Does Bitcoin/Crypto/Blockchain make sense for international money transfers?

“I think we will know when bitcoin has reached prime time when it is transferring more value each day than Western Union or Money Gram…”

Roger Ver, November 2013

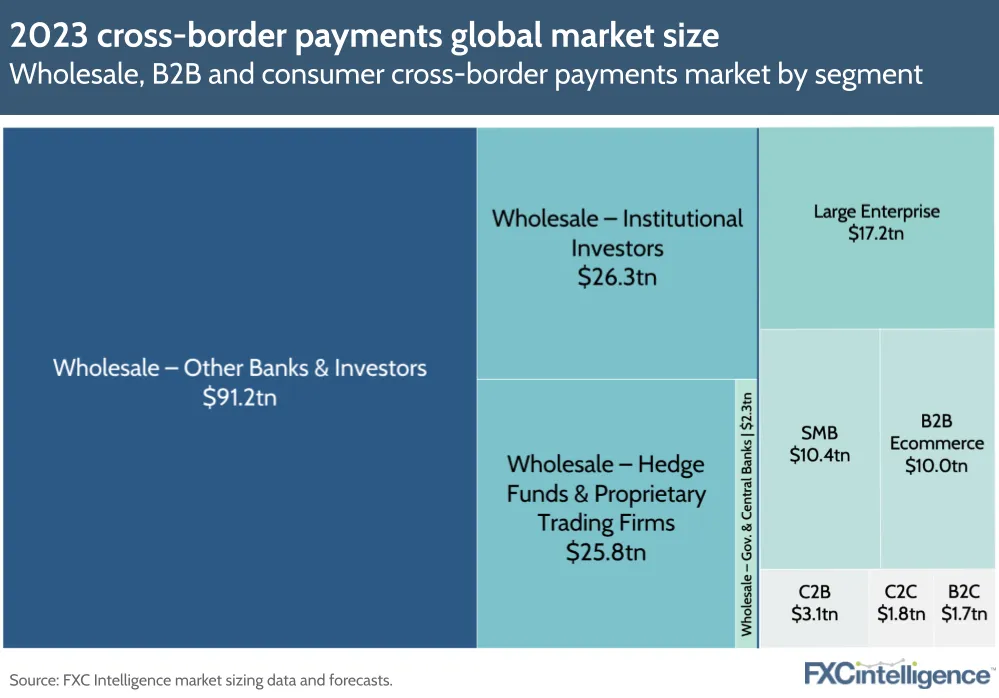

Since the publication of “Bitcoin: A Peer-to-Peer Electronic Cash System” in 2008, international money transfers, although constituting a smaller portion of cross-border payments, have emerged as one of the most promising use cases for crypto.

The initial assumption was that remittance users were experiencing exorbitant fees and subpar services from traditional players like Western Union. The prospect of an almost cost-free and instantaneous blockchain-based solution appeared to be a much-needed relief. Additionally, it presented an opportunity for affluent individuals in Western countries to showcase their efforts toward promoting financial inclusion in developing nations.

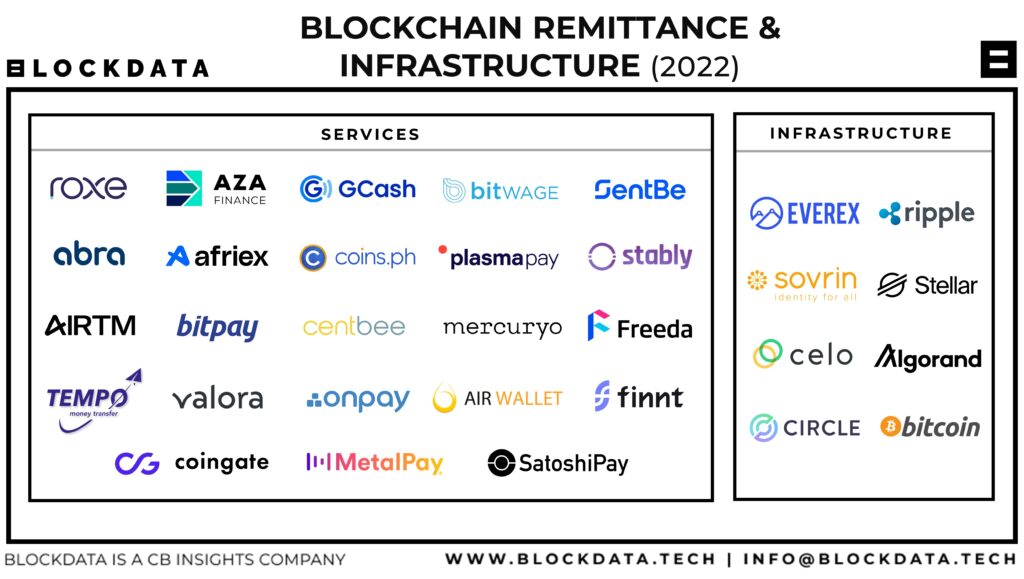

Subsequently, many startups received funding to test this hypothesis with consumers and partner with money transfer operators (MTOs). Additionally, one country recognized this as a national priority and encouraged its citizens to explore cryptocurrency-based remittances.

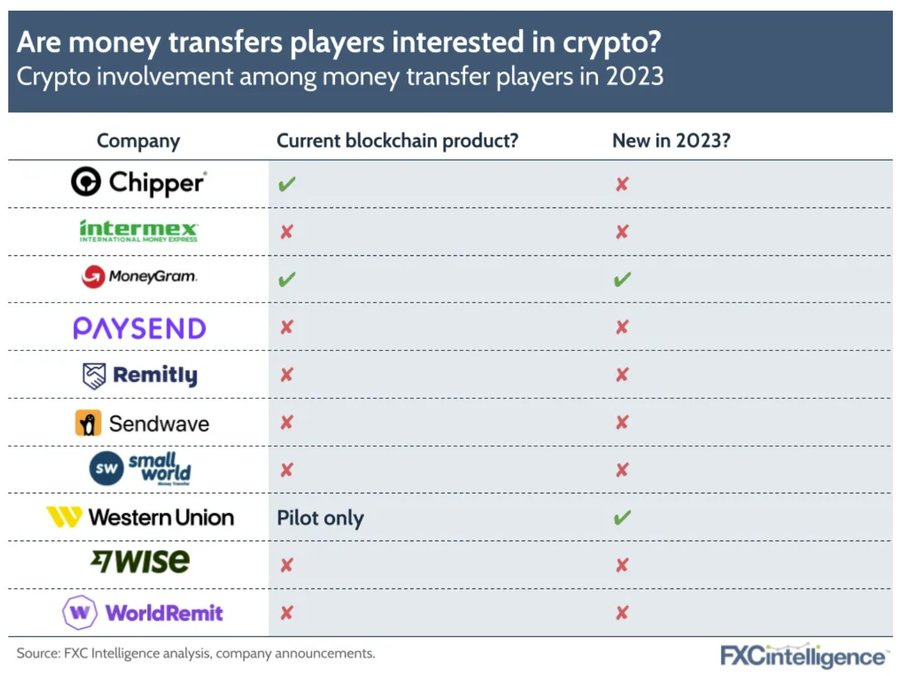

Despite this, the adoption of cryptocurrencies for remittances has not increased in the last decade. Using crypto for international money transfers remains a pilot or pay-per-play. More importantly, nobody can articulate an in-depth case for using private, public, or government crypto instead of or on top of Swift + local real-time rails.

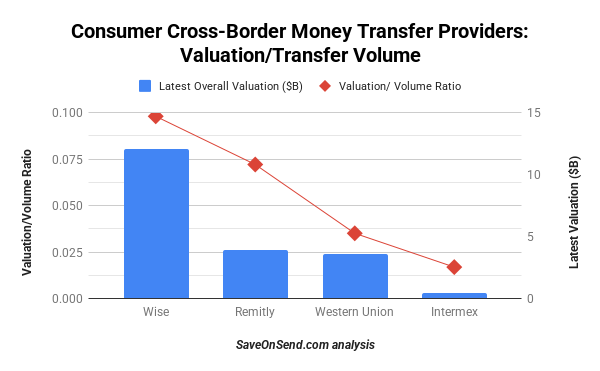

In contrast, non-crypto fintechs such as Wise and Remitly have emerged among the global leaders. What factors have contributed to the disappointing start for crypto, and will this innovative technology have a more significant impact in the future?

Innovation Adoption: 3 Cases

Consumers and businesses possess trillions of dollars of disposable income that they eagerly spend on various products and services, regardless of whether they are beneficial. For instance, consumers collectively spend around a trillion dollars annually on alcohol, junk food, or tobacco. Introducing genuinely innovative technology is an even more straightforward proposition. Financial services and insurance companies allocate a trillion dollars annually to technology spending alone. Apple generates $200 billion just from iPhone sales. While generative AI is still in the early phase, Nvidia’s annual sales of AI chips have already reached $150 billion. To achieve similar success, blockchain technology only needs to address one of the three following use cases:

Recent Comments