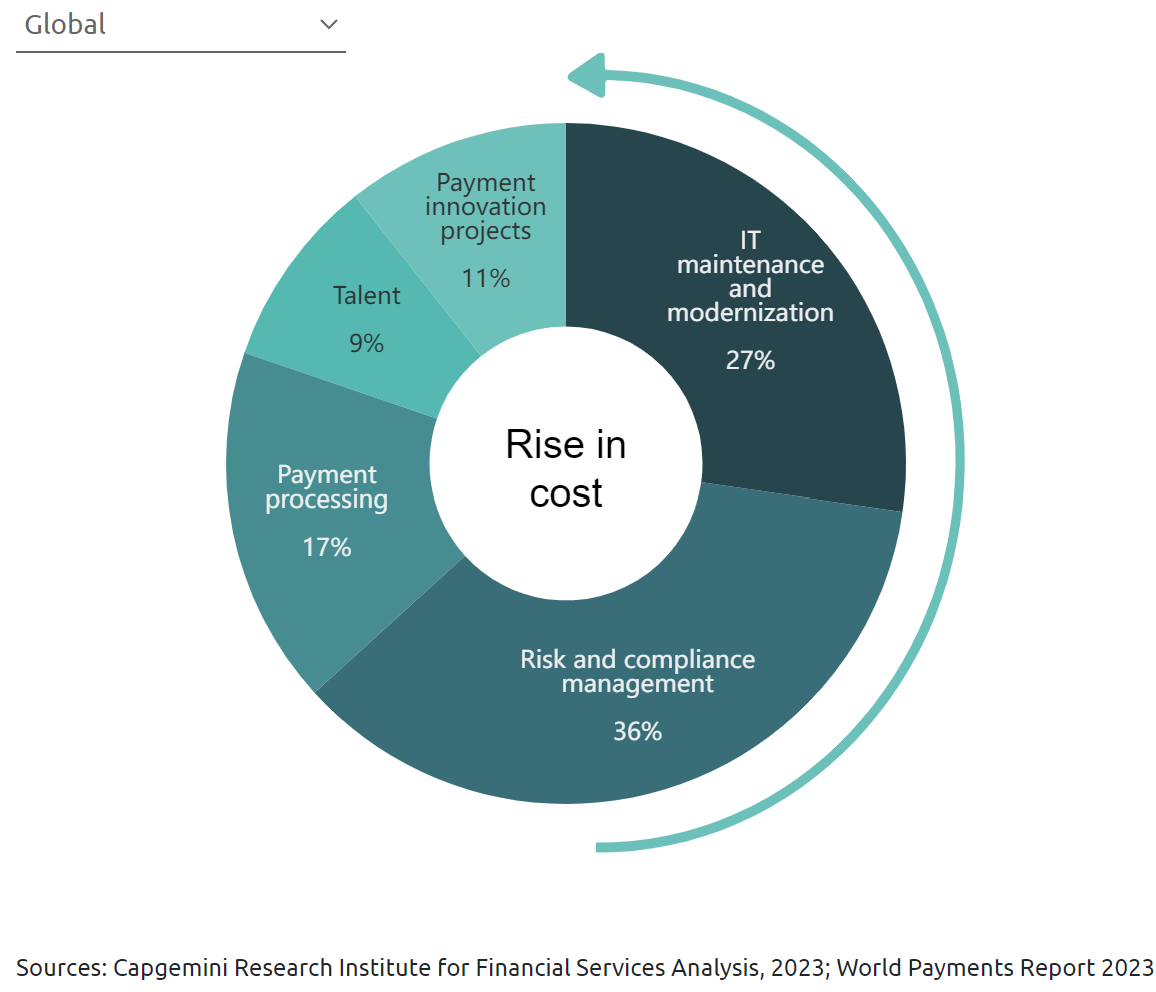

与合规性相关的功能非常昂贵. 它的费用西部联盟 $200 百万 每年涉及 2200 employees 或 更多 20% 致力于合规. 整个支付行业, 风险与合规管理占 36% 占总成本的, 使其成为最大的支出类别:

由于不透明的法规和零星的执法, 汇款提供商使用大量的体力劳动来打动监管机构,并向他们表明他们认真对待合规性. 由于政府没有减少金融犯罪的动力,因此几乎没有实际阻止犯罪, 因为这些资金有可能使其他发达国家致富. 故, 提供商勾选必要的方框以避免罚款, 并且在很多情况下, 实际调查只有在执法机构要求.

即使是最好的金融科技公司似乎也放弃了进一步扩展此功能. 在早期的 2025, 15% Wise的可用角色中有金融犯罪:

每个国家/地区的合规规则可能有所不同, 使他们难以遵循, 特别是因为大多数本地合作伙伴是独立组织. 想象确保所有代理合作伙伴位置的所有员工 (500,000+ 西联) 严格遵守合规程序.

因此,尽管在这一领域持续投入巨额资金, 西联汇款遭遇了 $568 百万 罚款在美国和 ~$2M fine by Ireland’s Central Bank, 速汇金支付 $13M 在美国被罚款并连续两次被罚款, $0.4M in total, 澳大利亚交易报告和分析中心. 新任 经常感觉 他们已经不成比例单挑这种遵守执法. 可能是准确的, 但这并不意味着其他成熟的提供商或金融科技公司不认真对待合规性.

Acquisition Channels

所有提供商都使用相同的渠道来获取客户: 付费搜索, THIS, PR, Billboards, 在线-TV-Radio印刷广告, Affiliate Marketing, 社交媒体, Referrals, 和促销. 明显的目标是使客户获取成本尽可能低. 在建立供应商, 成本范围可能是 $10-100 每个客户根据获取能力, 渠道, corridor, 和段, 除其他因素外.

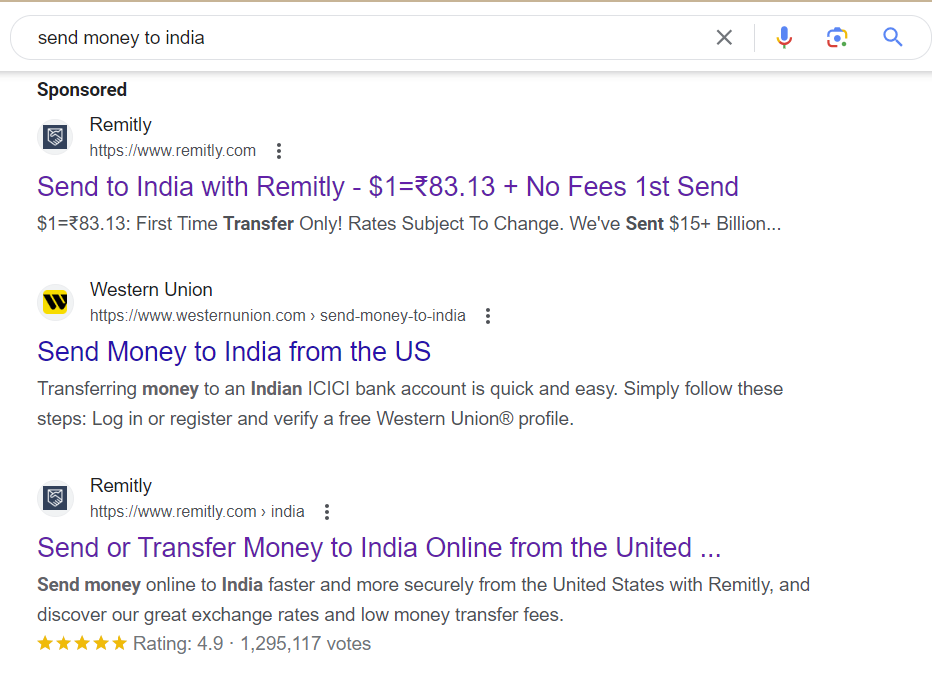

付费搜索: 汇款提供商向 Google 等搜索引擎支付在搜索页面顶部投放广告的费用. 越靠近左上角, 成本越高.

THIS: 目标是当客户在线搜索汇款选项时排名尽可能高. In the image below, Xoom has both the top SEO result and a paid ad in the right column.

付费搜索允许更具体的措辞, 而 SEO 则捕获更通用的页面标题. 比较赞助的和有机结果以备:

PR: 目标是在媒体上获得看似合法报道的好评. By definition, 局外人永远不知道特定的文章是否是 “sponsored” or not. 例如, read this article rooting for TransferWise: Richard Branson, Peter Thiel take aim at Western Union. 如你看到的, 很难找到懒惰报告和出色的公关工作之间的界限 (best described in Paul Graham’s classic The Submarine).

There are various ways to arrange PR publications. Sometimes, 出版商公开报价价格, 例如, “$100K用于四个正面文章。” 汇款公司经常雇用与出版商打交道的公关公司. 在汇款文章的SaveOnsend分析中, 大多数似乎是在交换条件下写的. 此类文章或访谈永远不会提出棘手的问题或跟进以进行澄清.

如果您发现有关消费者汇款的合法质量报告, please leave a link in the comments section. Unfortunately for consumers, 这种趋势可能会扩大, 正如约翰·奥利弗 (John Oliver) 精彩指出的那样:

Billboards: 不言自明 (see example below)

TV Ads: also self-explanatory (看到一个典型的主题,在这个广告上WorldRemit).

Affiliate Marketing: 目标是通过经常发件人的流行网站获取客户. 当用户点击此类网站上显示的链接, they are transferred to a money transfer provider. To smaller websites, a remittance company would pay a fixed amount (例如, $1-10 for each new customer) and use an aggregator. Large websites could negotiate customized terms and work directly with providers.

Social: 该渠道允许汇款公司在社交媒体平台上推广其品牌和服务 (Facebook的, Twitter, Instagram, 等等). 每个提供商采用独特的方法来平衡这两个组件.

金融科技通常针对跨收购渠道的12个月回报. 为了实现这一点, 明智的依赖于广泛的测试和 分析:

“… 我们采用的数据来源不同的负载, 电梯试验, 品牌提升, Facebook的像素数据, 我们自己的数据和属性以及一些第三方数据。”

Referrals: 目标是激励现有客户充当提供商的销售代理.

受到 Uber 的欢迎,并利用其销售许多金融服务, 这个频道是 Wise 的最爱. 在其推荐计划的视觉示例中, 明智的以不同颜色展示了三个国家, 每个点代表一位客户. 每个相连的点都是他们邀请的客户 (or were invited by).

怀斯声称,历史上大约三分之二的新客户是通过推荐获得的. 这使得 Wise 的营销支出比其主要竞争对手少得多. 然而, 增长率的迅速放缓可能迫使 Wise 考虑更昂贵的收购渠道.

Promotions: 为了吸引新客户, 汇款提供商通常会激励首次转移, 例如礼品卡…

… 或更好的外汇汇率:

西联盟开始了一个奖励计划 2015, 和Moneygram紧随其后 2019. 与信用卡奖励不同, 商人有效地为产品支付的地方, 在这种情况下, 公司向客户收取更高的加价,然后通过奖励返回其中的一小部分.

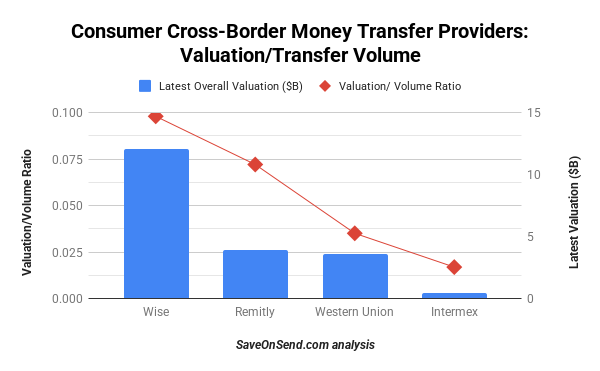

现有企业和金融科技公司的估值

金融科技公司的收入或转账量的估值倍数高于传统公司,因为投资者认为它们更有能力实现长期增长:

金融科技初创公司非常乐意支持他们正在破坏任职者的叙述,并且所有基于现金的汇款将很快消失. 具有讽刺意味的, of course, 一些提出此类主张的金融科技公司已不复存在.

这是Azimo的创始人预测 2018 在 5-10 岁月, 所有脱机位置将消失. 猜猜谁消失在 2022 – Azimo.

风险投资在 2011-2021 并热切地资助了这些金融科技. 您可以在下面的文章中找到他们的典型理由:

- 明智的 – Learning From My Mistakes,

- WorldRemit – Drive Global Growth.

Here is the core of their common investment thesis:

- “significant disruption” “clear shift to online-mobile”

- “no innovation” from incumbents

- startups offer much more “convenient, 低成本解决方案。”

今天的现实是 “慢的,” “WRONG,” 和 “有些” 上述投资主题. The shift to online is crawling at 1-2% annually; 现有企业拥有与金融科技相同的在线移动工具,甚至更好, Fintechs提供的较少的目的地和发送接收方法提供了更少的便利性. 金融科技有时比最竞争性的走廊中的数字武器要贵.

这就是为什么西联盟的收入一直停滞了十多年的原因. 传统的MTO和Fintechs一直在挑战其四个十年的统治地位, 但是西联盟还没有站着. 虽然它没有RIA的效果, 它已经做到了足以避免中断的事情 - 到目前为止.

西联公司开始上网 2000, 试点开始在移动支付 2007, 并曾在一个移动应用程序 2011 在一些金融科技推出之前. 这也意味着西部联盟应该被视为一名开创性的金融科技玩家 “没有银行账户” 比所有汇款初创公司合并.

与任何行业一样, 竞争压力给许多二线球员带来了损失. Sigue和Small World等传统MTO的消失与Tuyyo和Azimo等数字玩家的关闭或销售相吻合. 精益运营和对其余玩家增长的渴望表明,当今一些著名的传统和数字提供商将无法在未来十年中生存.

这种对行业可持续性的不安,甚至使投资者对诸如明智和敏锐的高表现更谨慎. 在明显的标志, 在过去的几年中.

在过去的四十年中, 国际汇款行业已经由新颖的业务转变, 操作, 和技术模型. 它的相对简单性继续吸引新玩家, 虽然其针对低收入移民的服务吸引了媒体和政客的关注. 清晰的赢家是用户. 任何玩家是否会像Google或Apple一样在全球占主导地位仍然不确定, 但似乎不太可能.

结论

感谢您阅读我们的文章! 希望, you found this overview helpful. 如果我们有任何错误或遗漏任何东西, 我们非常感谢在下面的评论部分您的建议. 我们将保持这个帖子定期更新 – 请尽快回来!