Tale of Two Wises

“Revolution is a rough business. You can’t make it wearing white gloves and with clean hands”

Lenin

Wise’s (ex-TransferWise) origins are often described as follows: Two Estonians, a former Skype employee, and a Deloitte consultant, became fed up with the exorbitant fees charged by banks for money transfers from the UK to Estonia. Fueled by their frustration, they had a stroke of brilliance – matching remittance senders and receivers within the same country. With a sauna in their office and a team unafraid to challenge the banking industry, TransferWise was born. The startup received backing from prominent investors such as Peter Thiel, Richard Branson, and Ben Horowitz, propelling it to the pinnacle of fintech consumer cross-border transfers, surpassing a valuation of $10 billion in 2021.

Like any compelling story, Wise stands out in the otherwise mundane world of fintech with its collection of key elements: suffering victims, conniving old despots, and a young, clever savior. And, as with most captivating tales, Wise’s PR spiel holds some truth on the surface. So, let’s begin with what is genuinely accurate about this intriguing narrative.

Wise Money Transfer: Things to Love

Wise is undoubtedly the epitome of a cool and unconventional money transmitter. Unlike the standard foosball and ping-pong tables found in many offices, Wise’s founders and employees took things to a whole new level, fearlessly running naked through the world’s most famous financial district in the chilling temperatures of February. And if that wasn’t unique enough, having a sauna right in their HQ further sets Wise apart from the crowd:

From its inception, Wise steadfastly focused on exposing the “hidden” fees charged by banks and money transmitters. While many providers may advertise “zero-fee” money transfers, they often impose FX markups. In contrast, TransferWise stood as a solitary voice among its competitors, persevering to advocate for legislative changes in the UK.

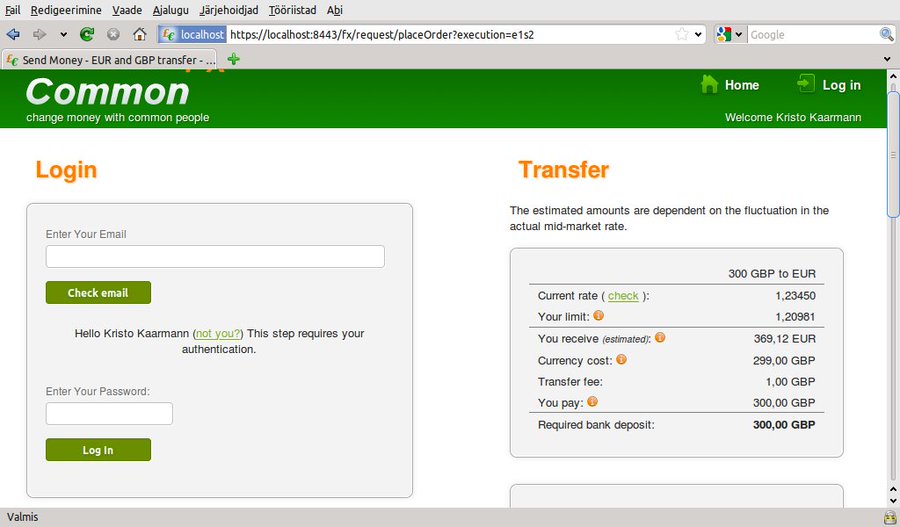

This commitment to transparency and fairness was evident even before Wise’s official founding, as its co-founder, Kristo Kaarmann, laid the groundwork with his prior startup in 2010:

That vision was further refined when TransferWise was launched in 2011:

Wise’s other distinctive cultural characteristic is its obsessive persistence in trying new approaches. Like many well-known startups, it faced challenges gaining traction during its first two years, reaching less than $10 million in monthly volumes…

… but it kept experimenting across different consumer sub-segments, trying various marketing techniques. Wise’s experimentation velocity was so high that when monthly volumes suddenly jumped to $50 million, the company’s management couldn’t initially pinpoint the exact cause. Unlike many fintech startups and even large financial services companies, Wise possesses a unique ability to rapidly learn from mistakes and adapt quickly:

When it comes to organizational practices, Wise is also at the forefront. The startup fosters a collaborative environment centered on perfecting the user experience and actively seeks out young, bright minds, empowering them with autonomy:

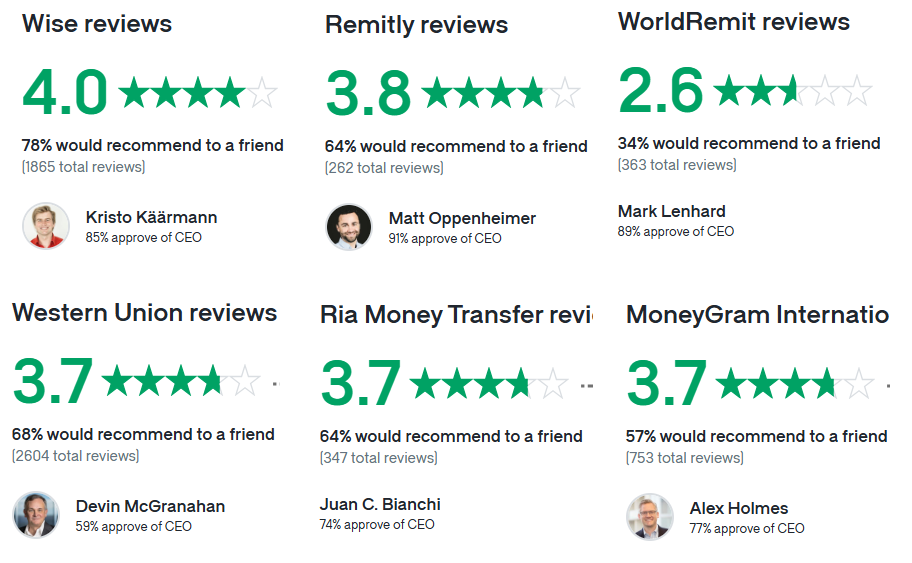

Wise’s employees consistently rate their work on a high end among traditional and fintech competitors:

Wise’s operating model autonomy also enables fast scaling (see the currently supported corridors here). For example, while WorldRemit took a couple of years to acquire US licenses, Wise immediately began offering services through an intermediary. It initially partnered with PreCash in 2014, which was fined $150,000 for working with TransferWise, and later in 2015 with CFSB:

In another example of a quick pivot, TransferWise suspended support for Nigeria in 2016 due to currency instability. However, the company returned in October 2017 by partnering with a local entity, Flutterwave, to share risk and revenue and resume its regional services.

After the first year in the US, TransferWise was already transferring $2 billion out of the country. Within the first two years, TransferWise had obtained US licenses in 39 states. However, it was still missing a few states that required longer approval times, such as New York and Illinois or were too small to be a significant concern (the latest status is available here). In states where TransferWise had licenses, it only needed a bank for a correspondent account, and it continued relying on CFSB for the rest of its operations:

Wise experienced even faster growth in Canada. Within a year of its launch in Spring 2016, it was already transferring $2 billion, approaching a 10% share of the country’s outbound cross-border market.

The company’s growth strategy revolves around a referral channel, achieved by providing customers with a superb experience. During SaveOnSend’s blind calls to the provider’s early days in the US, Wise’s phone representatives stood out for their ability to quickly understand and personally resolve issues pleasantly and humorously. Some of their under-serviced customers even received chocolates as a delightful gesture.

Wise’s approach to driving referral growth is indeed innovative. The company doesn’t merely test various referral amounts and their distribution between existing and new customers. Instead, Wise takes it further by actively engaging customers to act as a virtual army of individual PR agents. This strategy leverages satisfied customers’ enthusiasm to spread the word about the platform, fostering a strong and organic growth mechanism:

Wise analyzes referral data and uses it in marketing campaigns to drive more referrals:

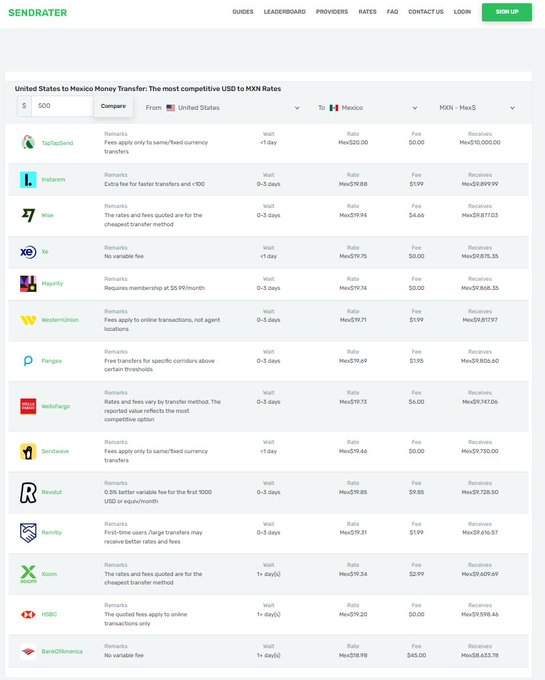

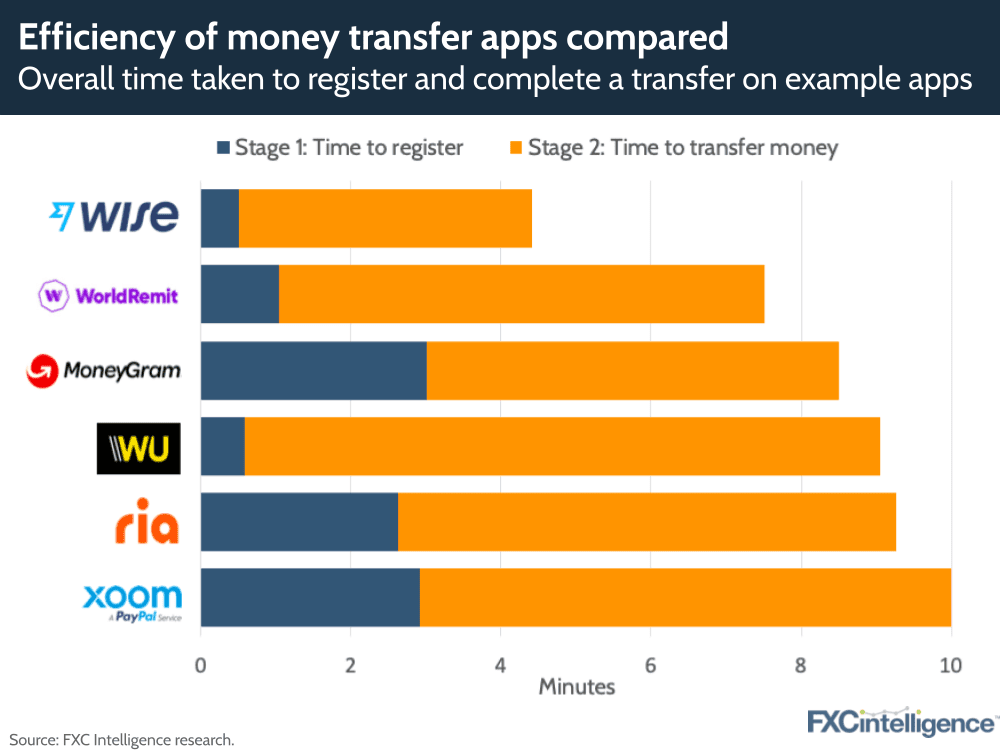

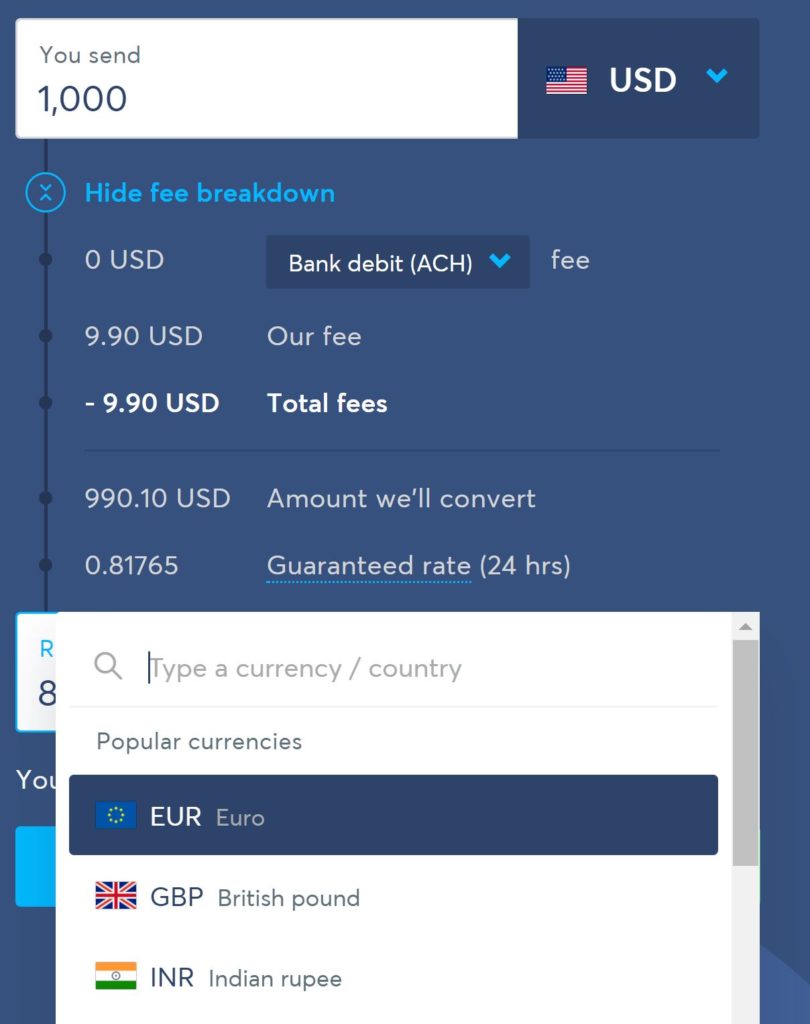

Wise offers transparent pricing with a fixed amount for smaller transfers and a percentage fee for larger amounts in the US. SaveOnSend can confirm that Wise does not charge an FX markup, and any price fluctuations are due to intra-day adjustments:

Indeed, Wise’s pricing is remarkably stable compared to other well-known providers. Wise maintains a consistent and consumer-friendly pricing strategy, unlike companies like Xoom, which often have fluctuating fees that can go up or down 2-3 times in a single day:

Wise’s commitment to transparency extends to the first-of-its-kind-in-Fintech world sharing of its product roadmap. This open approach lets customers and partners stay informed about upcoming features and improvements, enhancing trust and engagement with the platform.

Wise is often one of the cheapest providers for larger amounts ($300+) when using a bank-to-bank method in many large corridors, such as USA-to-Mexico or USA-to-Philippines.

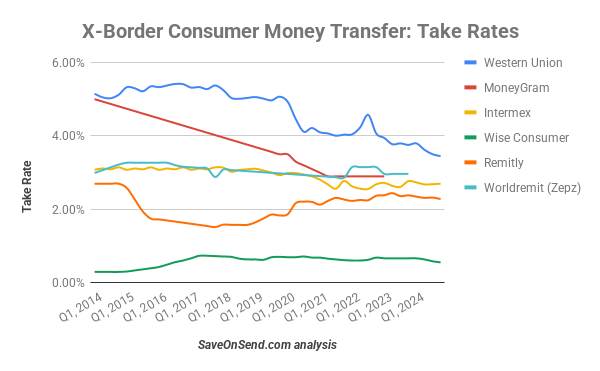

Overall, Wise’s average markup (aka take rate) tends to be much cheaper than that of fellow fintechs. This is partially due to Wise’s business model of competing on price and partly because sending larger amounts using the digital receive method costs less as a volume percentage.

Unlike Wise, some other money transfer companies, including fintechs, may engage in misleading practices by temporarily dropping prices in specific corridors to gain market share, only to raise them again later. This approach can create a false impression of competitiveness and may mislead both customers and investors:

Indeed, while many Fintech startups promote empathy for the underserved and disadvantaged, their actions during critical moments like the panic after Trump’s election in 2016 may tell a different story. Some of these players chose to raise prices for their services during a time when Mexican migrants needed affordable remittance options the most:

Around the same time, Wise chose to drop its prices to support its customers, setting itself apart from those firms that take advantage of vulnerable consumers for PR purposes and financial gains.

True to its price-reduction-and-transparency mission, in October 2017, Wise began emphasizing to its customers the higher fees for card payments while simultaneously lowering prices for transfers originating from the UK.

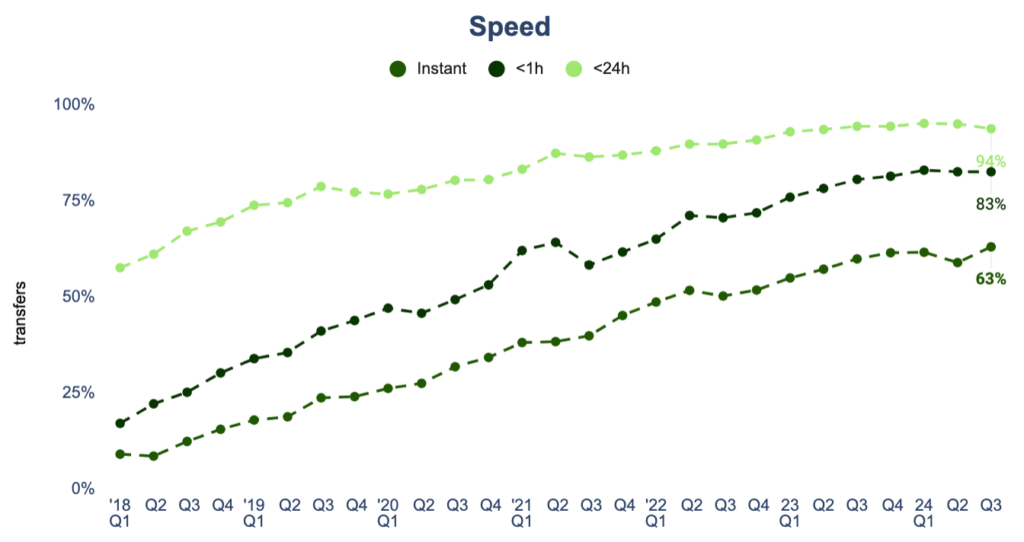

Besides pricing differentiation, Wise prioritizes instant transfer speed, reaching 65% by late 2024.

These unique features led to phenomenal and profitable growth, propelling Wise to become the world’s 3rd largest remittances company by mid-2017, a remarkable achievement within six years of its launch.

In October 2017, Wise’s exceptional performance was validated with a $280 million funding round, the largest among consumer cross-border money transfer startups:

At that point, Wise might have raised too much money:

By January 2018, Wise claimed a 15% market share of the UK outbound market. In May 2019, Wise was valued at $3.5 billion. By mid-2021, as Wise went public, its valuation exceeded $10 billion, and it had the best digital product on the market:

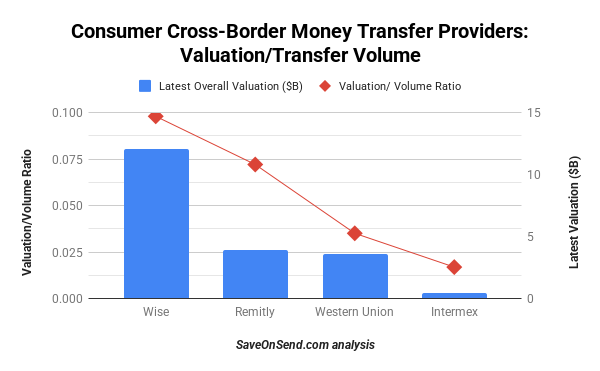

By 2022, Wise caught up to Western Union, a 40-year champion of consumer cross-border money transfers, and became the industry leader:

Now, let’s look under the hood.

Wise Strategy

1. Segmentation

Wise’s co-founder, Taavet Hinrikus, elaborated on the company’s strategic focus during an AMA on Reddit:

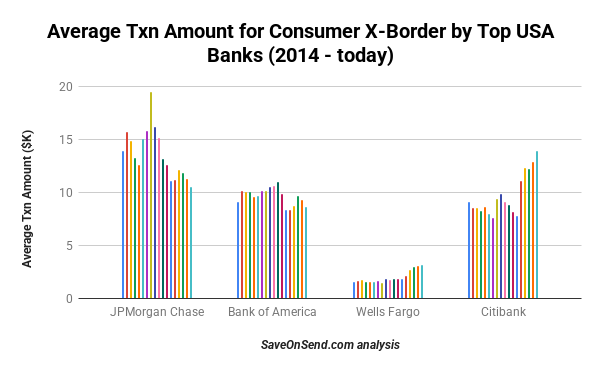

In the context mentioned, “non-remittance” refers to cross-border money transfers sent by white-collar expats, retirees, or students rather than typical blue-collar migrants. As a result, Wise’s average sent amount is much higher than the average sent amount by remittance startups like WorldRemit or Remitly.

However, it is much smaller than the average transaction amount of the majority of large banks (Wells Fargo is a special case – see here why):

For that reason, Wise was initially dismissed as a threat by remittance incumbents. Here is how Euronet’s CEO, the parent company of Ria Money Transfer, responded in early 2018 to a question on whether he was worried about TransferWise with regards to disrupting his cash-to-cash remittances business:

2. Pricing differentiation

Over the years, while being generally cheaper, Wise has made numerous misleading claims about its pricing. The practical concern with Wise’s behavior is what it will do if and when it gains decisive market share. Will it raise prices, as PayPal did in a similar circumstance, with some justification? Here are the facts so you can judge whether this behavior has been due to incompetence/ignorance, as Wise claimed when caught, or due to a lack of ethics in achieving its mission.

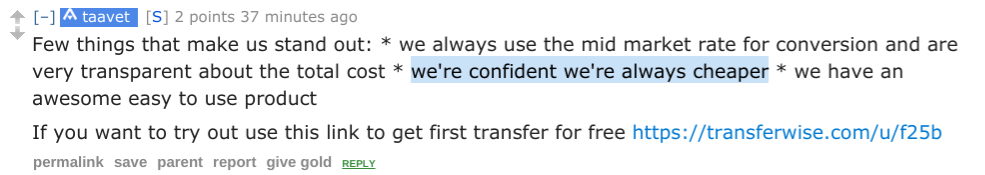

From the previously mentioned TransferWise CEO’s AMA on Reddit in 2015:

Here is a quote from a co-founder’s interview in June 2016 comparing Western Union and TransferWise pricing:

“Hinrikus says the company [Western Union] charges 10 times more than TransferWise, on average…”

TransferWise also repeatedly mentioned “10x cheaper” and “up to 90%” savings in its advertising:

With time, the company became less misleading. In this PR interview from October 2016, TransferWise claimed to be 80% cheaper than other cross-border providers from the US. In June 2017, TransferWise downgraded its “10x” claim only to be 7x cheaper:

By April 2018, TransferWise claimed only 3x superiority, while competitors maintained the same margins over those years.

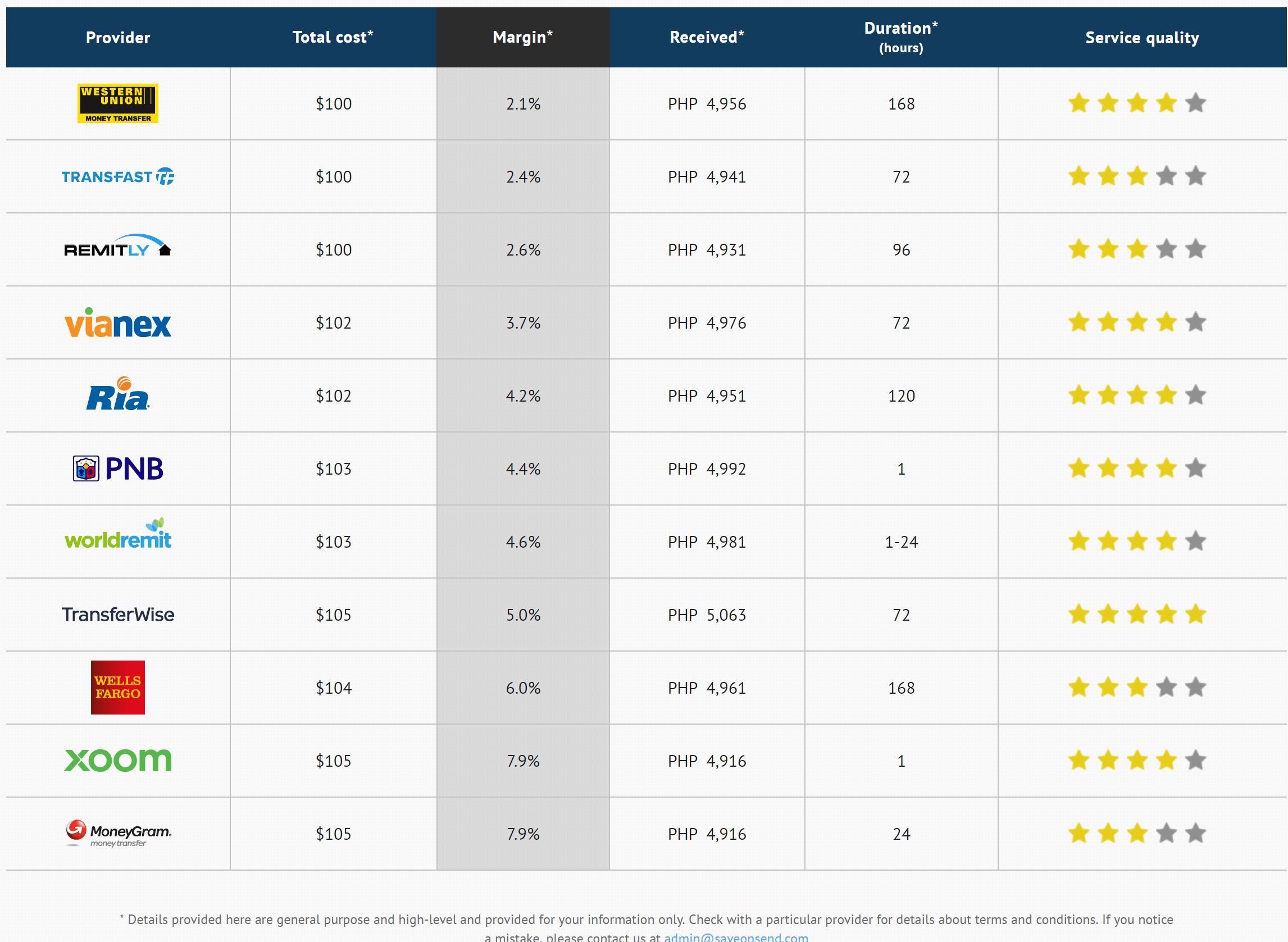

Let’s compare Wise’s claims of pricing superiority with the reality at the time. As mentioned earlier, Wise is often the cheapest bank-to-bank transfer provider for amounts above $300. However, this was not the case for sending smaller amounts:

It was also not the case in some of the world’s largest corridors. For example, for USA-to-China:

In the USA-to-India corridor, which includes uniquely sophisticated senders, TransferWise was not even among the top five cheapest providers for money transfers:

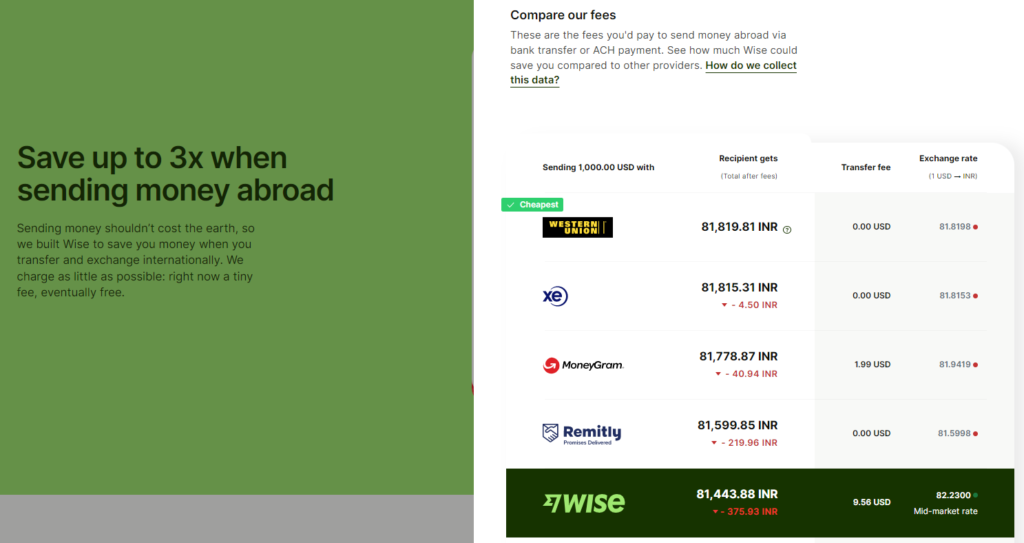

Indeed, on its comparison site in those years, Wise admitted to last place in the unique USA-to-India corridor while still claiming 3X savings on the same page:

The US-to-India corridor is unique globally (as mentioned in this SaveOnSend article). Wise couldn’t win on price and didn’t want to lose money to gain market share, but it continued advertising its pricing superiority. Here are some ads that specifically targeted this corridor:

India-specific ads were not different from the generic ones. Here is an advertisement from TransferWise’s launch in the US in 2015, displayed on the NYC Subway:

Here is an example of TransferWise’s advertisement on Google during those years, claiming “up to 90%” savings (compare it with the wording of its competitors’ ads on the same page).

Similar misleading claims were made using TransferWise’s comparison tool. Notice below a claim that “Bank average” equals a $46.58 fee and a much worse exchange rate.

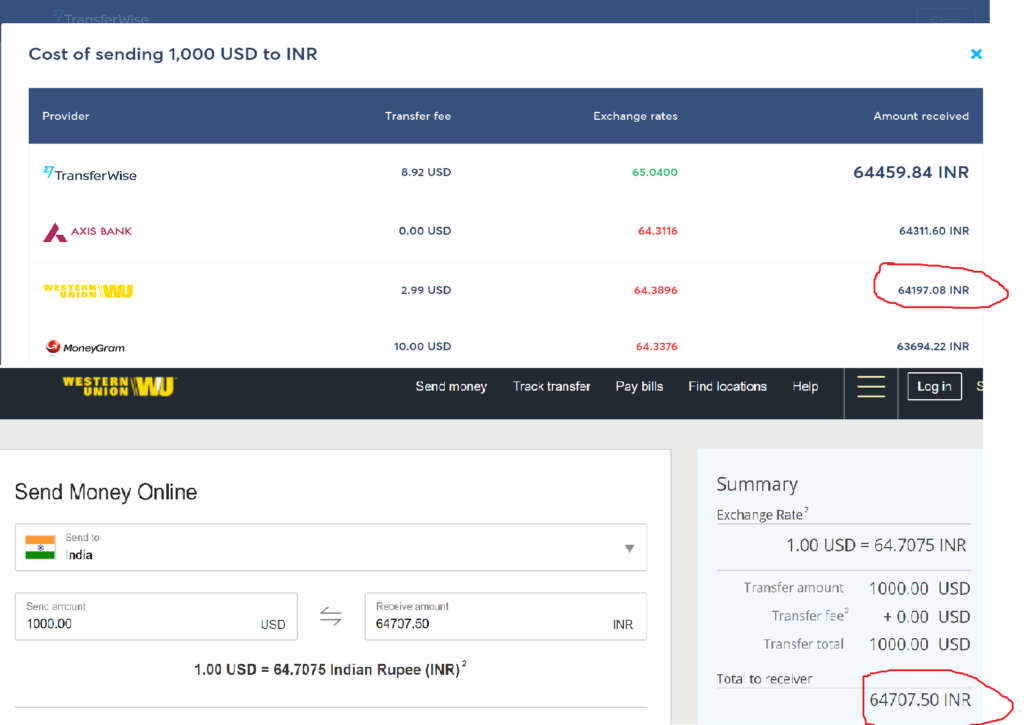

TransferWise conveniently compared its pricing with banks’ wire transfer services, which were rarely used by Indians to transfer money, except for very large amounts. Similarly, TransferWise compared its digital prices with Western Union’s offline service, which was also not commonly used by Indians in the US to send money home. As shown in the earlier comparison table, no provider charged such hefty fees for sending money to India. Additionally, the top competitors’ exchange rates around the same time were as follows: Western Union – 61.98, MoneyGram – 62.21, Xoom – 61.5, Ria – 62.17, TransFast – 61.9. These rates were slightly worse than TransferWise’s “honest rate” of $62.3418. While TransferWise still had a competitive edge, it seemed insufficient for its viral marketing claims.

Such shenanigans made Wise’s criticism of competitors for being “unfair” and “hiding” fees somewhat ironic. Despite SaveOnSend’s request to address this concern, Wise did not change its approach:

Deservingly, TransferWise was reprimanded by the UK government in 2015 and again in May 2016 for misleading ads. Here was TransferWise’s explanation in 2017:

In 2017, Wise developed a new marketing technique: a price comparison tool. Listen to this Fintech Insider podcast from October 2017, where TransferWise managers promoted it. They claimed that even if TransferWise’s pricing were not the best, the tool would transparently point a user to the cheapest provider.

How did the tool work at the time? It displayed a falsely inflated price for Western Union and omitted other competitors with better-than-TransferWise prices:

At that time, SaveOnSend tweeted the above feedback, and within 2 weeks, TransferWise fixed the issue:

In a January 2018 interview, Wise’s CEO described the fee structure as follows:

“Käärmann said, would allow users to change dollars into euros and back again without seeing the value of their money diminished. He said the company charges a fee — $3.50 per $1,000 in Europe and $7 per $1,000 in the United States — to cover its costs.”

Let’s compare that “$7” claim to the actual fee displayed on the TransferWise website on the same day:

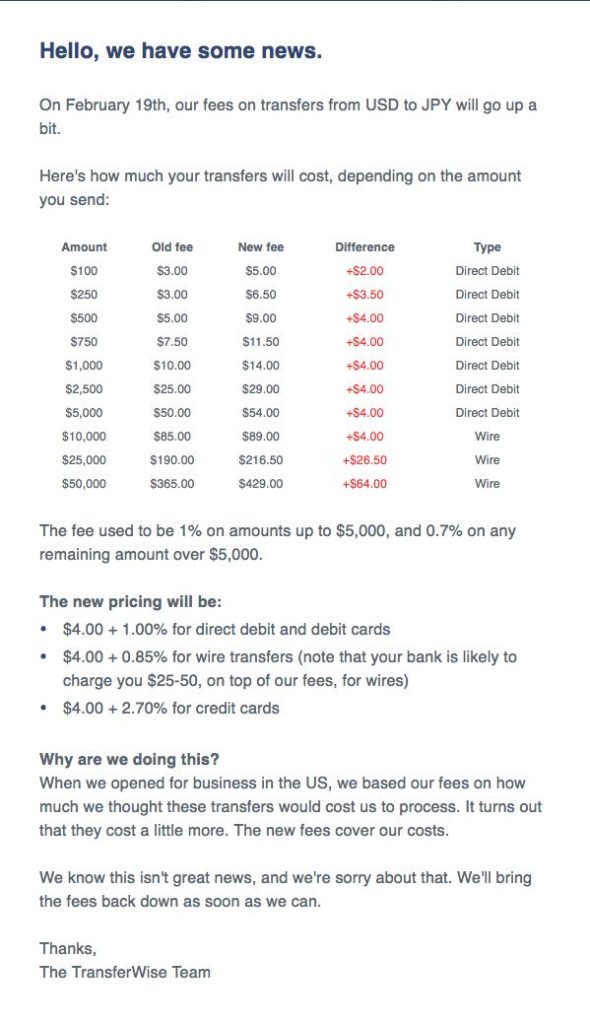

In February 2018, TransferWise announced price reductions:

In reality, TransferWise raised prices in many corridors, once again attributing it to their ignorance. Some of the increases, as in the case of US-to-Japan, were quite dramatic, while others were described as “up a bit” by TransferWise:

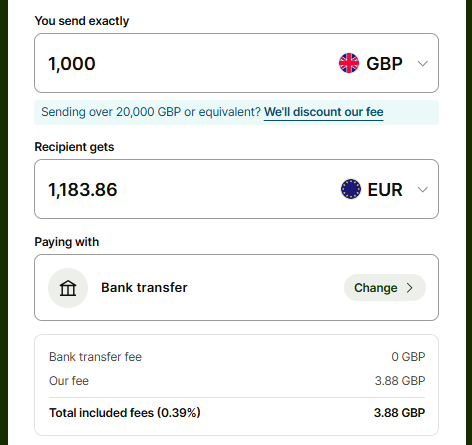

In its “Mission Reports,” published every quarter starting in April 2018, Wise aimed to showcase transparency and stay connected with customers under the overarching objective of “Making money transfers eventually free.” Yet, between late 2016 and mid-2024, the average markup fluctuated around 0.6-0.7% despite growing volumes 10x during that period. Even in its inception corridor, UK->EU, Wise has maintained about the same markup of around 0.4% for a decade:

A sensible response by Wise’s management would be apologizing for setting unrealistic expectations and dropping the utopian mission. However, deviating from a PR message is not Wise’s style. Instead, the company has inexplicably decided to blame one-off occurrences, like the switch to AWS in 2019:

Or, blaming the ACH fees in 2020.

3. P2P: reality vs. fiction

“P2P” (“person-to-person”) is when consumers send money to each other without a licensed financial intermediary that keeps reserves for such payouts. The debate over whether P2P could work for international remittances on a global scale or not is a slight myth that began in 2014. Startups like TransferWise and its B2B counterpart CurrencyFair were founded with an initial focus on cross-border money transfers among intra-Western-Europe expats. Those flows tend to be highly balanced and, hence, allow for a relatively high P2P ratio, according to CurrencyFair’s CEO:

After a few months of operating in the US, TransferWise realized the fundamental differences when working across different money transfer corridors. One example was the USA-to-Mexico corridor, the #1 global remittance corridor, with $60+ billion in annual money transfers. However, the amount sent back from Mexico to the US was less than $5 billion. This realization was acknowledged by TransferWise’s general manager in the USA, Joe Cross, and by a co-founder, Taavet:

By June 2016, TransferWise acknowledged that only a fraction of the corridors they served had a balance of money transfer inbound-outbound flow, which was applicable for any provider, even those who didn’t claim a secret sauce of “P2P” in their marketing.

“… it finds true peer-to-peer matches on at least 60 percent of its transaction volume on 20 “routes” among Europe, the U.S., the U.K., and Australia… almost every transfer into pounds is matched 100 percent peer-to-peer…”

On the cost side, “P2P” doesn’t mean much either – all providers are trying to minimize the flow of internal transfers. Wise doesn’t literally wait for $1,000 to arrive from the UK to the US to initiate an exact transfer of $1,000 from the US to the UK. Other money transfer players are also, obviously, not initiating bank transfers every time a request is made. They estimate how much money and in which currency is required to be pre-funded in countries of their operation and then buy/sell those currencies, often daily.

The largest players also have hedging operations to mitigate FX volatility (read this SaveOnSend article for more details). Moreover, for some corridors with an option to transfer money cross-border without FX conversion (e.g., USD-to-USD), incumbents offer a similar pricing structure, e.g., for USA-to-China or USA-to-Philippines.

By 2020, TransferWise finally stopped marketing “P2P” as its differentiator and acknowledged that it had to manage liquidity like anyone else:

4. Word-of-mouth acquisition: is it a differentiation?

“… the stat I’m most proud of, and the hardest thing to make happen out of all of that was we acquired 70% of the users that found out about Wise last month through word of mouth:

Source: Nilan Peiris, Wise’s Chief Product Officer, September 2023

Hiding from investors and charging users to slow down growth, WhatsApp set the bar for what “viral” expansion means. Wise wants us to believe that its growth has similar roots:

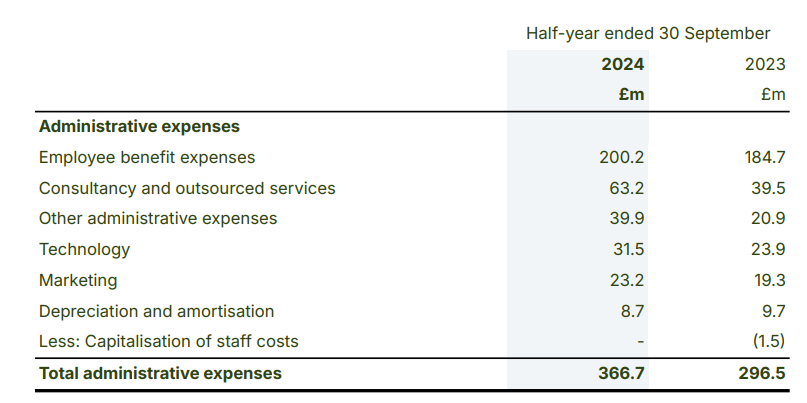

Overall, Wise is deploying standard marketing channels for acquiring customers, as every other money transfer player, including referral programs, partnerships, affiliate marketing, billboards, social media, PR, and SEO. However, marketing expenditure represents only 4% of revenues and 6% of administrative expenses, significantly below its traditional and fintech competitors.

Instead of heavy marketing, Wise’s differentiation in price and speed enables it to rely on referrals to attract the majority of new customers. Like everything else in Wise, the referral program is managed using a highly data-driven approach (see longer explanation here).

Besides free word of mouth, Wise offers a significant referral bonus, paying almost $40 for each referral on top of a free first transfer:

This paid referral amount is twice as high as a few years ago, while the marketing expense is half in relative terms, implying that most of the growth comes for free. Such success is probably why Wise stopped using PR tactics to promote its brand, like in the early years. In 2014-2015, Wise received favorable mentions in The Guardian over six articles, including a podcast that seemed like a blatant PR stunt. While some other remittance providers also leverage PR channels, Wise’s approach appeared more unethical, presenting these articles as genuine reporting, blurring the line between objective journalism and promotional content (see here).

5. Wise’s performance

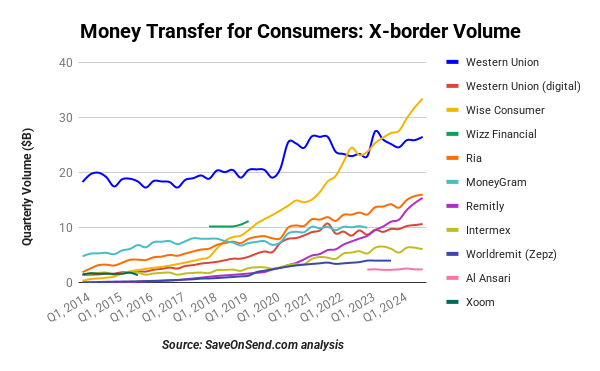

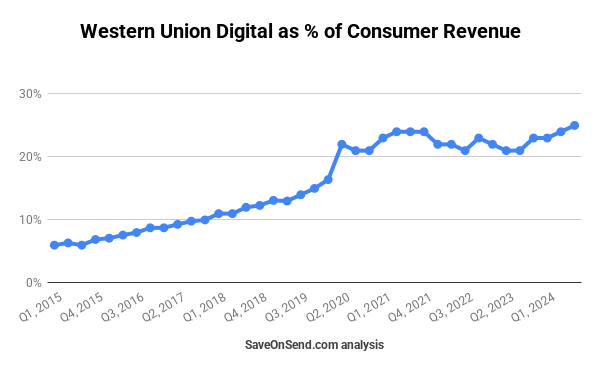

In the early days, the media often echoed Wise’s PR narrative of disruption and imminent threat to established players like Western Union. Over time, Wise achieved significant milestones, surpassing Xoom’s volumes in 2015, reaching break-even by 2016, surpassing MoneyGram in 2018, outpacing Ria Money Transfer in 2019, and surpassing Finablr in 2020. By 2022, while Western Union hit the wall, Wise kept growing by around 20%. It hasn’t yet disrupted Western Union as respective customer segments remain somewhat different, but it seems to be scooping new consumers who might have otherwise considered traditional players.

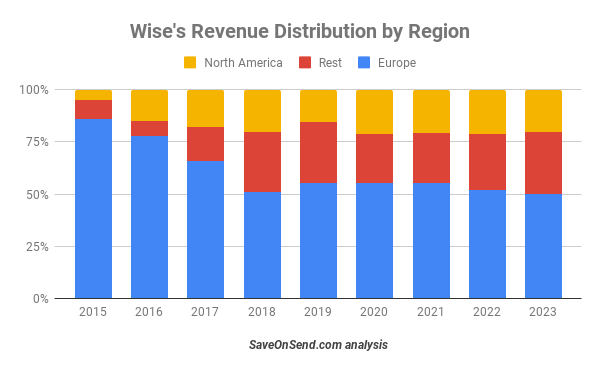

Since 2018, Wise’s regional performance has remained relatively stable, with Europe being the primary contributor to its revenue. The Asia Pacific and North America regions each contribute approximately 20% of Wise’s revenue, while the rest of the world contributes less than 10%.

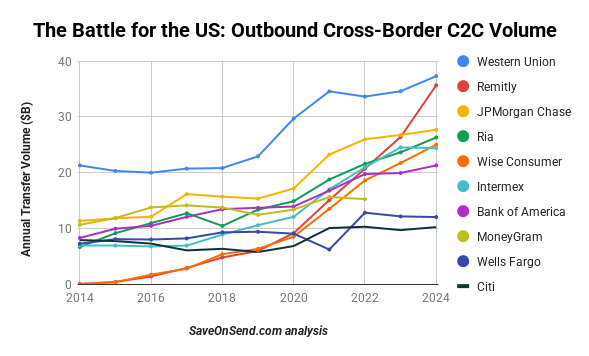

Despite Wise’s global leadership in consumer transfer volumes, it is still far behind Western Union and Remitly’s dominant positions in the US since its launch in 2015. By late 2024, Wise was in fifth place but on track to pass by JPMorgan Chase and Ria soon.

The key question surrounding Wise’s performance is whether its leaders have the tenacity to keep pushing forward as the company reaches its 15-year mark, especially with one co-founder already departed. Wise stands out among its competitors and across the fintech industry for its superior business, operating, and technology models. Despite some misleading marketing, it is a global case study in launching and scaling a business. Even the typically confident CEO of Euronet, which owns Ria Money Transfer, had to acknowledge how tough the digital competition for remittances had become by late 2023:

With the C2C cross-border market growing at around 9%, for Wise to sustain 20% growth, it would need to disrupt both traditional and digital competitors actively. Some, like Azimo, have already exited, while others, like WorldRemit, continue to struggle with growth and profitability, suggesting that disruption is possible, particularly given Wise’s superior scale. Interestingly, its main competitors—traditional banks like JPMorgan Chase and Bank of America—have continued to grow their volumes.

Alternatively, Wise could significantly increase its relatively small marketing budget. However, its preferred path to dominance isn’t to push banks out of the C2C cross-border market but rather to have them replace their core systems with Wise Platform.

6. Wise Platform

In the financial services industry, monetizing internal platforms for competitors has gained popularity, following the success stories of Amazon AWS and Blackrock’s Aladdin. Numerous large players have introduced platform solutions in the cross-border money transfer sector. Wise has also expanded into bank partnerships, offering its cross-border money transfer solution to banks instead of maintaining their own. This initiative began as a small-scale experiment in 2016, initially partnering with two relatively insignificant banks (N26 and LHV), followed by another in 2017 (Starling). In 2018, TransferWise decided to elevate this channel to a central part of its strategy. A dedicated global partnership team with an API portal was launched. Also, that year, Wise lost Starling but signed Monzo.

In June 2018, TransferWise made a significant announcement about its partnership agreement with a major bank, BPCE. However, there have been no indications that BPCE ever went live with the partnership. In 2019, TransferWise secured a few more partnerships with smaller banks in the US and Australia. During its Missions Days event in June 2019, TransferWise’s CEO humorously mentioned the possibility of signing a partnership with HSBC but clarified that it would probably take place in 2029.

By 2023, Wise Platform had signed agreements with 70 partners who serve 10 million customers and businesses (N26 and Monzo had grown significantly since the initial signing). By 2024, Wise Platform had 85+ partners:

Some partners even claim a 15% penetration rate by Wise’s platform. Wise expects that the majority of its future volume will eventually come through its API business. However, Wise continues claiming that Platform volumes remain “very small” and “not having a significant impact.” Surprisingly, not a single partner promoted on its website can confirm if they have moved their legacy cross-border C2C volume onto Wise:

In Conclusion: Rebel-Schmebel

In 2019, the TransferWise CEO expressed the hope that within 10 years, even reaching an African villager with their services would be feasible through digital means.

However, the transition from offline to online methods of sending money has been slow, with only temporary acceleration due to the global pandemic in 2020:

While Wise may not push out incumbents, its journey has been filled with positive surprises, making it unwise to bet against its continued success. However, Wise’s rebellious days may be behind them. Ethically, the disruptor appears to be on par with the banks they criticize, given its history of cutting corners in marketing while condemning others for doing the same. The biggest mystery remains why Wise engaged in such practices.

Any Feedback?

Hopefully, you found this overview helpful and feel more confident in your choices about whether or not to use Wise. Please let us know if we got anything wrong or did a good job—leave your comment in the section below.

We will be keeping this post regularly updated, so come back soon!