MoneyGram: Whack-a-Mole of Money Transfers

“…to date MoneyGram has refused to open a meaningful dialogue with us, leaving us no choice but to make this proposal public…”

Euronet CEO’s letter to employees, December 13, 2007

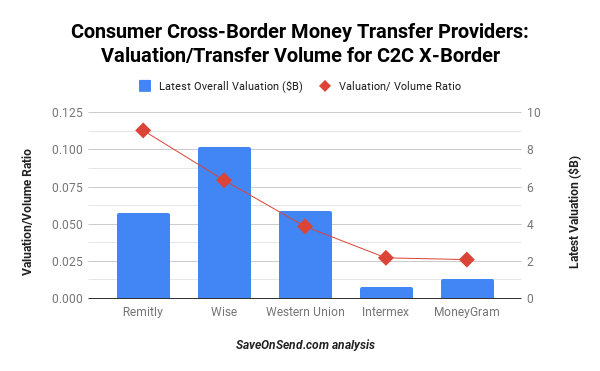

In the past, MoneyGram and Western Union were often called the “monopolies” of cross-border money transfers. However, MoneyGram’s valuation was significantly smaller than Western Union’s and had a multiple below that of any competitor.

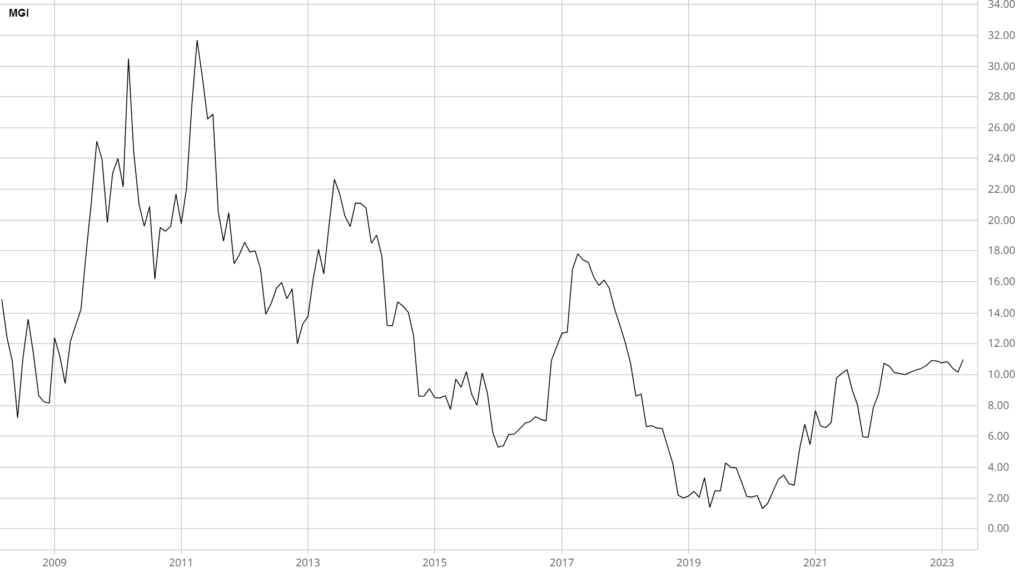

MoneyGram’s valuation had been erratic since its IPO in 2004, even reaching near-zero levels in 2019 and 2020, until it was finally acquired by a private equity firm, Madison Dearborn Partners, in 2023:

Throughout its history, MoneyGram has stood out as the most irrational player in remittances, defying the stereotype that incumbent financial services companies are too conservative. The only explanation for such behavior could be the curse of an eternal “silver medal.”

Recent Comments