Are you a Mexican-Chicano sending money from the USA to Mexico? Want to get the most pesos for your dollars? Not sure how to send money online and which provider is the best, cheapest or fastest? YOU came to the right place! We will cover all the most important topics:

- Sending money to Mexico: key trends

- Pesos to dollar exchange rates and timing

- Top providers for sending money to Mexico

- The best way to send money to Mexico for you

Please note this post is specific to Mexico. If you are looking for general knowledge of how to best send money, please review this other SaveOnSend blog post first. And if you only have 30 seconds, just find the best provider with well-known comparison sites: CompareRemit, Monito, or RemitRate.

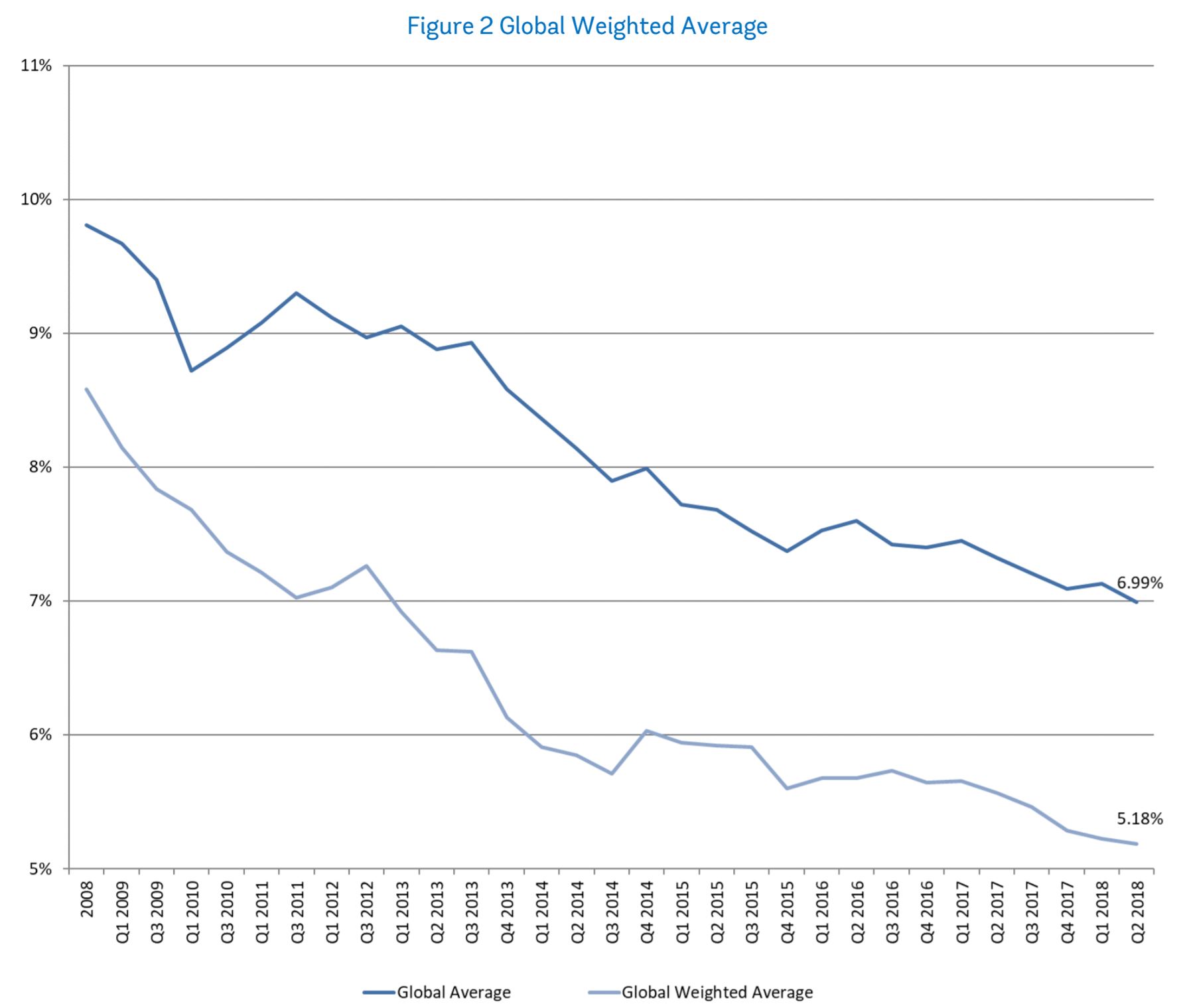

Before we get started… Great news if you are a consumer sending money from the US to Mexico: it is currently one of the most competitive corridors from the US, attracting more providers and larger investments than many other destinations. You could make a relatively safe assumption that when transferring money to Mexico with any top provider, you will get a reasonable price and service. Overall, the cost of sending money has been decreasing globally, dropping 30% in the last 10 years alone:

USA also happens to be one of the world’s least expensive countries to send money from:

We are recommending trying providers with the cheapest price – this way, you are helping your family while also supporting Mexico’ growth. Each 1% of savings generates additional 300 million dollars annually for your families and Mexico’s economy.

1. Sending money to Mexico: key trends

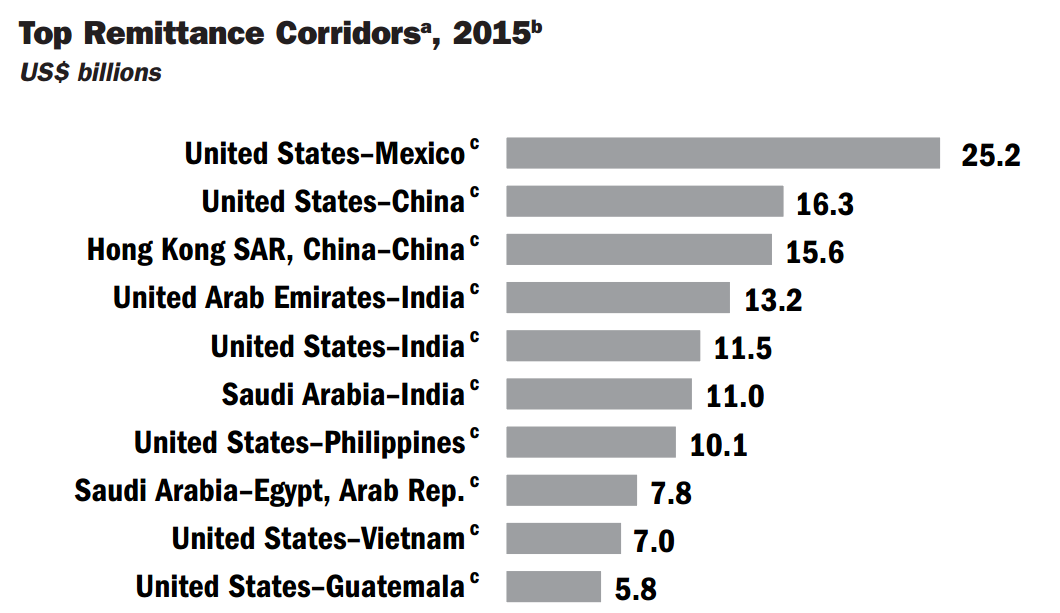

USA-to-Mexico is by far the world’s largest corridor for sending money. It represents around 20% of all cross-border money transfers from the US and almost 5% of the global volume. No other two countries in the world have such a mix of nationalities and a close connection with their birth and/or ancestry home. 37 million people living in the USA claim full or partial Mexican ancestry, and another 5 million are unauthorized immigrants from Mexico:

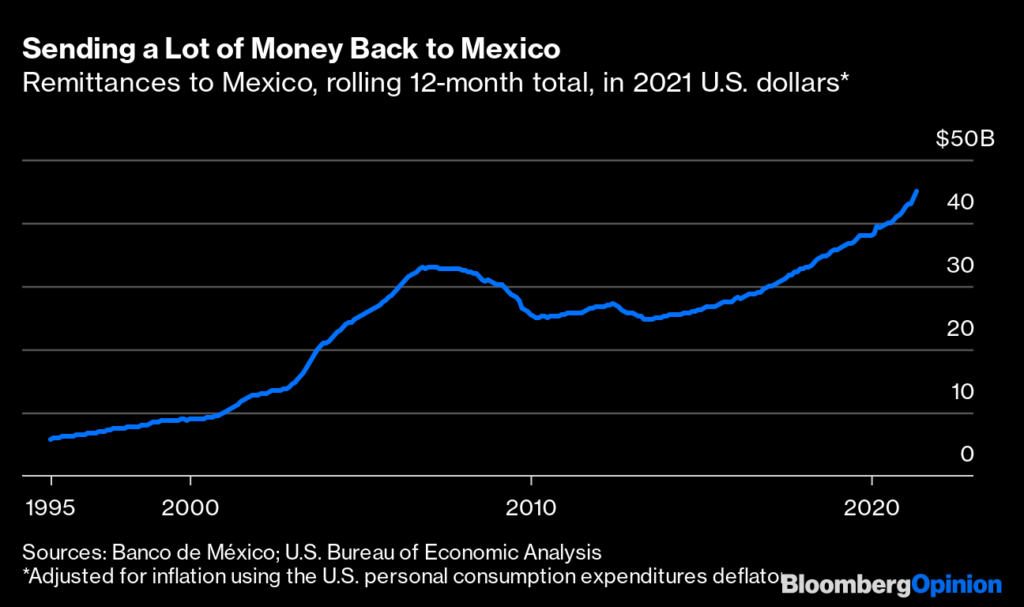

The US dwarfs all other countries combined when it comes to sending money to Mexico, responsible for around 90% of the total volume. The volume of remittances to Mexico had been rapidly increasing till the 2008 financial crisis, then dropping off temporarily and more than doubling in size between 2010 and 2020:

After Trump’s election in 2016, many experts were predicting an immediate spike in remittances volume with an eventual decline. However, the health of the US economy, and not its politics, has remained the key driving factor. Even during the global Covid19 pandemic money transfers to Mexico kept rapidly growing approaching $50B in annualized volumes by the middle of 2021.

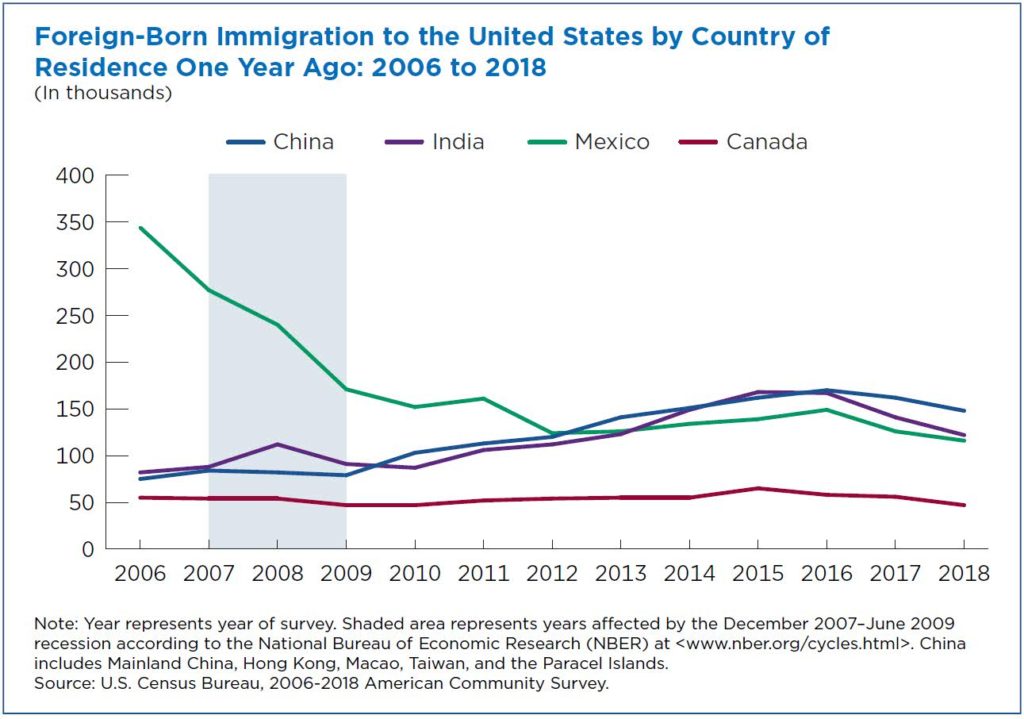

Within the US population, around 35% of Mexicans-Chicanos live in California and around 25% in Texas. New immigrants from Mexico, who typically send more money, are also arriving in large numbers to Chicago, Phoenix, and NYC metropolitan areas. However, the number of new arrivals has dropped sharply in the first decade of the 21st century due to a relative slowdown in the construction industry and an increase in deportations by the US government. Since 2013, Chinese and Indian migrants have become the largest sources of new arrivals to the US:

Mexicans-Chicanos send money from the USA using both an online channel (a provider’s website or mobile app) and via a cash agent. A great majority of senders continue using only cash agents despite the much higher cost of this transfer method:

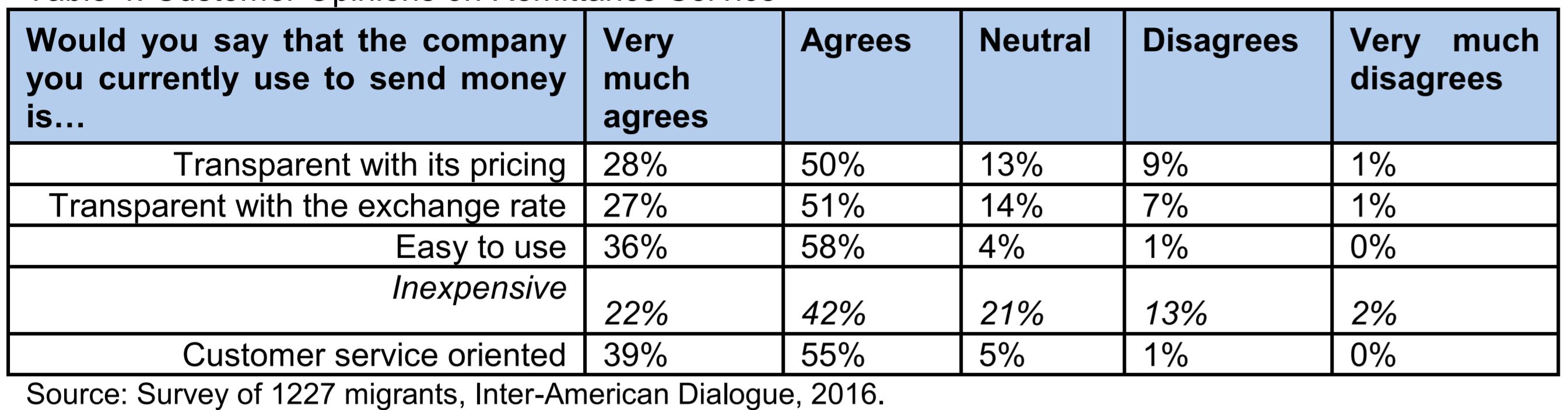

This could be explained by multiple factors. On the surface, migrants sending money to Mexico seem satisfied with the current offering:

While rapidly declining, a significant portion of senders still don’t have a bank account:

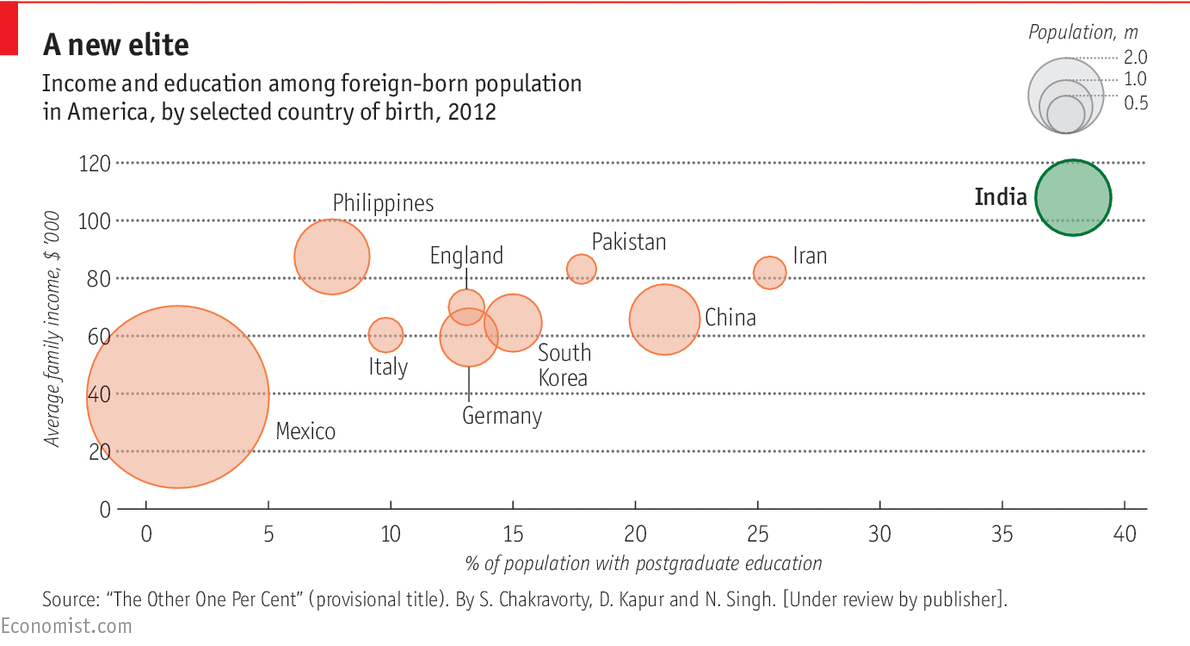

Finally, in comparison with other major migrant groups, Mexicans have the lowest levels of education and income:

It is also important to remember the significant presence of so-called “undocumented” migrants who get paid in cash and don’t pay taxes. They are worried that by placing money into a bank account, they could be reported to the IRS (USA’s tax service). Out of all remittances between the US and Mexico, about 50% are from such “undocumented” customers. Even among legal USA residents, a large portion of Mexicans works in fields where it is customary to get paid in cash (restaurants, cleaning, construction, nursing, etc.). For them, uploading money into a bank account is an extra step with, again, a potential tax liability. Here is how the CEO of one of the large offline remittances companies describes this situation:

So while millions of Mexicans-Chicanos in the USA already have a bank account and a smartphone and despite that the smartphone usage is also growing rapidly in Mexico, cash transfers will likely continue dominating remittances to Mexico. As a result, sending money from the USA to Mexico remains less price-competitive than for some smaller corridors (more on this later).

If you are reading this blog and haven’t yet tried sending money to Mexico online, via a website or a smartphone, you should definitely give it a shot. Most of the well-known providers have an easy-to-use mobile app, and the setup only takes a few minutes. Once you link your bank account or debit card, you might be surprised how easy it is to send money online and how much you could save. By using an online method for money transfers, all your past transactions are available for your review at any time, plus your future repeat transfers shall take less than a minute to complete since you don’t have to enter the same information again. There are also significant cost advantages (more on this later).

2. Pesos to dollar exchange rates and timing

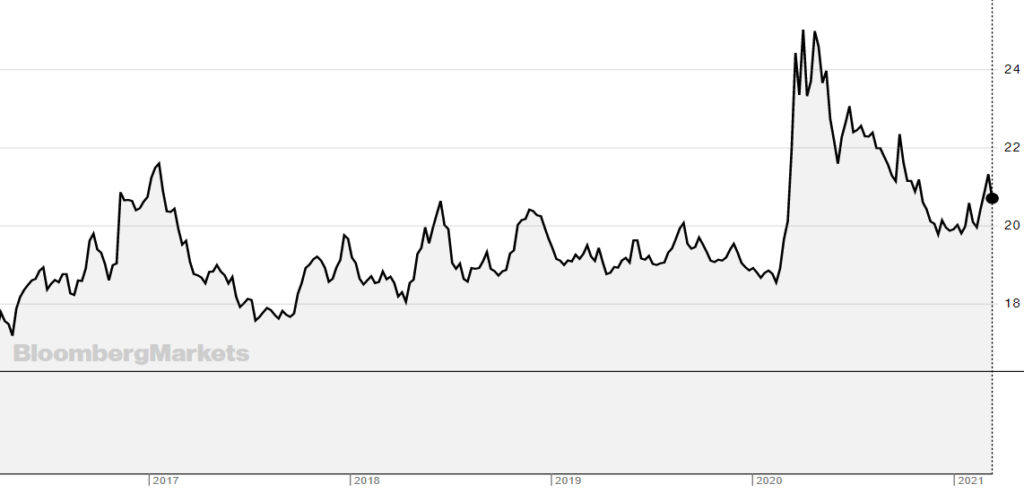

Are you wondering if you should wait for pesos to increase in value or for a dollar to fall? Trying to time the best exchange rate is unbelievably difficult if not impossible. If anybody gives you advice on this topic while not making millions trading on the same information, it might be a sign that you shouldn’t follow such a recommendation. Still not convinced? Look at the graph below for changes in the exchange rate of pesos to a dollar during the last 5 years – do you see any logic in the exchange rate’s short- or long-term movements?

However, there is a more practical approach to timing money transfers. Based on the analysis of FX markup (the difference between a peso-dollar exchange rate that providers get on the market vs. an exchange rate that you get from a provider). Not only does each money transmitter apply a very different FX markup, but each provider also makes daily changes to its FX markup to maximize profits. Some providers are even applying different FX markups for different sending-receiving methods. For example, for sending money from the USA to Mexico, MoneyGram has different peso-dollar exchange rates for sending a) cash, b) online, receiving cash, c) online, receiving to a linked bank account. So how do we use this knowledge against money transmitters? Look at this chart showing fluctuations in FX markups across remittance providers for USA-to-Mexico:

As you could see, except TransferWise, all providers keep significantly changing FX markups every couple of weeks. One of the worst offenders is Xoom, with massive fluctuations on a daily basis. Sending money with this provider is a bit like playing in a casino; a customer could pay 2-3x more or less in fees depending on the day:

The way you could take advantage of this is to compare your favorite provider’s FX markup to its average in the previous few months based on SaveOnSend charts. If FX markup is at or below the average trend, you could proceed with sending money; otherwise, it might make sense to wait 1-2 weeks till your provider’s FX markup comes down to its average level.

3. Top providers for sending money to Mexico

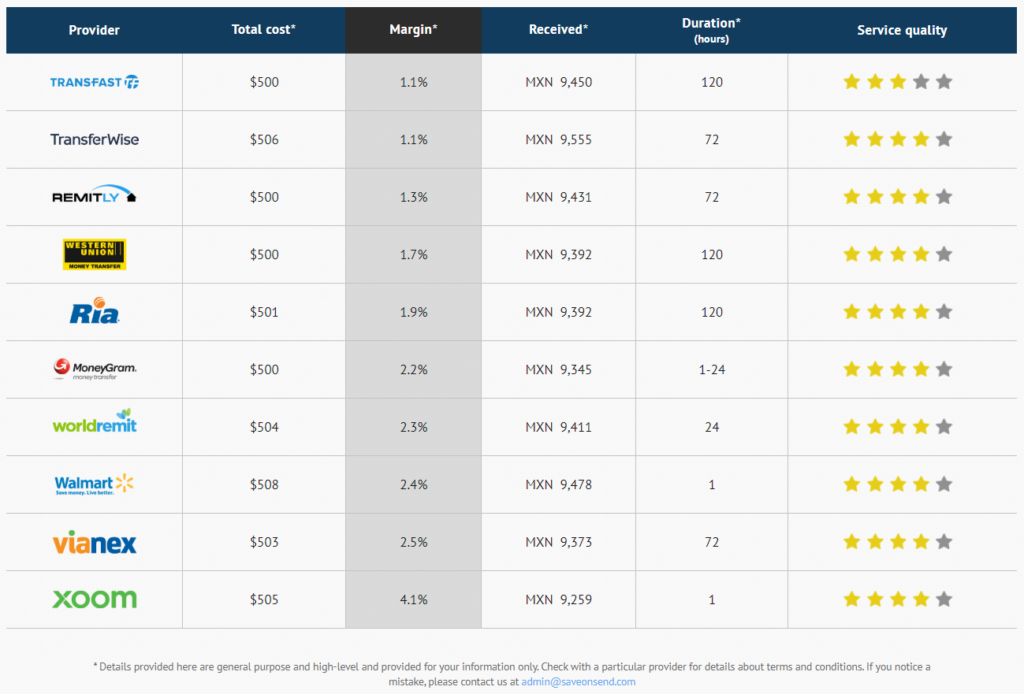

There are many well-established providers for sending money from the USA to Mexico. The least expensive option is to send money from a linked bank account in the USA to a linked bank account in Mexico. You could accomplish this via a provider’s website or mobile app. Here are the top providers for your consideration:

As you can see, TransferWise is less expensive but takes longer to deliver your money. Other providers, like Xoom, could be more expensive but deliver your money within one hour.

In terms of the market share, Western Union and MoneyGram used to have the largest market share for consumer money transfers from the US to Mexico:

By 2020, Intermex became the market leader, with a 20% market share.

Xoom leads among consumers sending money to Mexico online with around 15% of Xoom revenues coming from money sent from the USA to Mexico. This provider is known for instant money transfers and good customer tools and support. Western Union and MoneyGram, on the other hand, are known for their large network of cash agents worldwide.

4. The best way to send money to Mexico

As we discussed in another post on the overall strategy for sending money, “better” and “best” money transmitters are different for each of us. It is based on our unique preferences among cost, speed, convenience, and customer service. No one provider is the best across all these factors. Before sending money, you should use comparison sites like RemitFinder or SendRater to compare money transfer providers by price and speed.

But one decision should be very clear to you by now. Sending cash is much more expensive. You will be paying extra to support an agent, cash handling, and extra compliance activity. Try sending money via a mobile app a couple of times and leave a comment below about your experience.

To summarize, here are the leaders among providers that send money from the USA to Mexico:

- Fastest: Xoom

- Cheapest: Ria Money Transfer

- Service quality: Wise (aka, TransferWise)

- Availability of cash pick-up locations: Western Union, MoneyGram

There is another consideration: consistency of experience with a particular provider. As consumers, we like to pick a particular brand or local business and use them for years. That experience includes not just service but also prices. Imagine if your favorite restaurant or grocery store kept changing prices every time you went there, plus they also had different prices based on how much you purchased. We already covered Xoom’s price swings. Western Union and MoneyGram are also prioritizing profit maximization over the interests of consumers. Not only does their fee structure have more tiers, but they are also frequently changing their prices.

On this dimension, our favorite is TransferWise with the extremely simple, easily remembered, and consistent fee structure that doesn’t change every couple of months.

In Summary…

Hopefully, you found this overview helpful and feel more confident in how to find the best approach for YOU when sending money from the USA to Mexico. If we missed anything, please leave a comment. We will be keeping this post regularly updated, so come back soon!