“High fees, large incumbents, and a $400B+ market are under attack by a slew of remittance startups.”

CB Insights, February 26, 2015

For disruption to occur, it only takes one determined startup with a long-term vision spanning two or more decades. The disruptive force of innovation only required one Amazon for books, one Spotify for music, and one Netflix for entertainment. After over two decades since the founding of Xoom and over a decade since the launch of Wise (formerly TransferWise), the cross-border money transfer industry still does not know which fintech company will be such a disruptor. However, a decade of keen observation in this fiercely competitive space gives us a reasonable understanding of which ones still have a chance, which ones don’t, and why some fintechs are no longer around.

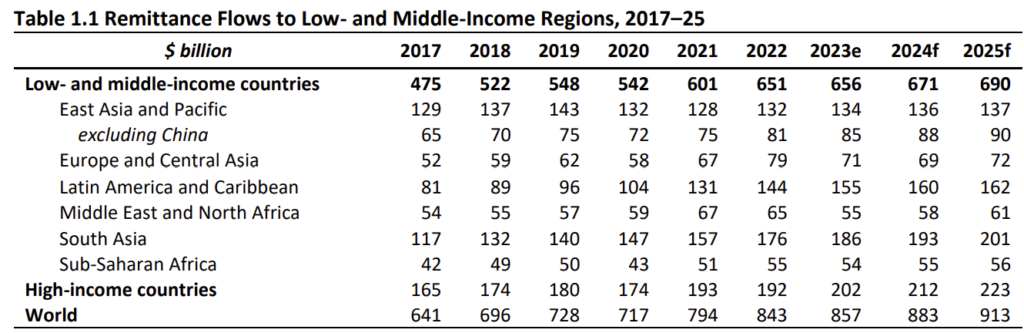

The good news for fintechs over the last decade is that the market keeps growing. FXCintelligence estimated the overall C2C x-border market at $1.8 trillion in 2024 and forecasted it to grow 9% in the foreseeable future. In remittances alone, the volume has been increasing by $25-50 billion annually, and the World Bank conservatively projects a 3% annual growth rate in the coming years.

The bad news is that the transition in consumer habits towards embracing fintechs and digital channels has been gradual. A decade ago, conventional wisdom suggested that the widespread availability of affordable smartphones and the shift from tech-averse elders to tech-savvy millennials would result in a swift increase in the utilization of online channels for cross-border money transfers.

Three years later, in 2018, some of the same folks were predicting that cash agents would completely vanish within the next five years:

Not only did none of that transpire, but in 2022, Azimo’s struggles resulted in its acquisition by a payroll company to salvage some of its payment technology. The competition among money transfer players has proven to be significantly more challenging than initially expected, and it is far from reaching its conclusion.

Money Transfer “Disruptors”

Around 2010, the potential for disrupting consumer cross-border money transfers appeared enormous. The prevailing perception was that established players like Western Union, MoneyGram, and Ria were committed to their brick-and-mortar branches and might be unwilling or unable to provide consumers with a more streamlined digital alternative. Xoom had been in the market for a few years and was experiencing significant growth, but it only targeted outbound corridors from the United States. Moreover, given the immense size of the market, it seemed feasible to accommodate more than one fintech, especially during the early stages of the digital revolution.

Hence, the aspiration to become a larger and more superior alternative to Western Union didn’t appear too daunting. So, a new generation of fintech founders challenged the CEOs of established money transfer businesses.

Bottom row: Ria Money Transfer, MoneyGram, Western Union Digital Ventures, Xoom, Transfast

Some of the noteworthy startups that emerged during those years were:

- Zepz, aka WorldRemit (founded in 2009)

- Wise (2011)

- Remitly (2011)

- Azimo (2012)

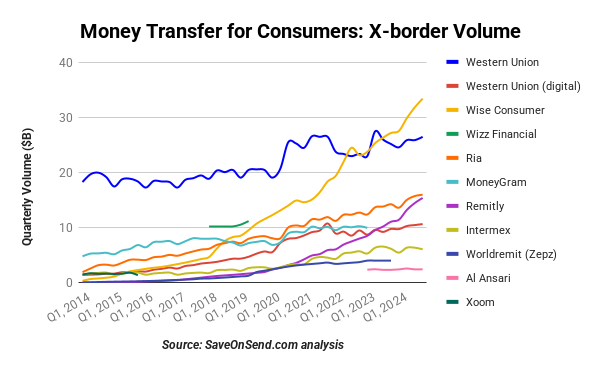

While Azimo is no longer around, Wise passed Western Union’s transfer volumes in 2022, and Remitly has inched closer to the top three global players:

Has the disruption affected traditional players so far?

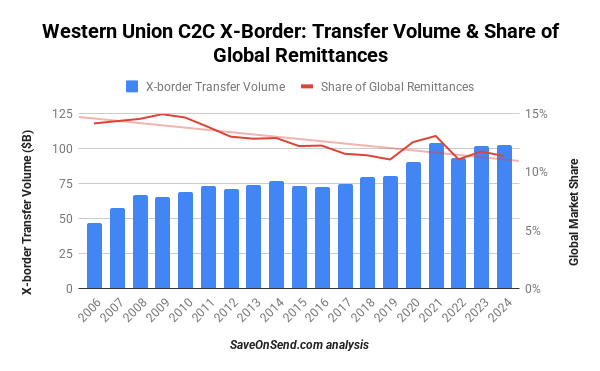

Western Union has doubled its transfer volumes since the early days of Xoom (the original fintech for remittances). However, this growth wasn’t sufficient to keep pace with the expanding market, leading to a gradual erosion in its market share of remittances over almost two decades:

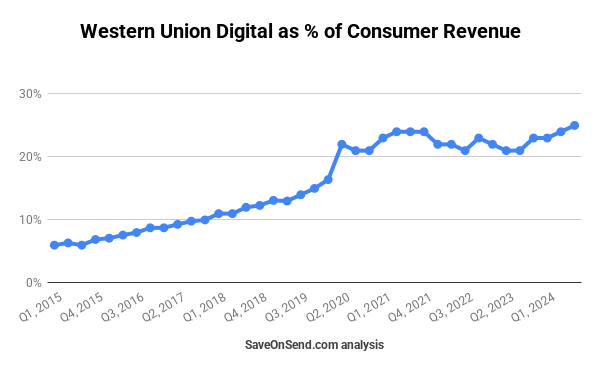

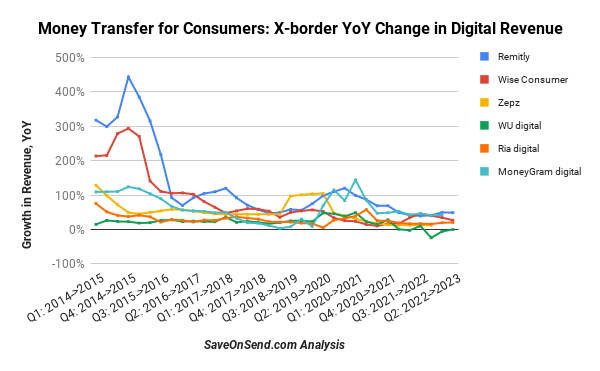

While not disruptive, it’s evident that once fintechs achieved scale by 2021, they collectively slowed down Western Union’s expansion in digital channels:

Another sign of the collective impact as fintechs achieved scale is the decline in the margins of the incumbents, commonly known as the “take rate.”. Before fintechs reached scale in 2020, incumbents didn’t pay much attention to this aspect. Here’s how the CEOs of Western Union and early 2018 (parent company of Ria Money Transfer) described the competitive pricing environment in 2018.

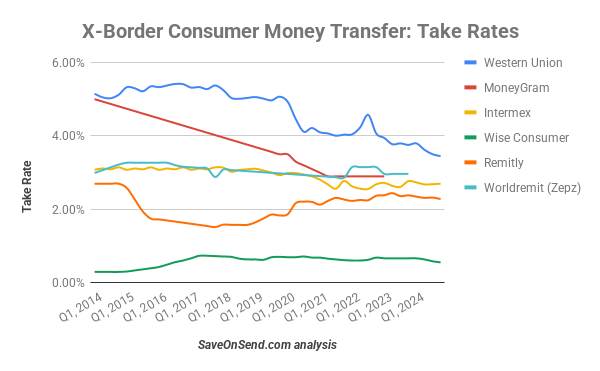

In 2020, Western Union’s margin declined by over 20%, falling from around 5% to less than 4%. This was partially driven by price reductions and the gradually expanding share of less expensive digital transfers. Other incumbents also reduced their margins, while those of Wise and Remitly remained relatively stable:

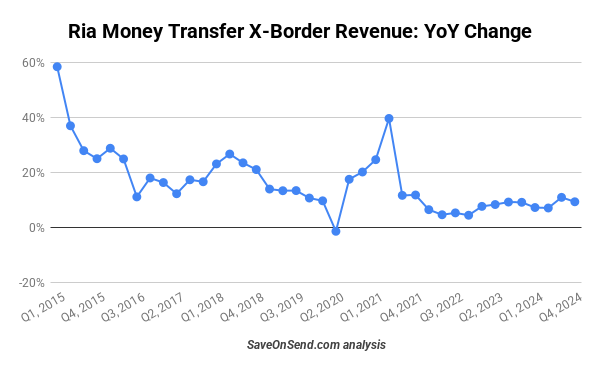

The second-largest incumbent, Ria Money Transfer, has also not experienced disruption yet, but its growth rates, which were previously around 20%, have now decreased to 5-10%:

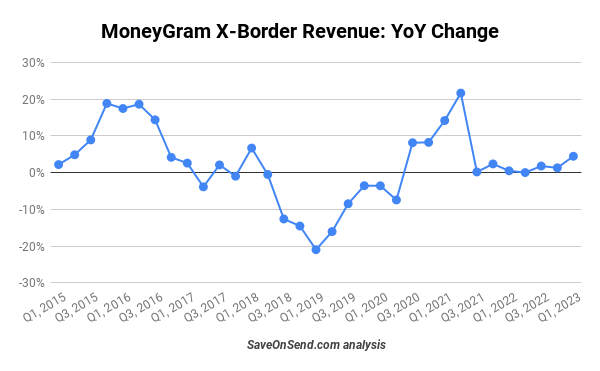

MoneyGram, once the second-largest incumbent in the industry after Western Union, is in a stable state now but is grappling with a lack of growth after a near-death experience in 2019 (as discussed in this SaveOnSend article):

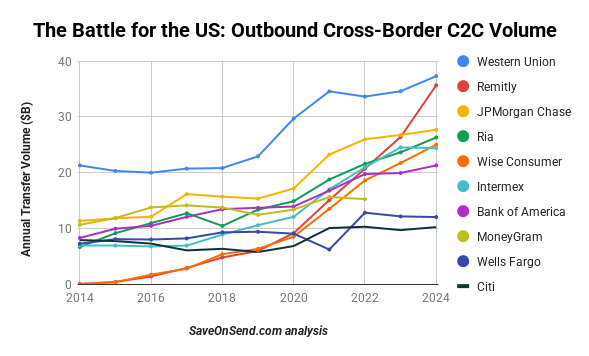

In addition to traditional money transfer operators, banks play a significant role in cross-border money transfers. Consumers in the US send more than $100 billion annually via banks. Banks have yet to experience disruption and have nearly doubled their transfer volumes in the last decade (for more information, refer to this SaveOnSend article). The largest consumer bank in the US, JPMorgan Chase, has remained among the top 3 players:

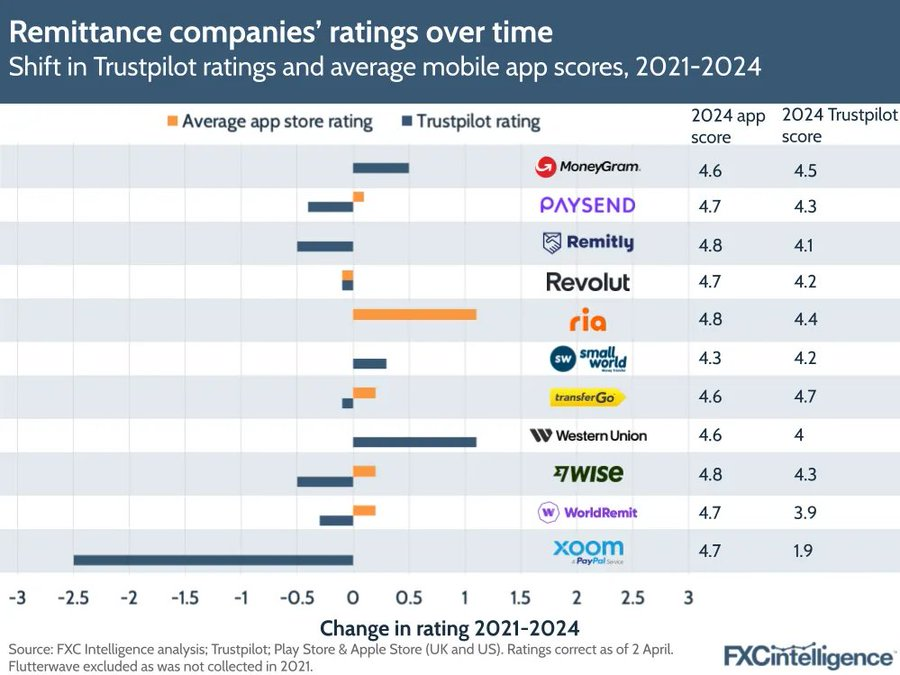

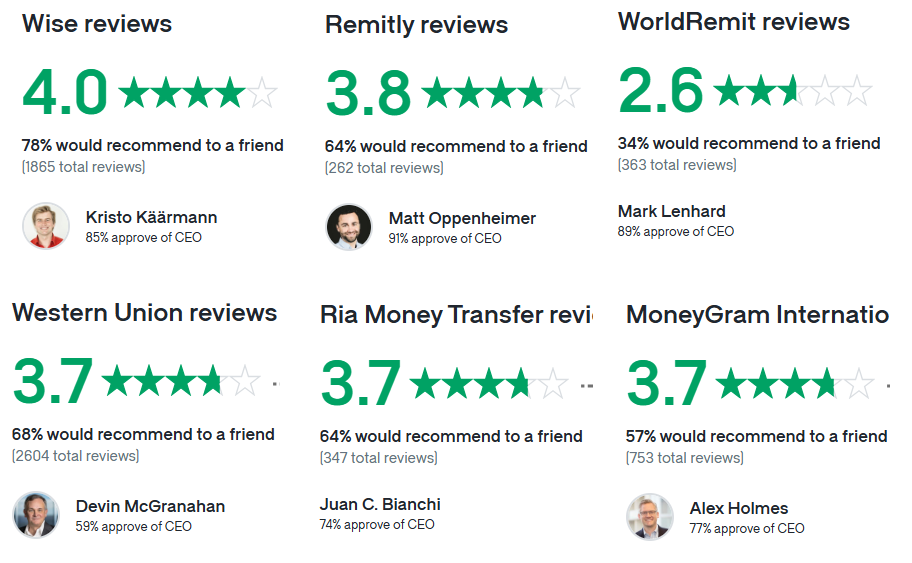

The lack of disruption so far is partly caused by traditional players not standing still. They are typically slower than fintechs in launching new features, but eventually, they catch up by observing startups and copying what works. For example, between 2021 and 2024, the Trustpilot rating of traditional players has improved, while that of fintechs has declined, making the two groups indistinguishable regarding customer satisfaction:

The crucial role of focus in disruption

As Jim Barksdale, CEO of Netscape (the world’s largest browser at the time), famously said in 1995, “… there are only two ways I know of to make money: bundling and unbundling.” Fintechs are generating revenue by unbundling incumbents until they reach a sufficient size to begin bundling additional products. Subsequently, new fintechs emerge to unbundle the previous generation. In cross-border consumer money transfers, Xoom and Remitly were introduced to unbundle Western Union, Wise to unbundle banks, and new fintechs keep getting launched to unbundle Wise and Remitly.

One of the most challenging dilemmas for a growing fintech company revolves around the timing of bundling new products and entering new regions. With the rise in product and geographical complexity, founders and key employees may find their attention stretched too thin. Additionally, they might become disengaged with the core product, especially if its growth begins to slow down, and prefer to work on a new internal venture with higher growth potential. A straightforward way to determine if bundling is premature is by examining the growth rate of the core product to assess whether it’s decelerating rapidly or gradually.

In recent quarters, Remitly and Wise have stabilized C2C x-border volume growth at around 40% and 20%, respectively. Since the market is growing less than 10%, with their massive scale, their sustained focus could maintain those growth rates and push incumbents among banks and MTOs out of business.

Money transfer funding and valuation

The appeal of disruption and the substantial assets held by VC firms ensured an abundance of capital available to fintechs in this space. Between 2010 and 2019, just four startups attracted over $1.5 billion in funding:

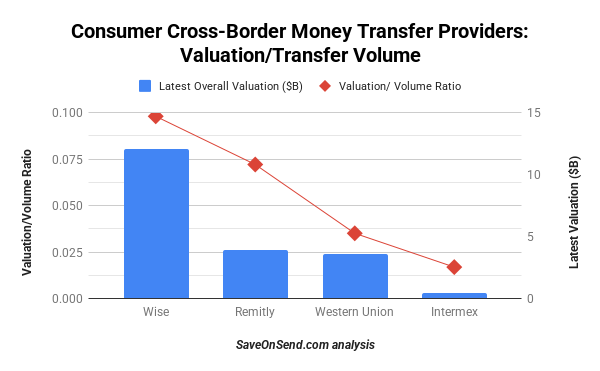

As is customary with faster-growing fintechs, they command higher valuation multiples. For instance, the valuations per unit of transfer volume for Wise and Remitly are two to four times higher than those of Western Union and Intermex:

While there hasn’t been a disruption in the volumes of the incumbents yet, it is fascinating to note that the value of Wise and Remitly, which didn’t exist before 2011, is now higher than that of Western Union. Investors are clear about which type of companies have a much higher potential in consumer cross-border money transfers.

Performance differences across fintechs

After a couple of years, investors began distinguishing fintechs based on their performance quality, encompassing business, operational, and technological models. When examining the speed and scale of funding rounds from their launch, Wise had significantly outpaced the competition by Year 3. Remitly and WorldRemit were striving to keep pace with varying degrees of success, while Azimo never entirely gained traction:

By September 2018, Remitly had reached $6 billion in annualized transfers. While this might appear substantial, it paled compared to TransferWise’s growth trajectory. Both companies were founded around the same time and received their first $1 million+ in funding in April 2012. However, TransferWise reached a $2 million monthly transfer volume just a year later, more than two years ahead of Remitly. By mid-2015, TransferWise was transferring thirty times more per month than Remitly:

The underlying reason is in Remitly’s much slower scaling. In the first three years after Remitly was launched, the fintech served only one corridor: USA-to-Philippines. In February 2015, Remitly launched the second corridor, USA-to-India, and in October 2015, USA-to-Mexico. In July 2015, Remitly also announced its first acquisition of a failing application, Talio, to bring in local talent (both companies are based in Seattle) and beef up messaging features in Remitly’s mobile technology. In April 2016, Remitly opened an outbound business from Canada to India and the Philippines. In September 2016, the startup added seven more countries in Latin America for transfers from the US:

In early 2017, Remitly expanded its services to include a couple of outbound corridors from the UK. Given the excitement surrounding the digital remittances niche, it was not surprising that in the October 2017 funding round, Remitly was valued at “at least” $345 million.

Remitly utilized the funding to expand into new markets, such as Australia, in May 2018. By July 2019, Remitly had operations in 16 countries and had surpassed $2 billion in quarterly transfer volume:

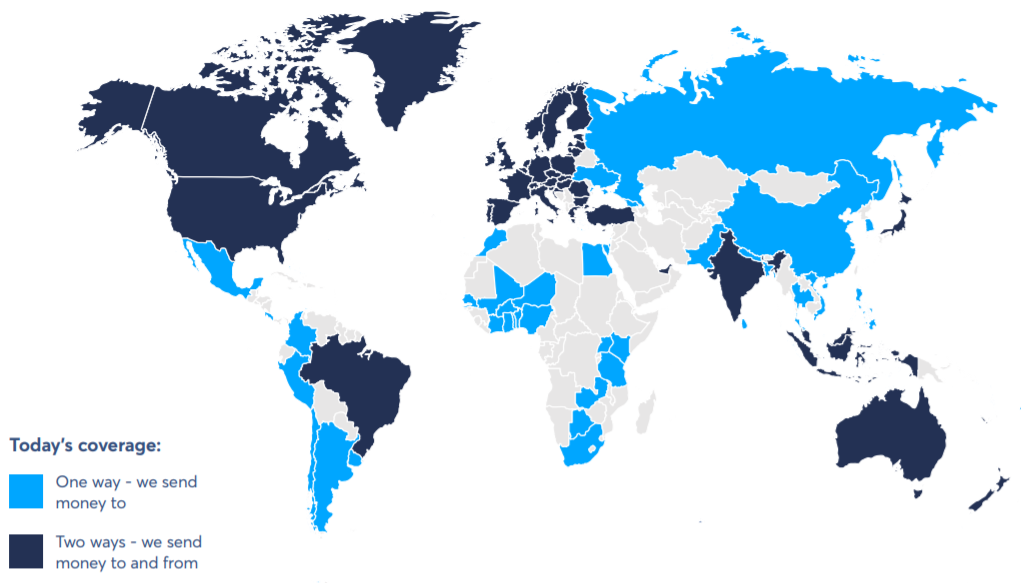

While Remitly’s progress is commendable, it is overshadowed by TransferWise’s rapid expansion. TransferWise launched hundreds of corridors in the first four years, reaching $1 billion in transfers within its first 12 months in the US alone. By mid-2019, TransferWise handled seven times more volume than Remitly, with only 60% more employees. By 2021, TransferWise had expanded to cover over 40 outbound countries.

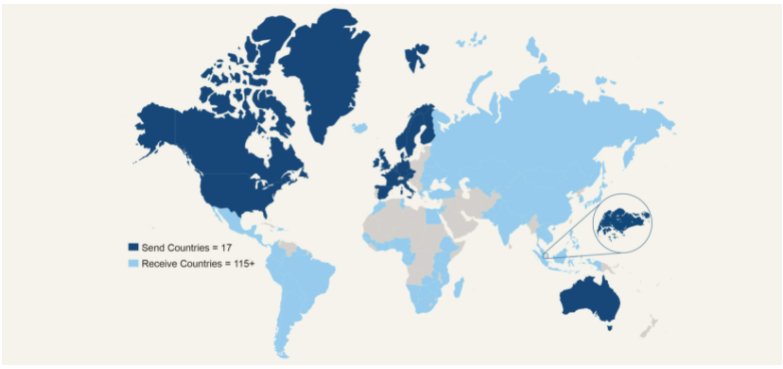

… while Remitly covered only 17:

However, the battle for global dominance in consumer cross-border transfers between Wise and Remitly is not over. While Wise transfers roughly twice the volume in consumer cross-border transfers, Remitly is growing twice as fast. This resulted in a relative gap in volume between the two players fluctuating in $15-20 billion per quarter since 2022.

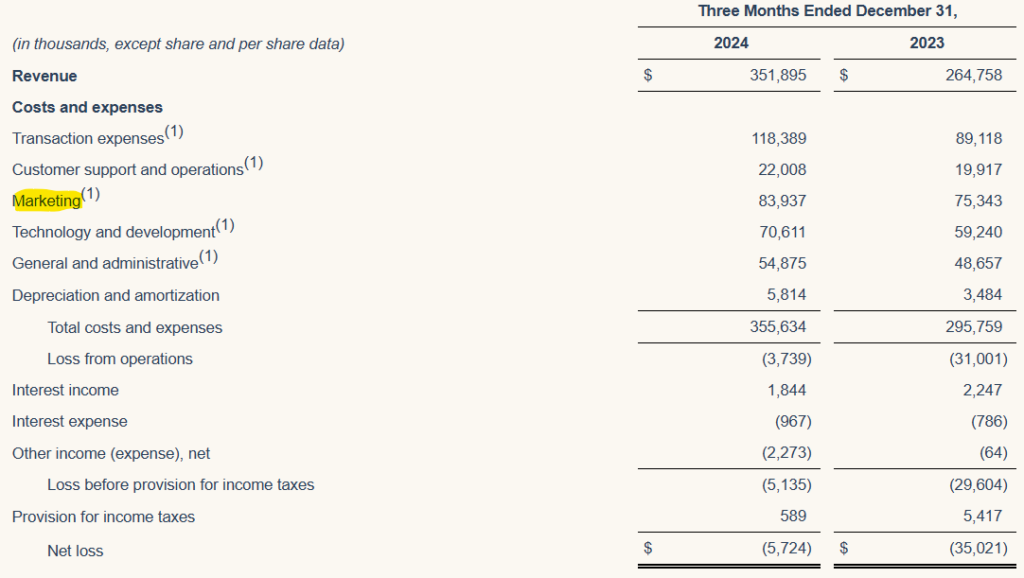

Wise prides itself on a low-cost referral channel (aka, paid “word of mouth”) responsible for 70% of its growth while spending only 4% of revenues on marketing. Wise could theoretically increase its marketing spend if its volume growth rate starts slipping below 20%. Remitly, on the other hand, has maintained its 40% volume growth rate by spending nearly 25% of its revenues on marketing. As a result, it is on track to finally turn a profit only in 2025.

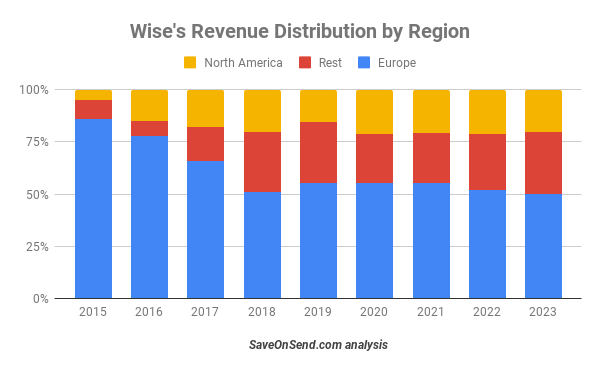

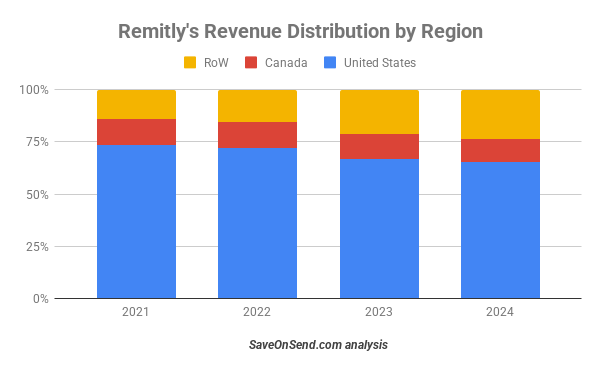

Wise’s larger transfer volumes and faster global expansion have resulted in more diversified regional revenue than Remitly. However, what’s notable in recent years is how stable these regional splits remain at scale, even as both fintechs continue growing 20-40%.

Why do money transfer fintechs fail?

A successful fintech typically takes five years to achieve profitability, necessitating investments of hundreds of millions of dollars in the interim to acquire millions of customers. VC firms step in to fund this cash flow gap. Given that most fintechs fail, VCs are only willing to take such significant investment risks if they believe the fintech has the potential to become a market leader, at least in one large region. Remitly was primarily seen as a player in the US outbound market, WorldRemit in Africa inbound, and Wise in Europe outbound.

Unfortunately for Azimo, it began operations a year after Wise with a similar regional focus. While its customer base comprised blue-collar migrants, compared to Wise’s focus on white-collar expats, Wise’s remarkable growth indicated to investors that all types of cross-border consumers would eventually be interested in its service.

However, Azimo’s slower growth compared to Wise wasn’t solely due to the one-year lag. It was also attributed to less capable leadership, although the comparison was against an extremely high bar. Without a comparable success to Wise and Remilty, the Azimo founders appeared more inclined to speak at conferences about their achievements and make unsupported statements about the imminent disappearance of offline channels. Instead of actively acquiring new customers, they seemed to rely on the digital wave to bring customers to them.

Even more unusually, the lack of intensity manifested in Azimo openly discussing its desire to be acquired as early as 2015, just three years after launch. The negative impact of Azimo’s less competent management team and lower intensity compared to leading fintech competitors was exacerbated by the sudden exit of a co-founder in 2017, whom employees described as the “heart and soul of the place.”

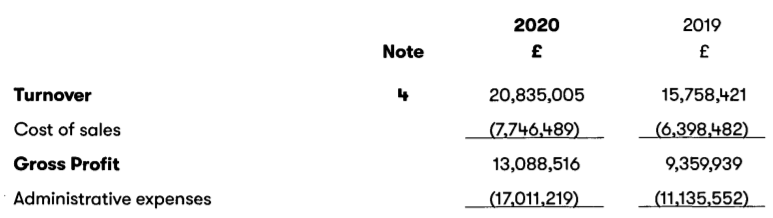

Similar to Xoom, Azimo also limited its growth ambition to just one outbound geography (in Azimo’s case, it was Europe, whereas, for Xoom, it was North America for the first decade). As a result, Azimo’s growth slowed down to 25% by 2020, even as expenses increased by 50%:

While investors were willing to provide hundreds of millions of dollars to Wise, Remitly, and WorldRemit, Azimo’s final funding round in May 2018 amounted to only $20 million, and the underlying valuation wasn’t disclosed. In early 2022, Azimo was acquired by a payroll payments company for a valuation similar to that of 2018.

TransferGo and WorldRemit (Zepz)

A somewhat similar fate met another Europe-based startup, TransferGo, although it is still in operation. The startup was founded a year after Wise by Lithuanians who openly admitted they were trying to clone their Estonian competitor. While Wise was small enough and the market was expanding, TransferGo managed to grow rapidly, with a 100% growth rate in 2018:

By 2021, TransferGo’s growth slowed to 25%, with a cumulative volume of $6 billion over the previous almost decade. Remitly was already transferring $6 billion annually, not in total, three years earlier. Wise crossed $6 billion in cumulative transfer volume in 2015, six years before TransferGo. In 2022, its primary UK subsidiary showed declining revenues and increasing losses. In 2024, 12 years into existence, TransferGo raised only $10 million without disclosing its performance.

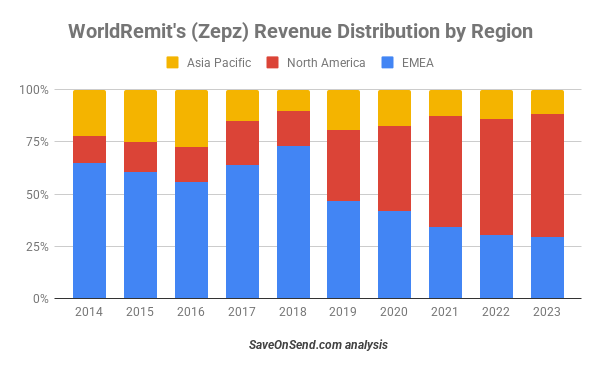

WorldRemit (aka Zepz) falls into a middle-ground category, being more successful than Azimo but trailing behind Wise and Remitly. he underlying reason for its lower valuation compared to the leading fintechs is essentially the same: relatively weak planning and execution. For instance, in 2015, WorldRemit significantly overestimated the speed of its growth across markets, leading to employee layoffs in the US and the UK.

In 2017, WorldRemit was eager to expand in the US and drastically cut pricing by two-thirds in its two top corridors, resulting in a loss of approximately 0.5% on each transaction. However, realizing that this strategy wasn’t working or sustainable, WorldRemit eventually raised its prices back to previous levels:

Mistakes in regional expansion efforts cost years of hard work and resulted in a combined market share outside of Europe that was lower in 2018 than it was in 2014, only starting to recover afterward:

The performance gap is also evidenced by a critical difference in employee reviews of working for WorldRemit versus other fintechs and traditional MTOs:

WorldRemit’s uneven management also led to forecasting misses. In June 2015, its founder & CEO expected to triple 2015 revenue compared to 2014. In November, WorldRemit downgraded expectations to “at least double” and finished 2015 with an 80% growth.

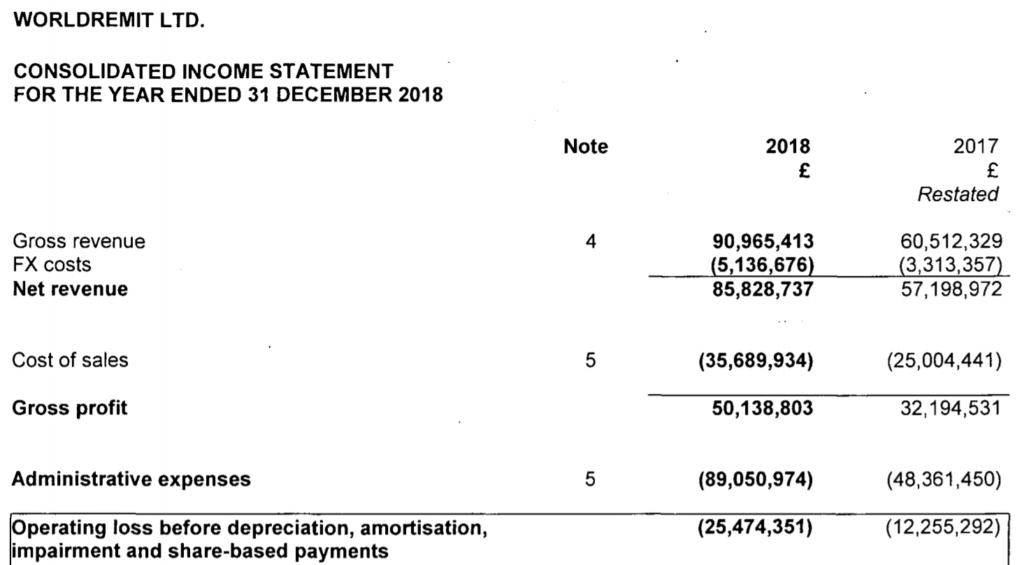

WorldRemit also underperformed in developing a scalable business model. A company growing by 50% should be enjoying rapidly increasing operating margins. However, WorldRemit doubled its losses between 2017 and 2018:

What was even more uncharacteristic for a near-unicorn fintech is that to address its management deficiencies, WorldRemit was spending millions on management consultants, tripling the spending to $8.5 million in 2018:

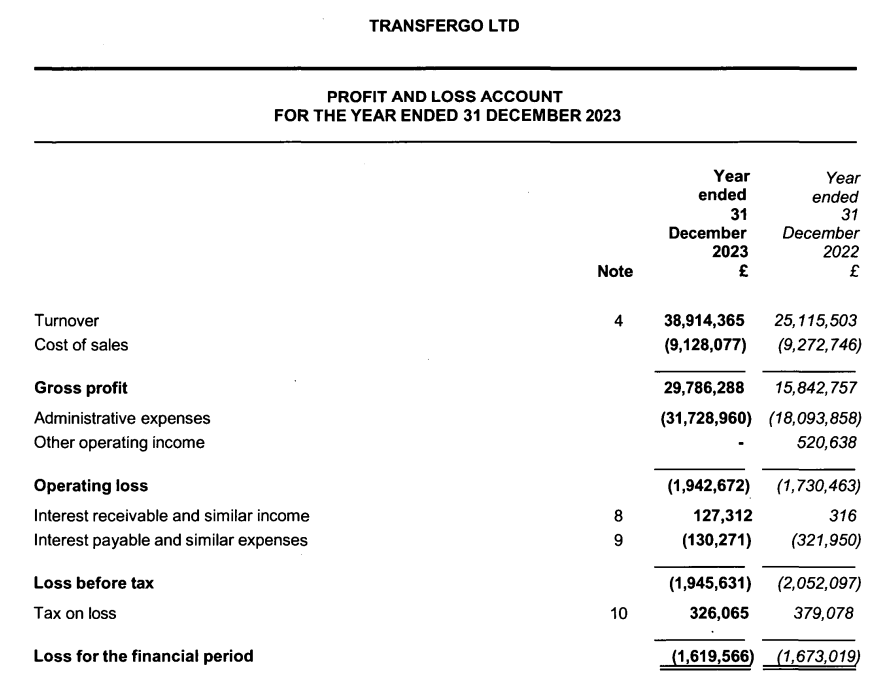

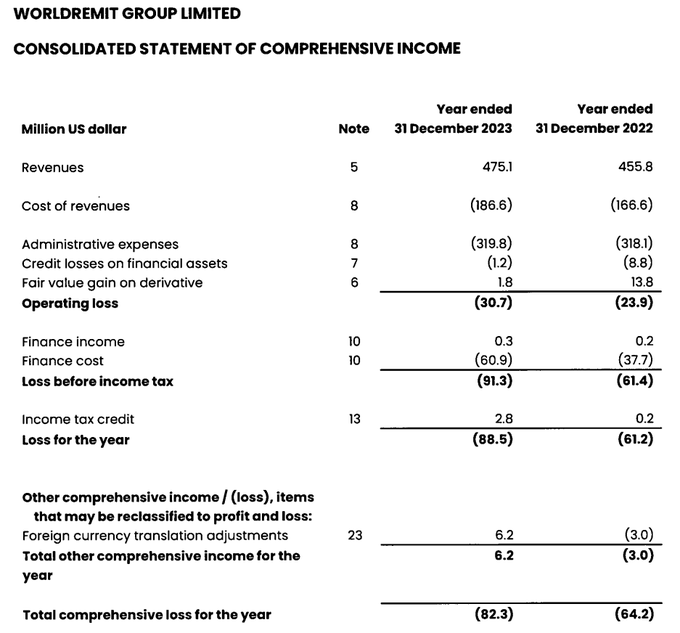

More fundamentally, in its growth strategy, WorldRemit has faced a similar dilemma as Remitly till 2021: it was also growing rapidly but was unprofitable due to spending almost 25% of revenue on marketing. In 2022, under pressure from investors, WorldRemit had to cut marketing spending by 40% to 13% of revenue. Not surprisingly, that resulted in a collapsing growth rate of just 14%. Its 2023 performance was even worse, with 5% revenue growth on only 11% volume growth and rapidly expanding operating and income losses.

When comparing WorldRemit to the second-largest traditional incumbent after Western Union, Ria Money Transfer transfers four times more volume with a similar revenue growth and nicely growing operating income. Which one is fintech again?

New players joining the consumer cross-border money transfer game

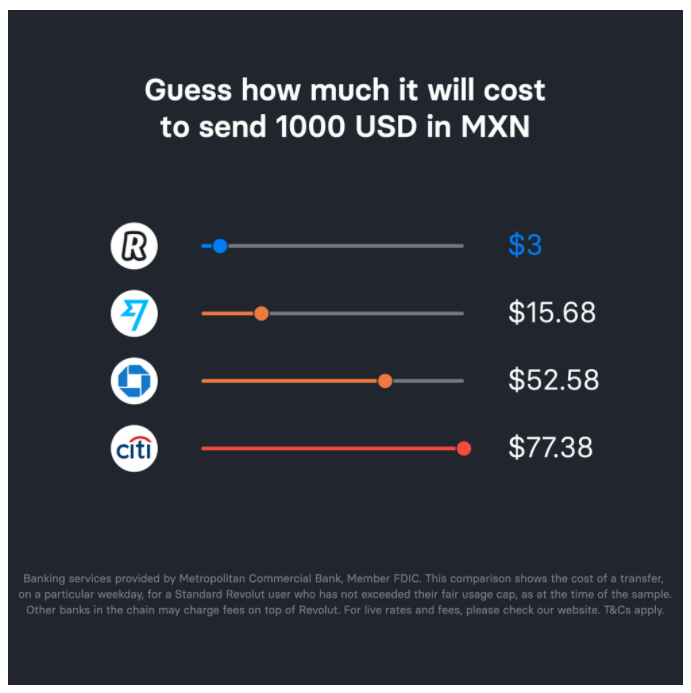

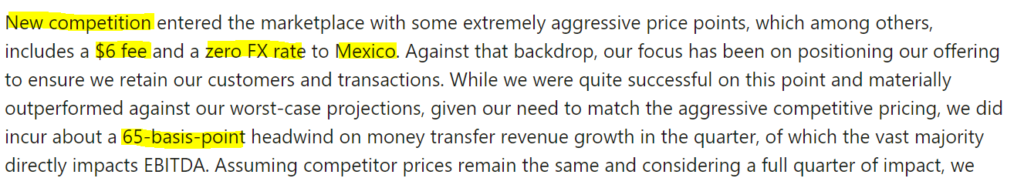

One might assume that the competitive nature of the money transfers for consumers would dissuade other fintechs from entering the market. However, that hasn’t been the case. In 2021, Revolut ventured into the world’s largest remittances corridor, from the US to Mexico (worth over $60 billion), by offering nearly free transfers with no foreign exchange markup to its customers:

The impact was so strong that MoneyGram had to acknowledge it publicly:

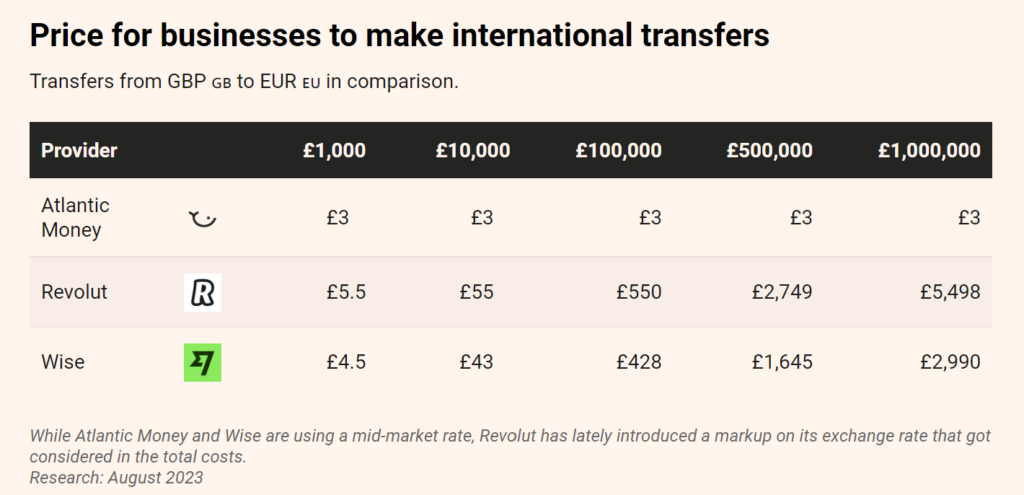

In 2020, Atlantic Money was introduced in the UK by former employees of renowned fintechs, Robinhood and Tinkoff. Their marketing approach aimed to compete directly with Wise. Atlantic Money offered fixed fee transfers for £3 or €3 at the prevailing exchange rate (eliminating foreign exchange markup):

After 1.5 years, Atlantic Money was running one year ahead of Wise, which passed the same £30M/month milestone around the 2.5-year mark. Additionally, Atlantic Money planned to expand to the US three years sooner. Its tiny fee and zero FX markup were naturally attracting higher send amounts:

Atlantic Money questioned the premise of variable costs for cross-border money transfers. Do the costs actually increase with larger amounts? And if they are more or less fixed, why should providers charge more depending on the amount?

An even more surprising entry into the market came from HSBC’s subsidiary Zing. Launched in early 2024, Zing charges only 0.2% across all corridors with no additional fees and offers more lucrative promotions, including better referral bonuses than Wise. Despite the failure of similar efforts by BBVA (Tuyyo) and Santander (PagoFx), HSBC has wholeheartedly jumped into this highly competitive field, and no less than on the home turf of intense players like Wise, Revolut, and Atlantic Money. True to its scale, HSBC launched Zing with a massive group of 80 employees, supporting transfers in dozens of currencies.

While great for consumers, such intense price competition raised concerns about the sustainability of business models for new entrants. It took Wise six years to reach profitability, and Remitly aims to achieve that after 14 years. However, Atlantic Money and HSBC’s Zing were charging much less than these leading fintechs, putting additional pressure on margins and long-term viability. Indeed, by late 2024, Atlantic Money was acquired by a payroll platform, and by early 2025, HSBC shut down Zing.

The disruption in international money transfers never seems to stop, so let’s stay alert for more surprises: Banks ← Western Union ← Xoom ← Wise / Remitly ← Who is Next?

Conclusion

Hopefully, this overview helped you understand which players will become the dominant leaders in consumer cross-border money transfers. As with all our analyses, if you encounter any errors or believe we’ve missed essential perspectives in this article, please don’t hesitate to comment below. We value your feedback and will continually update this post, so check back soon for more insights!